Singapore is on fire when it comes to crypto, and it’s not just the older people getting in on the action. A 26% of Singaporeans now own cryptocurrency, and the youth are leading the way.

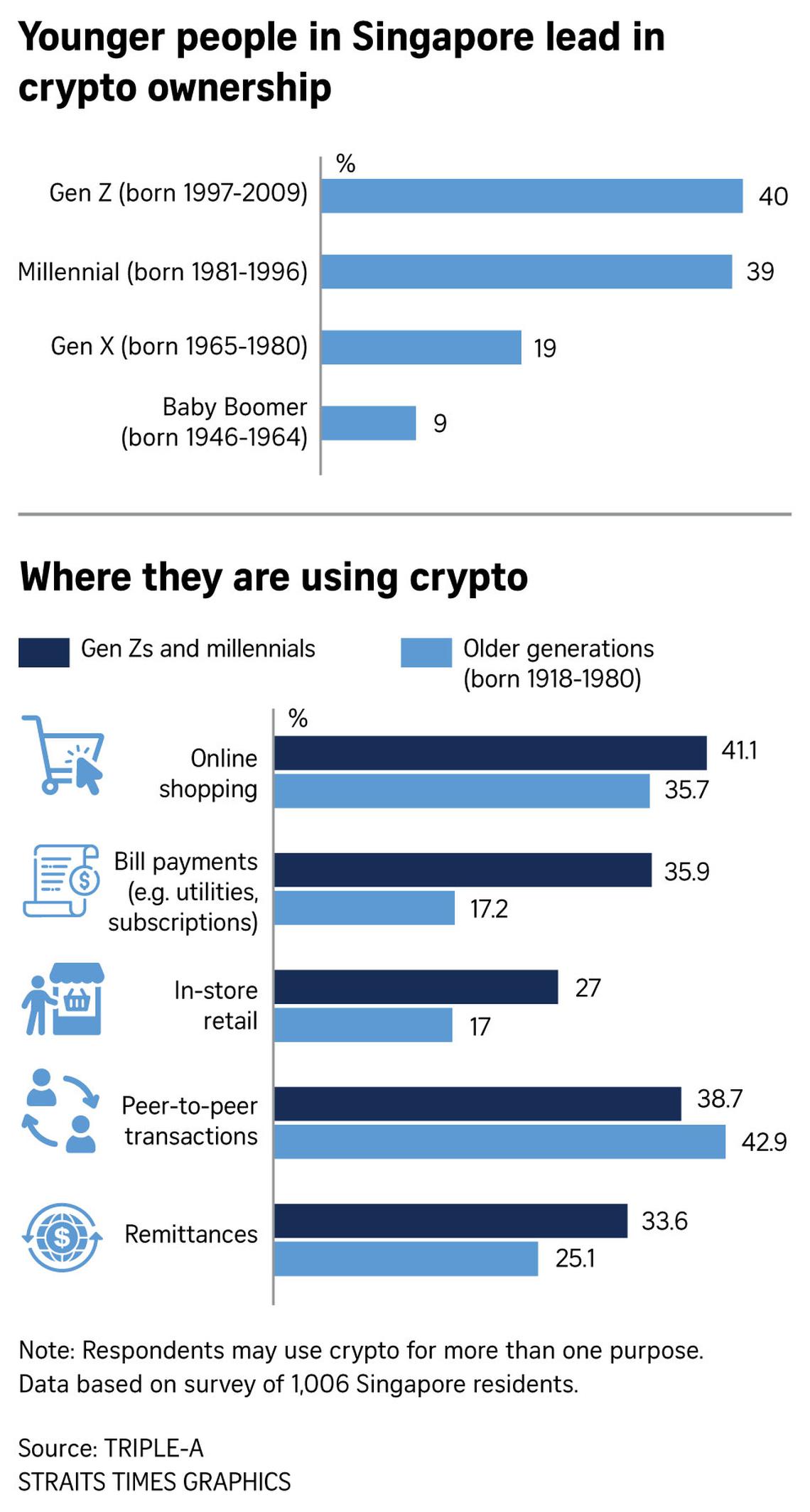

Gen Z and Millennials are the driving force, with around 40% and 39% respectively holding cryptocurrency.

Different usage

But what’s really interesting is how different generations use crypto. Younger Singaporeans are all about e-commerce and bill payments, with 41.1% using crypto for online shopping and 35.9% for utility bills.

They’re also more likely to use crypto for cross-border remittances, showing they’re not afraid to explore beyond traditional banking.

Meanwhile, older generations prefer peer-to-peer transfers and internet shopping, but at much lower rates.

Progress

Singapore’s crypto payment ecosystem is booming, with over $1 billion processed in just one quarter.

Companies like AXS and Charles & Keith are now accepting crypto, making it easier for people to use cryptocurrencies in their daily lives.

But despite the growth, users still face challenges like complexity and security concerns.

Industry development

The Monetary Authority of Singapore, the MAS is keeping pace with this growth, accelerating licenses for digital payment token firms. And guess what?

The future looks bright for blockchain jobs in Singapore. Over 75% of Web3 firms plan to hire more staff in 2025, with roles ranging from software engineering to marketing strategy.

So, if you’re in Singapore, you’re already part of a vibrant crypto community that’s pushing boundaries. And if you’re not, you might want to take a page out of their book.

The youth are leading the charge, and it’s time to join the party. Whether you’re a seasoned investor or just curious, Singapore’s crypto scene is one to watch.

Have you read it yet? Schiff and Saylor agrees on Bitcoin, is this a legendary moment?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.