The crypto market just witnessed a bloodbath, and it’s not just your average Joe who got burned.

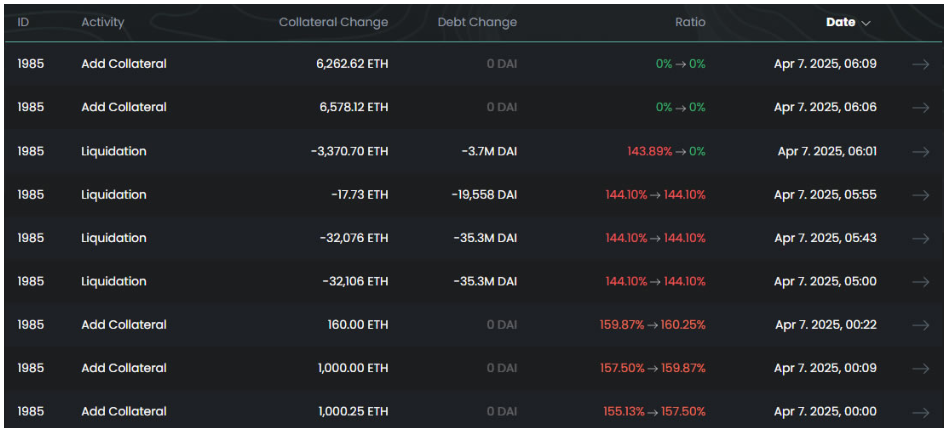

An Ethereum whale, someone with a massive stake in the game, just got liquidated for $106 million on the Sky lending platform.

Collateral

Ethereum prices plummeted by over 14% on April 6, triggering a cascade of liquidations on decentralized finance platforms.

This particular whale had 67,570 ETH, worth around $106 million, tied up in a collateralized debt position on Sky.

The platform, which rebranded from Maker, works by allowing users to borrow its stablecoin, DAI, by putting up ETH as collateral.

The catch? You need to overcollateralize, meaning you have to put up at least $150 worth of ETH to borrow $100 in DAI.

But when ETH prices tanked, this whale’s collateral ratio fell to 144%, making their position eligible for liquidation. And that’s exactly what happened.

Sky seized the ETH, auctioned it off to cover the debt, and any leftovers went back to the whale. It’s a brutal system, but that’s how the game is played.

Bad days

And this whale wasn’t alone. Another big player was on the verge of losing $91 million worth of wrapped ETH.

The Ethereum price has crashed to levels not seen since October 2023, and it’s still 68% off its all-time high from 2021.

The wider crypto market is in chaos, partly due to external factors like U.S. economic policies.

Risk business

The numbers are pretty staggering, over 320,000 traders got liquidated in the past 24 hours, with losses nearing $1 billion.

Most of those were Ethereum positions. It’s a reminder that in crypto, fortunes can change overnight.

So, if you’re playing in this space, be prepared for the rollercoaster ride of a lifetime.

Or, you know, just watch from the sidelines and enjoy the fireworks. In times like this, that may be the best decision. Your call.

Have you read it yet? No KYC, no FTX payout for victims

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.