The new report from Kaiko and Bitvavo reveals that compliant stablecoins are claiming the bigger slice of the market pie.

With regulatory frameworks changing, it seems like these stablecoins are becoming the go-to choice for many European traders.

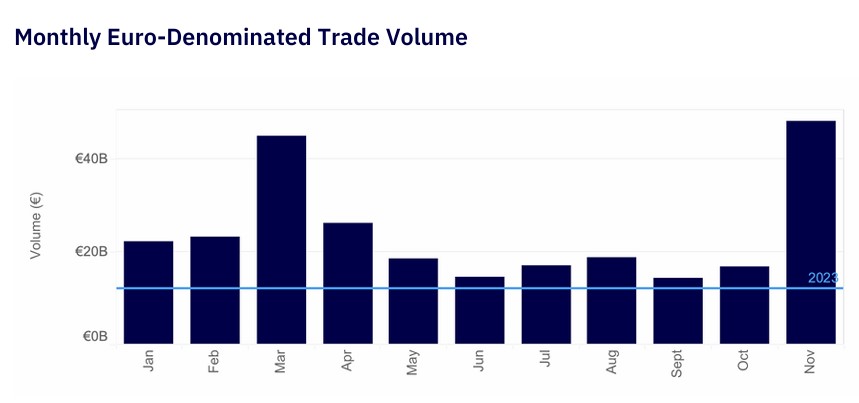

Trading volumes on the rise

The report shows a visible growth in crypto trading across Europe, particularly with euro-denominated transactions.

Throughout the year, trading volumes in euros consistently surpassed the average from 2023, hitting impressive peaks of over $42 billion in both March and November, and this uptick shows that the euro is solidifying its position as a major player in the local crypto markets.

In fact, the euro has become the third most-traded fiat currency in the crypto world this year, making up 7.5% of all fiat trading volume.

Of course, the U.S. dollar, as the world’s reserve currency still reigns supreme with a 49.9% share, while the Korean won follows with 33.4%.

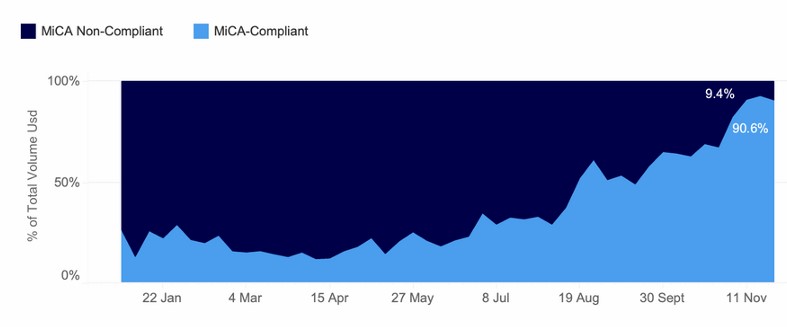

Stablecoins under MiCA

But it’s not just about euro, as the environment for stablecoins is shifting big time thanks to the new Markets in Crypto-Assets Regulation, the famous or infamous MiCA.

It started rolling out on June 30 and will be fully implemented by December 30, are reshaping how stablecoins operate in the old continent.

Tether announced it would stop supporting its euro-pegged stablecoin, EURt, across all blockchains, and they cited Europe’s changing regulatory environment as a key reason for this decision.

Euro-backed stablecoins are thriving btw, with monthly trading volumes exceeding $300 million throughout 2024. November was particularly strong, seeing nearly $800 million in trading activity.

Market share

By late 2024, MiCA-compliant stablecoins have captured 91% of the European market share, and bigger players include Circle’s EURC, Societe Generale’s EURCV, and Banking Circle’s EURI. Binance has also made waves by nearly matching Coinbase’s market share after listing EURI in August.

The growth of MiCA-compliant stablecoins is clearly a huge shift in how cryptocurrencies are regulated and traded in Europe.

As these regulations take hold, they promise to bring more clarity and security to the market while supporting greater crypto adoption. For our safety, as always.