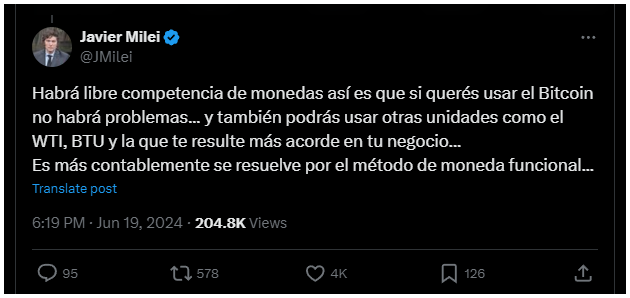

Argentine President Javier Milei has reiterated his support for integrating Bitcoin and other currencies into the national economy.

He want toimplement a system where multiple currencies compete freely, allowing citizens to choose their preferred money.

Everything is money

Milei’s comments came in response to Gabor Gurbacs, former Director of Digital Asset Strategy at VanEck, who tweeted “Bitcoin for all.”

The president stated his administration would support free currency competition, including Bitcoin and other units like West Texas Intermediate (WTI) and British Thermal Units (BTU), which aren’t money actually, but could act as unit of account.

He shared with his followers that businesses could choose whichever currency suited their needs, because Argentine is a free country.

The nation’s economy is still weak

This approach mirrors Nayib Bukele’s administration in El Salvador, which has allowed Bitcoin to circulate freely, after it became legal tender in the country.

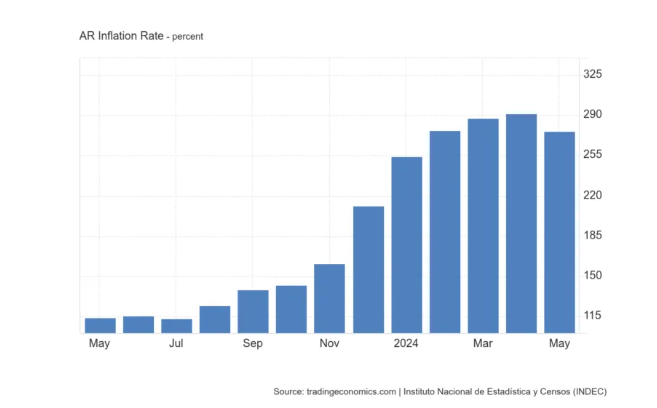

Of course, while there are similarities, Argentina’s situation is different. The country has faced severe inflation and tax uncertainties related to cryptocurrencies.

The stablecoins are preferred by many as a payment method, because the purchasing power loss is pretty fast.

Despite these problems, Milei wants to integrate Bitcoin more formally into the economy, showing a commitment to cryptocurrency adoption.

Big changes

In December 2023, Argentina’s government announced it would permit contracts in Bitcoin, boosting optimism within the crypto community.

Despite this, Milei’s administration also got criticism, especially after tightening regulations on Virtual Asset Service Providers in response to the Financial Action Task Force, the advisory company’s help.

While some see this as bowing to external pressure, the move towards free currency competition could impact Argentina’s economy in a big way, which is grappling with high inflation and economic instability.

The future will reveal how well these measures are implemented and accepted, and if there will be any meaningful success.