With Bitcoin. Japan’s big public companies, the heavy hitters like Metaplanet, ANAP, Remixpoint, and Gumi, are stepping into Bitcoin.

Why? Because the yen’s been losing its mojo, interest rates are stuck in the gutter, and traditional investments just don’t cut it anymore.

It’s like watching the office crew ditch the stale coffee for something stronger.

Inflation-resistance

Public firms worldwide now hold over 820,000 BTC, that’s $85 billion worth of digital gold. Strategy leads the pack with 592,000 BTC.

But Metaplanet? They’re Asia’s rising star, shaking up the market and sending their stock price northward since jumping into crypto.

But why the sudden love affair with Bitcoin? First off, the yen’s been on a slippery slope.

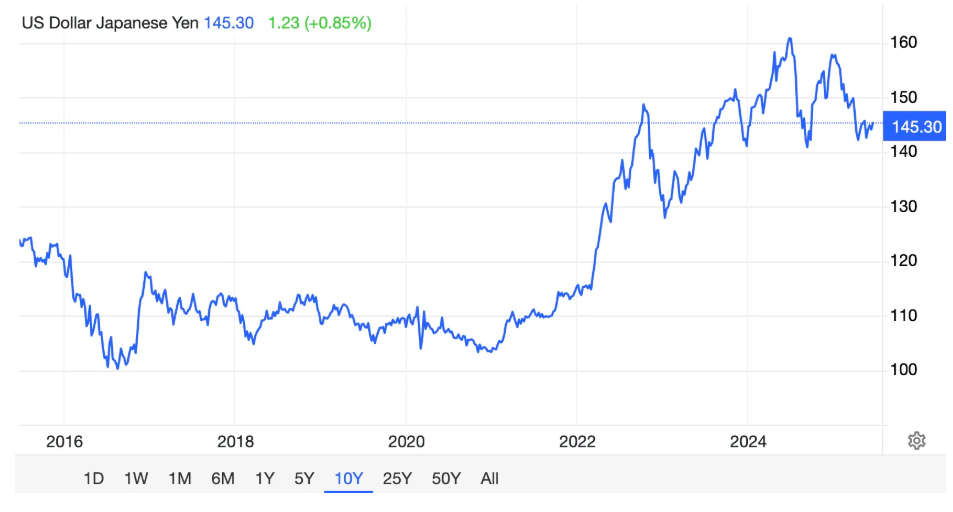

Trading Economics shows the yen has taken a serious hit in the past years, thanks in large part to the Bank of Japan’s stubborn negative interest rate policy.

The BOJ’s 2025 report admits this move, aimed at jump-starting the economy, has had a side effect, weakening the yen.

So, what’s a savvy company to do? They look for assets that don’t melt away with inflation. Enter Bitcoin, the inflation-resistant knight in shining armor.

The Strategy-script

Second, Japan’s traditional investments are about as exciting as watching paint dry.

Negative interest rates have turned government bonds and other local assets into low-yield traps.

No wonder firms are eyeing Bitcoin as their long-term play, channeling a Strategy-style strategy from the US. Investors seem to like it too.

Just look at Metaplanet’s stock climbing after their crypto bet.

Friendly environment

And let’s not forget Japan’s crypto-friendly vibe. The Financial Services Agency has laid down clear rules, KYC, AML, the works, making it a safer playground for companies compared to countries with tighter restrictions.

It’s like having a well-lit, secure office instead of a dark alley when it comes to crypto dealings.

But hey, don’t get too cozy. Bitcoin’s notorious for its price swings, and global monetary shifts could shake things up.

Plus, the BOJ’s move to scrap negative interest rates might change the game again, making future Bitcoin buys a bit trickier.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.