The stablecoin market is at a new ATH. The sector, once the quiet cousin at the crypto family dinner, just strutted in wearing a $220 billion badge, the biggest it’s ever been.

USDT and USDC pumped up their market caps and brought the whole party with them.

This is a clear a sign that the money’s flowing, the mood’s changing, and the crypto scene’s got its swagger back.

Market sentiment is changing

Now, you know how it goes,when the stablecoins start flexing, Bitcoin usually smells opportunity.

And sure enough, Bitcoin’s Bull Score Index, a little meter that tells us if the market’s feeling lucky, jumped from a sad 20 to a much friskier 50.

Translation? Bitcoin just crawled outta the bearish basement and into neutral territory. Not exactly the penthouse, but hey, you gotta start somewhere.

Liquidity is back.

Stablecoin market cap just hit $220B, a new record.

Bitcoin exits bearish phase as capital returns to the market. pic.twitter.com/LbnFpXFspb

— CryptoQuant.com (@cryptoquant_com) May 2, 2025

Warmup

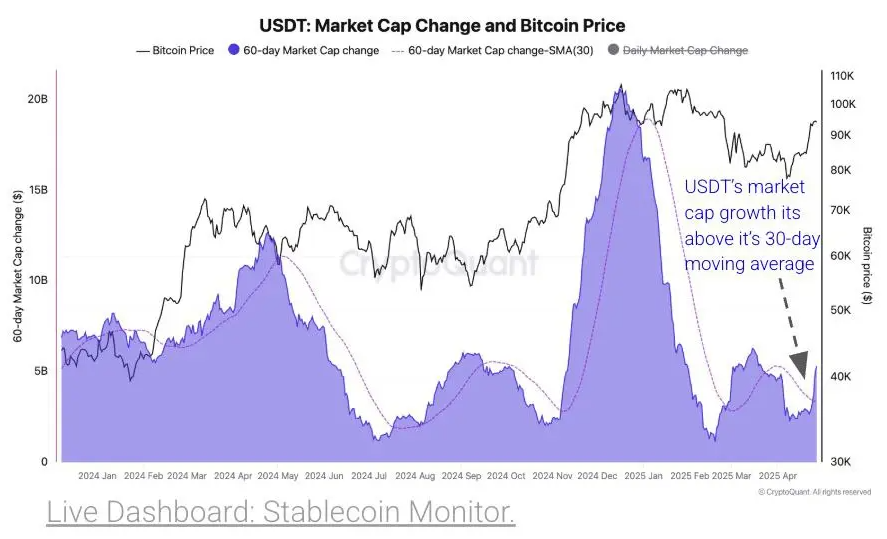

Let’s talk numbers, because USDT and USDC didn’t just grow but exploded. Over the past month, USDT’s market cap shot up by $5.3 billion, and USDC wasn’t far behind, leaping by $6 billion.

That’s a lotta dough waiting to jump into action. In April alone, stablecoin transfer volumes hit $1.2 trillion-up 15% from March.

You ever see that much cash move that fast? That’s like every wise guy in town suddenly showing up at the same poker game.

But while USDT’s liquidity on exchanges is still down 12% from its February high, USDC’s exchange stash just hit a level we haven’t seen since March 2023.

So, the capital’s moving around, maybe getting ready for the next big score.

Rally is coming?

And don’t forget, stablecoins aren’t just a US dollar story anymore. There’s a growing appetite for non-USD flavors, even non-currency flavors, especially with all the drama around tariffs and dollar volatility.

But USD-backed coins still run the show, holding 99% of the market. Maybe someday we’ll see another one, but not today.

And lucky us, when stablecoin liquidity grows, Bitcoin usually gets a lift. More capital, more trading, more action.

But don’t get too giddy, the analysts say that for a real, lasting rally, that Bull Score needs to punch above 60. For now, though, Bitcoin’s outta the dumps and eyeing the next big move.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.