I’m quite sure have you heard about it that Bybit, a major crypto exchange, just got hit with the largest hack in history, $1.4 billion gone in a flash.

And the culprits? None other than North Korea’s infamous Lazarus Group.

Clues

It’s like something out of a spy novel, but this time, it’s real, and it went down like this. Hackers used a slick social engineering trick to get Bybit’s CEO to approve a fake transaction.

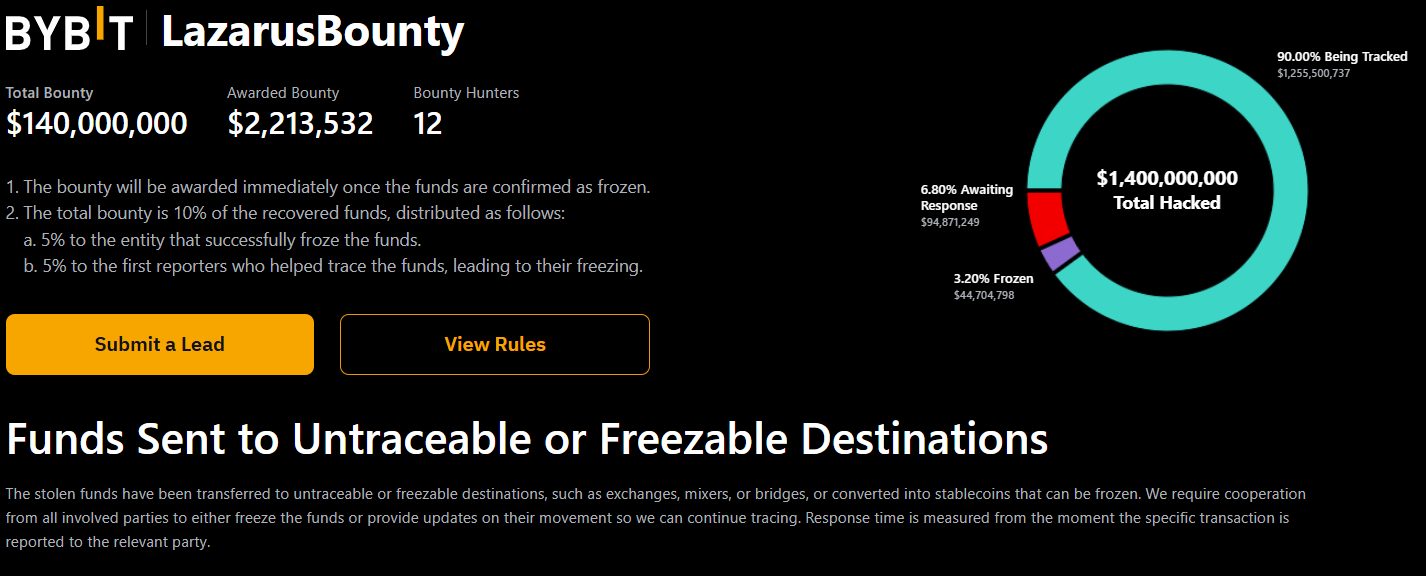

3.20.25 Executive Summary on Hacked Funds:

Hacker started to use BTC mixers: 1. Wasbi 2. CryptoMixer 3. Railgun 4. TornadoCash

Total hacked funds of USD 1.4bn around 500k ETH. 88.87% remain traceable, 7.59% have gone dark, 3.54% have been frozen.

Breakdown: – 86.29% (440,091…— Ben Zhou (@benbybit) March 20, 2025

Next thing you know, 401,346 Ethereum are gone, valued at over $1.4 billion. But here’s the twist, despite the hackers’ best efforts to launder the funds, over 88% of the stolen crypto is still traceable.

That’s right, blockchain investigators are hot on their heels. And because we’re talking about billions, that’s a pretty good news, isn’t it?

Do you have something for me?

Bybit’s CEO, Ben Zhou, is optimistic. He says that most of the funds have been converted into Bitcoin and are scattered across thousands of wallets.

But the real challenge is decoding those cryptocurrency mixers. It’s like trying to find a needle in a haystack, except the needle is worth billions.

Bybit’s offering big bucks for bounty hunters who can help track down these funds. They’ve already paid out $2.2 million to those who’ve provided valuable intel.

It’s a cat-and-mouse game, but the stakes are high. The crypto industry needs more white hat hackers to take on these sophisticated cyberattacks.

Security

What does this mean for you and me, for the average users? Well, it’s a painful reminder that even the strongest security can be undone by human error.

Bybit thought it was secure, but a simple trick was all it took to bring it down.

In the end, it’s a wake-up call for the entire crypto market. We need better security, more vigilance, and a lot of luck to catch these thieves.

But hey, if you’re feeling like a digital detective, now’s your chance to shine. The hunt is on, and the reward is worth it.

Have you read it yet? Gotbit’s dirty laundry: the $23 million plea deal

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.