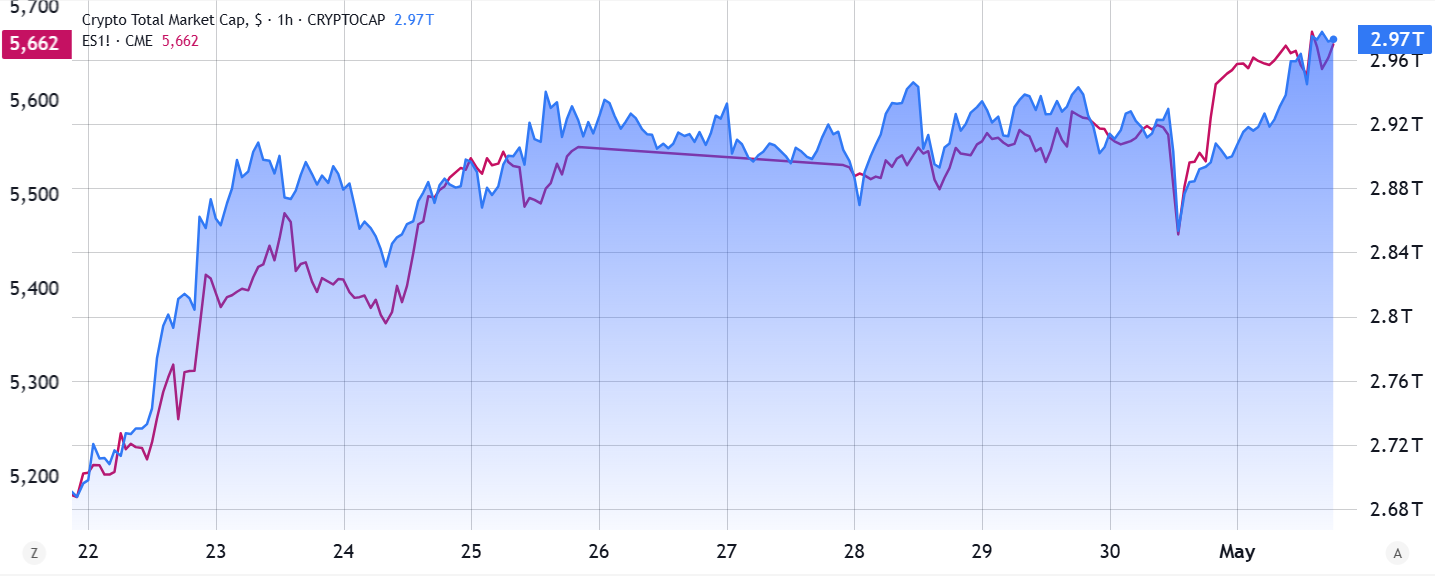

The decoupling just happened, and it’s not what you think. For years, crypto diehards have been praying for that magical moment, the big decoupling, when Bitcoin would finally break free from Wall Street’s grip, riding solo, calling its own shots. No more correlation with traditional markets.

Is this a decoupling?

Well, guess what? That story’s over, guys. The last ten days? Bitcoin and the S&P 500 have been moving together like two wiseguys in matching tracksuits. So much for independence. But you know what’s funny?

All this talk about cryptocurrencies being their own thing, a safe haven if the global economy tanks.

But every time the market sneezes, Bitcoin catches a cold. Trade wars, tariffs, you name it, their charts start looking like twins separated at birth.

If you were hoping for crypto to be your recession-proof getaway car, you might wanna check the engine.

Now, let’s talk about the stock market, because the S&P 500 hit its high-water mark back in February, tried to claw its way back to 5,800, but kept slipping on banana peels. Trade tensions with Canada and Mexico?

Tariffs flying left and right? Doesn’t matter. Stocks just keep taking the punches and getting back up. Like Rocky Balboa, but with more spreadsheets.

Geopolitics

The U.S. and China are doing this dance, tariffs here, waivers there. China’s still got a 125% tariff on American goods, but suddenly they’re giving passes to ethane and semiconductors.

America’s letting some carmakers off the hook, too. It’s like two mob bosses trading favors at Sunday dinner.

Maybe, just maybe, we’ve seen the market bottom out at 4,835 in April, and now we’re hovering around 5,635.

And get this, tech giants are flexing. Microsoft’s raking in 13% more dough than last year. Meta’s blowing past earnings expectations. Turns out, the AI bubble everyone was sweating? Not popping yet.

Companies are dodging tariffs by moving factories outta China or beefing up operations at home. Adapt or die, right?

Printer is coming?

But everyone’s got their eyes glued to the Fed. Manufacturing’s down, sure, but the real action is in the Fed’s next move.

After a year of tightening the belt, they’re thinking about pumping more money in. More liquidity means riskier bets start looking good again.

Even if crypto can’t cut the cord from stocks, a little economic juice could keep both parties going strong.

Still, let’s not kid ourselves. Crypto’s been outpacing stocks lately, up 8.5% since March, while the S&P 500 dropped 5.3%.

Over six months? Crypto’s up 29%, stocks down 2%. So, yeah, they’re not joined at the hip. But don’t get cocky. If a real recession hits, both markets are gonna feel it.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.