As the crypto market experienced a sharp decline earlier this week, one unexpected player made a bold move by purchasing $40 million worth of Ethereum.

A hacker seized the opportunity to buy ETH as it neared its lowest point, around $2,200.

What downturn? It’s sale.

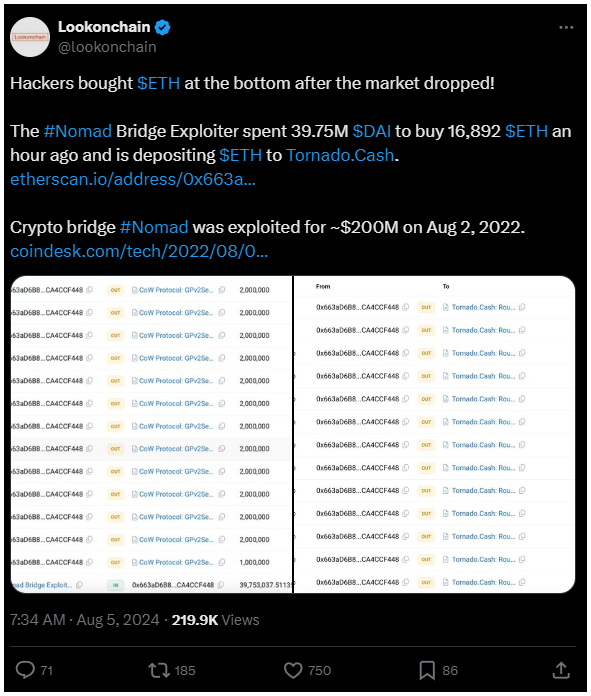

In the center of the market chaos, blockchain analytics platform Lookonchain shared that the Nomad Bridge hacker spent nearly $39.75 million of MakerDAO’s DAI stablecoin to acquire 16,892 ETH, averaging a purchase price of approximately $2,350 per ETH.

Following the transaction, the hacker funneled the assets through Tornado Cash, a sanctioned cryptocurrency mixing service, to obscure the funds’ trail.

Patience pays

This event marks just over two years since the Nomad Bridge was exploited in a widespread hack that allowed multiple parties to duplicate the original attacker’s actions.

A flaw introduced during a routine upgrade to the bridge’s smart contracts mistakenly approved all ‘process’ calls as legitimate, allowing unauthorized withdrawals.

The exploit ultimately resulted in losses of $150 million, with the top three attackers netting over $95 million, as reported by crypto security firm Peckshield.

Free for all? Not so hurry!

The Nomad hacker wasn’t the only one trying to capitalize on the market turmoil.

Another hacker, who had previously stolen $45 million from Binance Smart Chain’s yield farm Pancake Bunny in 2021, made an ill-fated attempt to move their stolen funds.

Dubbed the “On-chain clown of the day” by blockchain investigator ZachXBT, this hacker mistakenly sent $3.6 million worth of DAI directly to the token’s contract address, making the unusable. Ouch.