When your Layer2 doing so well it defeat you in a key metric, the happiness is bittersweet.

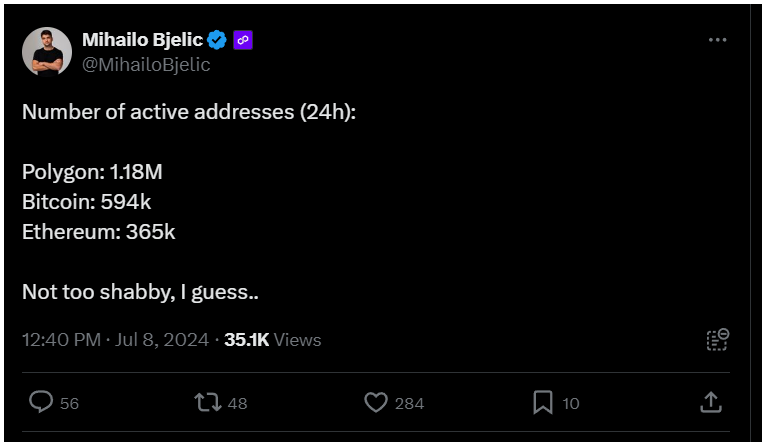

Polygon now achieved a big milestone by surpassing Ethereum in number of addresses, and Polygon cofounder Mihailo Bjelic shared this achievement on X, revealing that the total number of active addresses on Polygon is now greater than those of Bitcoin and Ethereum combined.

The fruit of labor

Polygon is no doubt becoming a prominent digital currency, because despite the drop in price, Polygon’s active users increased by 1.18 million in just 24 hours.

During the same period, Bitcoin had about 594,000 active users, and Ethereum had 365,000.

Polygon has a smaller market capitalization, as a Layer2 sidechain, it remains a well-used chain.

The steady operation of the Polygon network, even with heavy on-chain transactions, shows the success of the team’s efforts to scale the protocol, and now, the results started to coming in big time.

Bulls are coming?

Data from IntoTheBlock indicates that 90.62% of all Polygon addresses are currently in losses, which equals about 627,350 addresses.

But worth to mention, many people holding MATIC only for the network gas, not as investment.

Next to this, many analysts think this situation calls for a recovery for MATIC holders, and to acchieve this, positive developments in the ecosystem are needed.

MATIC has started to respond to these positive fundamentals, with its price finally showing a bullish trend.

As of now, the time of writing, the price of MATIC has increased by 4.63% in the past 24 hours, trading at $0.5046, based on Coinmarketcap’s numbers.

After experiencing a 9% drop in the past week, this nice recovery suggests that a better week might be ahead.