Circle’s CRCL stock took a textbook nosedive, dropping a brutal 42% from nearly $299 to $171.50 since late June.

That kind of fall makes you think the whole ship’s sinking. But July’s been a different story. CRCL shrugged off the gloom and bounced back by 14%.

Circle have applied for national bank charter

First, let’s not pretend this rebound is just some random market magic. Sure, the S&P 500 hit fresh all-time highs, lifting a lot of boats. But CRCL’s recovery likely got some muscle behind it.

One big boost came from Circle teaming up with Fiserv, a global payments powerhouse.

With Fiserv’s reach across the U.S., Europe, Asia-Pacific, and South America, this partnership is like getting a nod from the big bosses. It signals confidence in Circle’s stablecoin tech and infrastructure.

Then there’s the GENIUS Act, the new stablecoin law in the U.S. that’s shaking up the game.

Circle’s not sitting on the sidelines, as they’ve applied for a national bank charter to play nice with regulators and get fully legit.

This move could give them a serious edge, especially since the GENIUS Act is speeding through the House of Representatives.

CBDCs might hurt profits

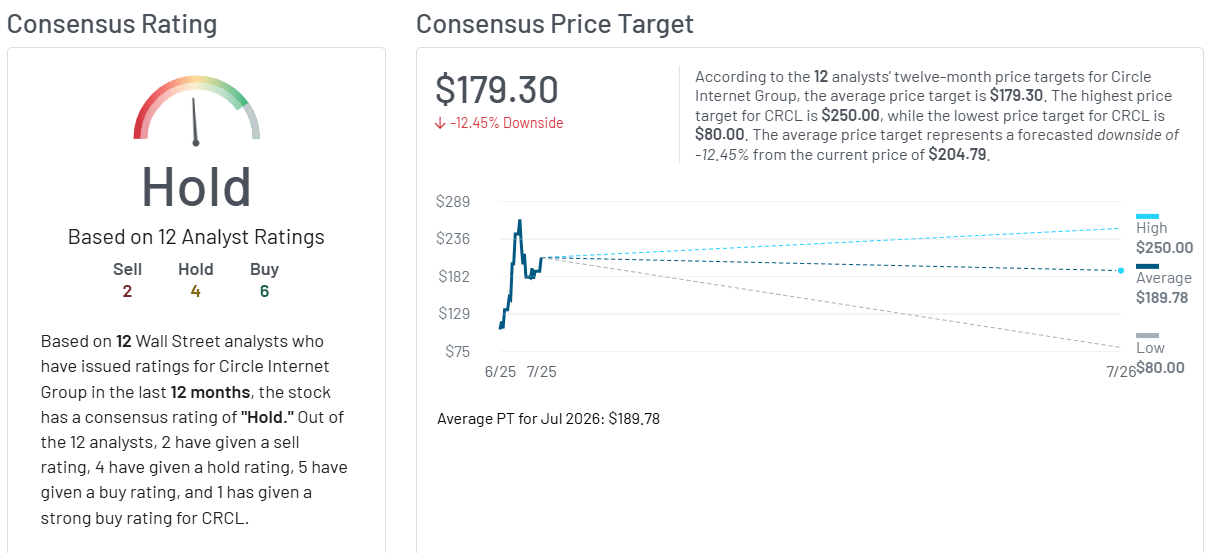

Now, don’t get me wrong, the street’s still divided on CRCL. Over a dozen analysts have thrown their hats in the ring with mixed calls. Seaport Research was shouting strong buy back in June.

John Todaro from Needham & Company’s got his sights set on $250, Barclays is eyeing $215, and Citigroup’s calling for $243. Sounds like a party, right?

But then, on the other side of the table, you’ve got Mizuho, Goldman Sachs, and the big boss JP Morgan, all predicting a dip to the $80 range.

JP Morgan’s take? The rise of Central Bank Digital Currencies, especially in Europe, could seriously cramp Circle’s style. They warn that CBDCs might block Circle’s global growth, hurting profits down the line.

Sharks are circling

So, what’s next? Market Beat says the consensus is a cautious ‘HOLD’ from 12 Wall Street analysts. Circle’s CRCL is playing a high-stakes game.

Partnerships, regulation, and global competition all in the mix.

The stock’s bounce-back is a clear sign the company’s not down for the count, but with sharks circling, the next few months could get pretty interesting.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.