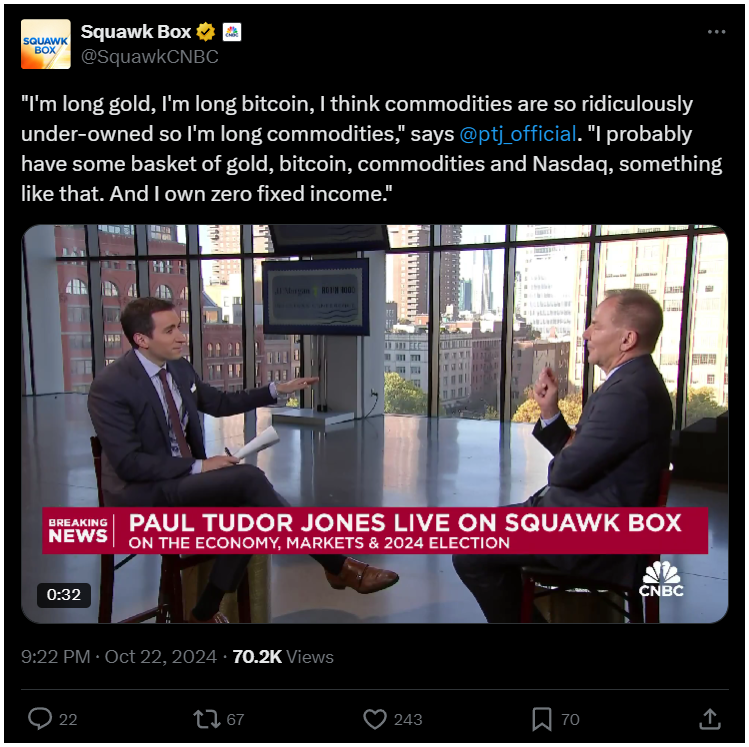

The billionaire hedge fund manager is putting his money on Bitcoin and commodities, sounding the alarm about rising inflation.

In an interview with CNBC he stated that all roads lead to inflation.

Inflation is coming?

Jones explained that his investment mix includes gold, Bitcoin, commodities, and Nasdaq stocks, while he has no interest in fixed income investments at all.

Anthony Pompliano, a well-known figure in the Bitcoin community, had a lighthearted take on Jones’ announcement, joking that it was probably nothing, but many see Jones’ move as significant.

A Twitter account called PiWhales noted that Jones, as veteran investor going long on both Bitcoin and gold speaks volumes about the current market situation.

They added that inflation could make decentralized assets like Bitcoin even more appealing.

Safe havens are rising

Bitcoin came close to its ATH on October 21 but has since pulled back to around $67,000.

Gold prices have surged by 33% this year, trading above $2,750 for the first time ever.

Silver is also enjoying a good run, reaching its highest price since 2012 with 46% increase in 2024.

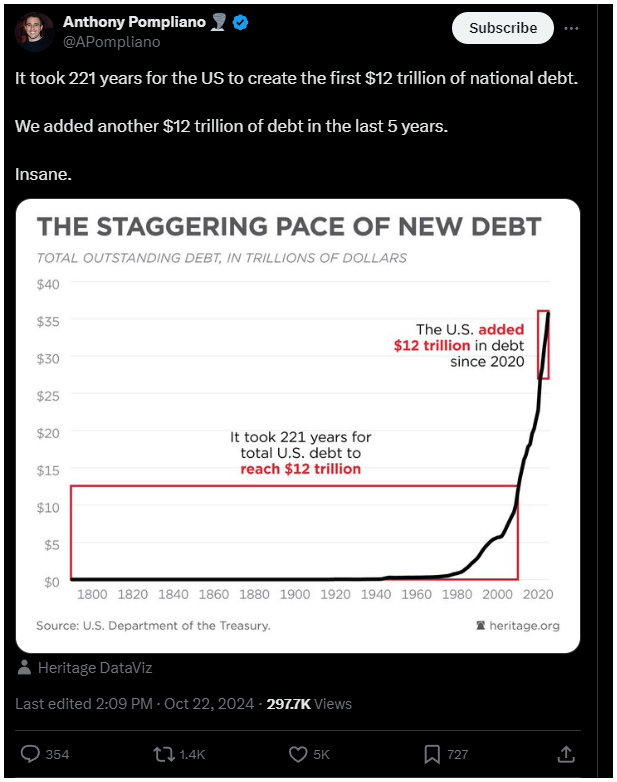

Jones explained that inflation will happen regardless of what the central bank does because the country needs to address its debt-to-GDP issues.

He said if we want to stabilize debt relative to GDP, we need to adopt a very relaxed monetary policy without letting inflation become too much of a burden for citizens.

The total U.S. public debt stands at about 120% of its GDP, and high debt-to-GDP ratio can limit how a country responds to economic challenges and increase the risk of defaulting on debt.

This situation can create a nasty cycle of debt, inflation, and stunted economic growth, ultimately threatening long-term stability.

The national debt is currently an eye-watering $35.7 trillion and is growing rapidly. Some say way too rapidly.

Central banks says they aren’t causing inflation, after printing huge chunk of money which caused inflation

Despite Jones’ warnings, central banks around the world have a different perspective.

In its World Economic Outlook report, the International Monetary Fund claimed that the battle against inflation is largely won.

While global inflation rates spiked during COVID lockdowns, they have since decreased. Yet many consumers still feel the pinch as costs for fuel, food, energy, and utilities keep rising in most countries.

This is because slower inflation is still inflation, no matter what bankers wants us to believe.