A California federal court has ruled that Lido DAO, the governing body behind the popular liquid staking protocol, can be treated as a general partnership under state law.

This means that members of the decentralized autonomous organization could be held liable for its actions.

What’s the ruling about?

On Monday, the court dismissed Lido’s argument that it isn’t a legal entity and instead classified it as a general partnership.

This ruling sets an important precedent for how profit-driven DAOs might be treated legally.

In this case identifiable participants were actively managing Lido’s operations, meaning they can’t just hide behind its decentralized structure to avoid responsibility.

Judge Vince Chhabria noted in his ruling that this case raises important questions about whether people in the crypto space can shield themselves from liability by creating new legal frameworks to profit from complex financial instruments.

The ruling implicates several major players in the crypto world. Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management were identified as general partners due to their active roles in Lido’s governance and operations.

On the other hand, Robot Ventures was let off the hook because there wasn’t enough evidence of their involvement.

No free lunch

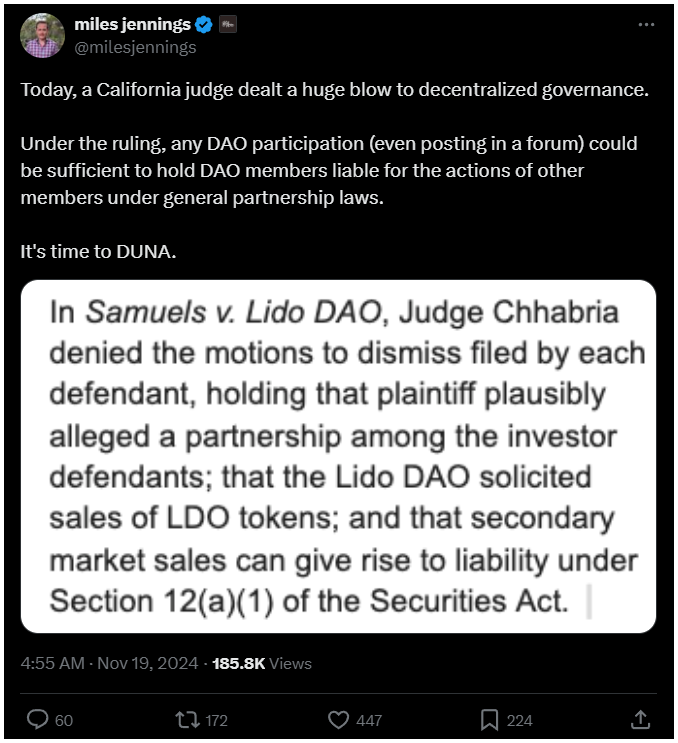

Miles Jennings, General Counsel and Head of Decentralization at a16z crypto, expressed concerns about the ruling on X, saying it dealt a significant blow to decentralized governance.

He pointed out that under this decision, even minimal participation in a DAO, like posting in a forum, could make members liable for the actions of others.

So how did we get here? The plaintiff, Andrew Samuels, bought LDO tokens on the secondary market through Gemini in April and May 2023.

After suffering losses from these investments, he filed a class-action lawsuit in December, claiming that the tokens were sold as unregistered securities and holding Lido DAO responsible for their plummeting value.

The court sided with Samuels, agreeing that Lido’s structure, where token holders govern decisions and earn staking rewards, fits the definition of a general partnership under California law.

The judge also noted that Lido’s lack of direct token sales didn’t exempt it from liability.

A new era for DAOs?

As Judge Chhabria pointed out, California courts interpret the phrase “offers or sells” broadly enough to include anyone who solicits purchases of securities.

Samuels successfully argued that Lido had solicited the purchase of these tokens on crypto exchanges.

This ruling could have serious implications for how DAOs operate and how members engage with them.

As more people step into decentralized finance and digital assets as investors or industry participants, understanding these legal frameworks will be pretty important, as it seems.