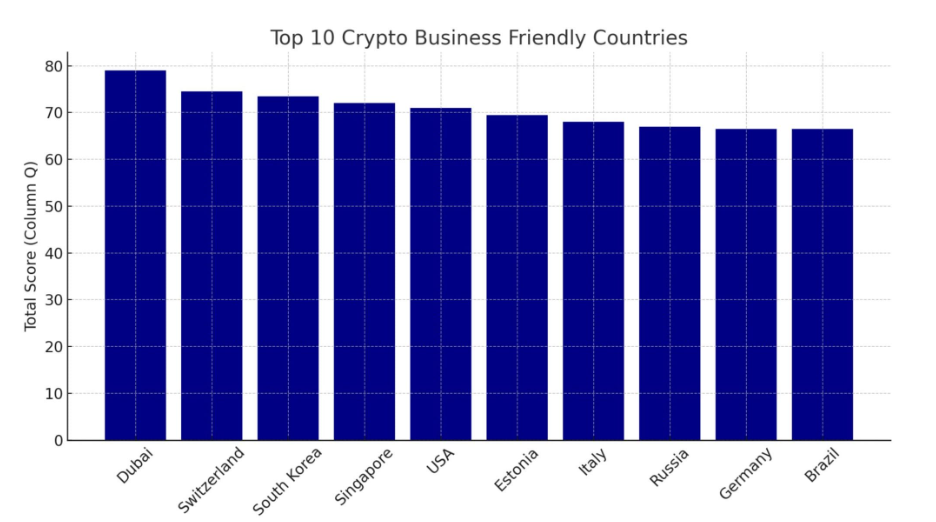

Dubai, Switzerland, and South Korea have been recognized as the number one locations for crypto businesses in 2024, due to the legal clarity, favorable tax rates on capital gains and corporate income, and a large number of registered crypto firms.

Dubai takes the lead

Dubai earned the top spot with a score of 79 due to its clear regulations, no capital gains tax, a low corporate tax rate of 9%, and reasonable licensing fees.

The city positioned itself as a major center for cryptocurrency and blockchain activities by implementing progressive regulatory frameworks and attractive tax policies.

The establishment of the Virtual Asset Regulatory Authority and the Dubai Financial Services Authority also created a transparent legal environment that encourages innovation in the crypto sector.

The DMCC Crypto Centre also supports the growth of crypto and blockchain companies by offering specialized infrastructure.

With no capital gains tax on crypto transactions and a corporate tax threshold set at AED 375,000, Dubai’s tax strategy boosts its appeal to global crypto businesses.

Switzerland’s Crypto Valley, the well-known name

Switzerland ranks second with a score of 74.5, featuring around 900 registered crypto companies and a capital gains tax of just 7.8% for long-term investors.

The Swiss financial regulator, FINMA developed a supportive regulatory framework for crypto businesses, particularly in regions like Zug, known as “Crypto Valley.”

Mandatory registration with FINMA provides legal certainty for companies operating in Switzerland.

The country’s tax system is favorable compared to global averages, with corporate taxes ranging from 12% to 21%. Now over 400 businesses in Switzerland accept cryptocurrencies for transactions, showing how deeply integrated crypto is within the economy.

South Korea’s growing influence in the market

South Korea comes in third with a score of 73.5 and is actively shaping the global crypto market.

The Korea Financial Intelligence Unit, part of the Financial Services Commission created an evolving regulatory framework that wants to incorporate cryptocurrencies into the financial system.

By requiring crypto businesses to register with the FSC, South Korea ensures oversight and legitimacy for these operations.

The country’s tax policies also make it attractive for crypto ventures; there is currently a delay in capital gains tax on cryptocurrencies, along with plans to introduce corporate taxes in 2025, providing temporary relief that could draw more businesses.

With over 376 active crypto companies, South Korea is expanding its market presence and setting an example in the region.