Let me tell you something, guys, Bitcoin isn’t just for tech geeks and crypto bros anymore. It’s gone corporate, big time.

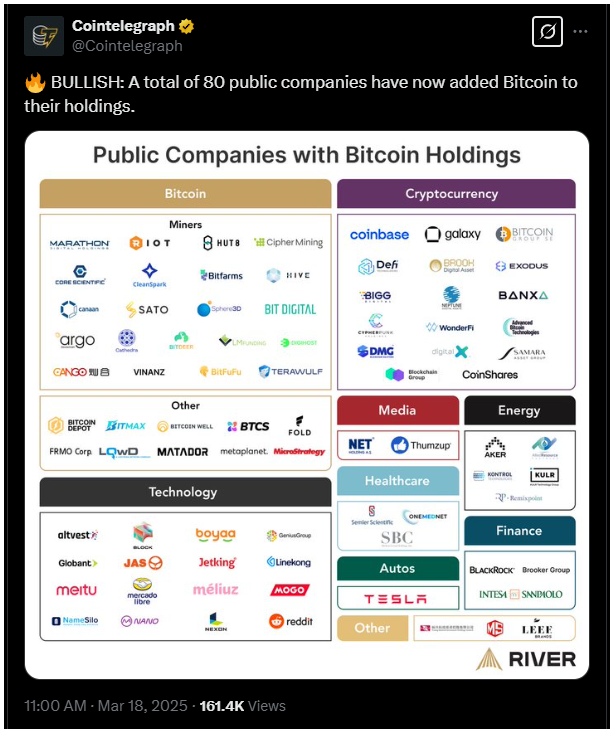

Eighty public companies now hold Bitcoin on their balance sheets. The same digital asset once dismissed as a fringe experiment is now a darling of the business world.

Funny money, or store of value?

What’s the reason, why are they doing this? Simple, Bitcoin is a hedge against inflation and a way to diversify portfolios. And these companies?

They’re not playing around. First, let’s talk about the miners, Marathon Digital Holdings, Riot Platforms, Bitfarms, and others.

These guys are the lifeblood of the Bitcoin network, running massive computer rigs to validate transactions and earn Bitcoin rewards.

Marathon alone has amassed thousands of Bitcoins through mining and strategic purchases.

They’re not just mining, they’re doubling down, treating Bitcoin like a long-term investment. It’s like they’re saying, “We’re all in, no turning back.”

All-in on BTC

Then you’ve got the crypto-native firms like Coinbase and Galaxy Digital. Coinbase, one of the biggest crypto exchanges out there, holds Bitcoin as part of its corporate treasury. Galaxy Digital?

They’re in deep too, managing crypto assets and keeping a nice stash of Bitcoin on their books. These companies aren’t just testing the waters, let me say this.

Now, here’s where it gets interesting. Tech giants like Tesla and Reddit have jumped on the Bitcoin bandwagon.

Tesla made quite a noise back in 2021 with its $1.5 billion Bitcoin purchase, while Reddit has quietly added crypto to its treasury as part of its blockchain push.

Even BlackRock, the world’s largest asset manager is getting in on the action. Their exposure to Bitcoin through ETFs shows that institutional interest in crypto is no longer a niche, it’s mainstream.

Strategy, the king of corporate Bitcoin

And then there’s MicroStrategy, or simply Strategy now, the undisputed heavyweight champion of corporate Bitcoin holdings.

With 461,000 BTC worth over $48 billion, they own more than 2% of all Bitcoin in circulation.

Michael Saylor, their executive chairman, has turned his company into a Bitcoin powerhouse, claiming it outperforms traditional assets like gold and even art.

And all this means Bitcoin isn’t just surviving, but it’s thriving in boardrooms around the world.

These companies are betting big on a future where digital assets aren’t just an option, but requirement.

Have you read it yet? Crypto heist like in the movies, from digital to deadly?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.