The first rule of Bitcoin is everything is good for Bitcoin. Imagine a world where economic chaos becomes Bitcoin’s best friend. Sounds crazy.

But welcome to the world of Arthur Hayes, co-founder of BitMEX, who’s cheering on tariffs as a potential catalyst for Bitcoin’s rise.

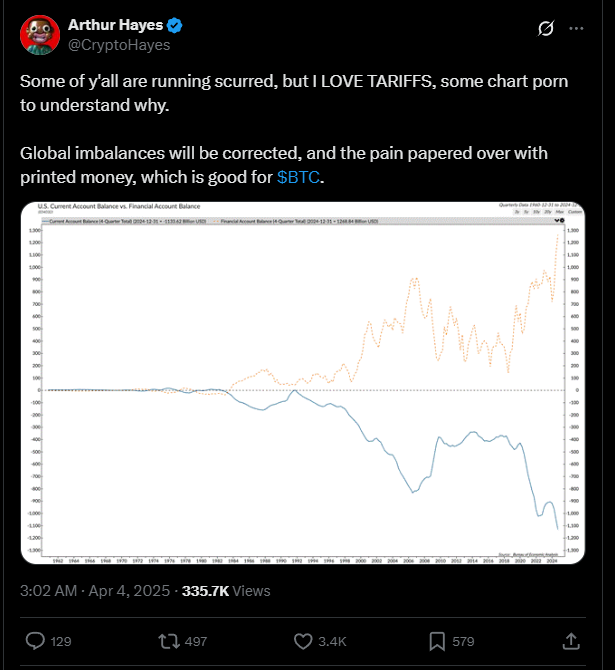

In a new post, Hayes expressed his love for tariffs, saying they’ll correct global imbalances and lead to more printed money, music to Bitcoin’s ears.

Printer go brr

But why would tariffs, which are essentially economic speed bumps, be good for Bitcoin?

Hayes believes that as tariffs rattle the global economy, the US Dollar Index will weaken.

This happens when overseas investors sell off US stocks and bring their money back home. It’s like a big game of economic musical chairs, where everyone’s scrambling to find a safe seat. And for some, that safe seat is Bitcoin.

Safe haven

The tariff announcements, including 34% on China, have already caused a hype, and not in a good way.

The Nasdaq 100 saw its largest single-day point loss in history, with a drop of 1,060 points.

This kind of economic uncertainty often sends investors running to safer havens like gold and, you guessed it, Bitcoin.

But here’s the twist in the story, because a weakening yuan in China could push investors towards riskier assets like Bitcoin to protect their wealth.

It’s like a game of economic Jenga, when one block falls, others might follow, and Bitcoin could be the beneficiary.

Rate cutting on the horizon?

Hayes also believes that the Federal Reserve will respond to these economic pressures by cutting rates and possibly restarting quantitative easing.

This would flood the market with liquidity, making riskier assets like crypto more attractive.

It’s a bit like throwing gasoline on a fire, sometimes it burns out of control, but sometimes it fuels a rally.

We need Fed easing, the 2yr treasury yield dumped after Tariff annc because the market is telling us the Fed will be cutting soon and possibly restarting QE to counter -ve economic impact. pic.twitter.com/081kiGf9Jk

— Arthur Hayes (@CryptoHayes) April 4, 2025

Jeff Park from Bitwise Invest agrees, suggesting that a weaker dollar and lower US rates could send risk assets skyrocketing.

So if you’re a Bitcoin fan, you might just find yourself cheering on tariffs alongside Arthur Hayes.

Have you read it yet? PayPal announced that Solana and Chainlink join the party

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.