The infamous hacker who pulled off that $300 million breach at Coinbase? Yeah, that guy’s back in the game, making moves that’d make even Wall Street’s slickest traders raise an eyebrow.

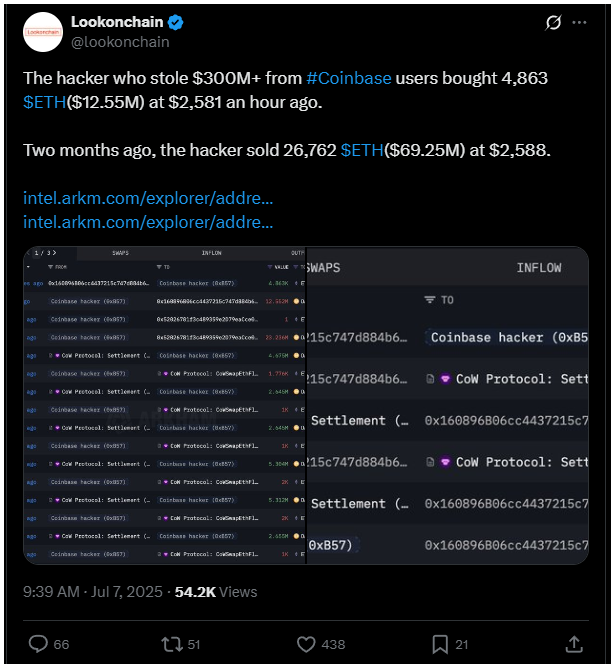

After months of laying low, this figure just dropped a cool $12.55 million on Ethereum, scooping up 4,863 ETH.

How it was

Let’s rewind a bit. This breach wasn’t your run-of-the-mill hack, because the attacker didn’t just simply storm the gates, they bribed a Coinbase customer support employee to get inside.

Sneaky, right? Around 97,000 users got caught in the crossfire. The thief then moved fast, converting a chunk of the stolen Ethereum, 26,347 ETH worth over $68 million, into DAI stablecoins through THORChain. Smooth operation.

Analysts see this latest Ethereum buy as a calculated move, a chess player setting up for the next big bull run.

Ethereum’s been on a roll lately, climbing about 1.9% to around $2,562, with a solid 4.5% gain over the past week.

The hacker’s timing? Impeccable. It’s like watching a pro gambler doubling down when the odds look good.

Sophistication

Experts are actually impressed with the hacker’s level of sophistication. Their risk management?

Way ahead of many legit traders. It’s strategic positioning, playing the long game, not just flipping some coins.

It’s like that quiet guy in the office who suddenly drops a killer presentation and everyone’s blown away. Only here, the stakes are millions, and the moves are digital.

The game has changed

This incident is one of the biggest black eyes in Coinbase’s history and also a painful reminder of how complex the crypto world has become. Criminals are evolving, using social methods and AI to stay a step ahead.

So, crypto platforms, exchanges, and companies better wise up and invest big in security.

Because if this hacker’s moves tell us anything, it’s that the game has changed. The bad guys are smarter, craftier, and ready to exploit any weak link.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.