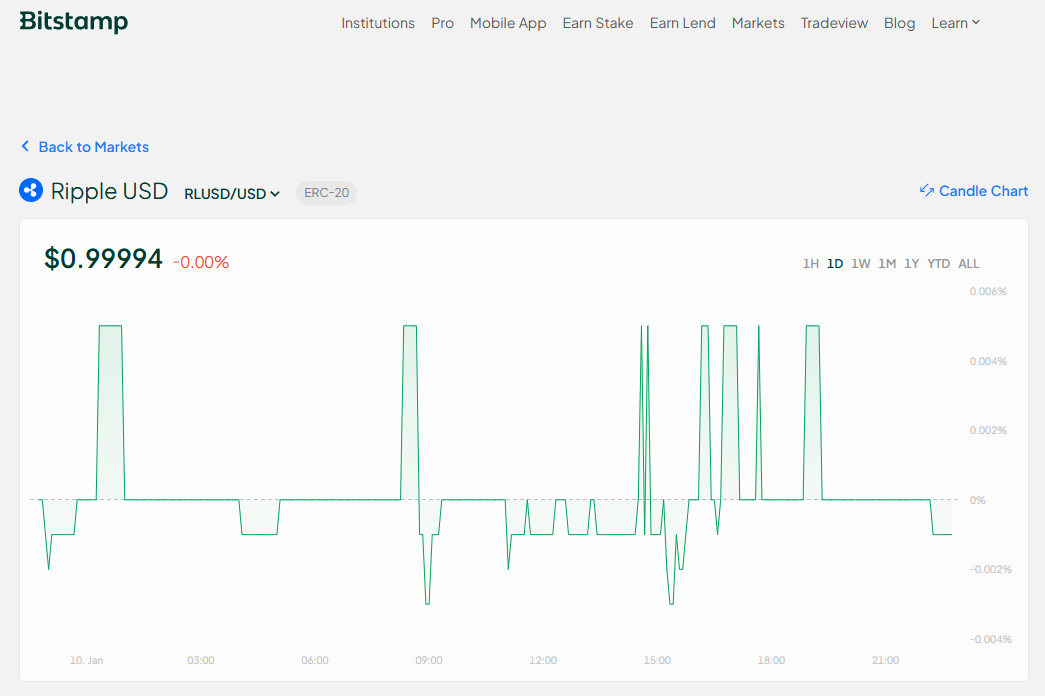

Ripple has just launched its new stablecoin, Ripple USD on the popular exchange Bitstamp.

This stablecoin is pegged to the U.S. dollar and designed to bring liquidity and stability to the market.

Yet another stablecoin, or this is something else?

RLUSD is now live on Bitstamp and is available on the Ethereum network. Ripple has been in the game for over a decade, so they know a thing or two about enterprise financial solutions.

The new stablecoin wants to cater to institutional needs, and you can now trade it in several pairs: RLUSD/EUR, RLUSD/USD, RLUSD/USDT, RLUSD/BTC, RLUSD/ETH, and RLUSD/XRP.

Bitstamp clarified that while RLUSD is supported on both the XRP Ledger and Ethereum blockchains, it’s currently listed on Ethereum.

Every RLUSD is fully backed by cash and cash equivalents, meaning you can redeem it 1:1 for U.S. dollars.

Since its launch on December 17, 2024, RLUSD has been gaining visible traction in the crypto market.

Trust and compliance matter

Ripple is all about compliance and building trust, so they’ve issued RLUSD under a New York Trust Charter, ensuring that it meets regulatory standards. This stablecoin not only provides stability for transactions but also bridges fiat currencies with crypto through global partnerships.

You can also find RLUSD on other exchanges like Uphold, Bitso, or Moonpay. Ripple President Monica Long has hinted that more platforms will soon support RLUSD.

Plus, Ripple is teaming up with Chainlink to provide reliable on-chain pricing data for its stablecoin, making it even more attractive for DeFi applications.

Impact on XRP prices?

The introduction of RLUSD has already had a positive effect on XRP prices, and analysts believe that this new stablecoin could boost XRP’s liquidity and utility in the market, potentially leading to further price increases.

Ripple’s bigwigs, including CEO Brad Garlinghouse, are even optimistic about seeing XRP ETFs in the near future.