Ethereum ETFs in the U.S. reached a milestone on July 23, 2025, marking one year since trading began.

The nine Spot Ether ETFs have collected $8.69 billion in net inflows. Total assets under management (AUM) now exceed $16.57 billion, according to CoinGlass.

The U.S. Securities and Exchange Commission (SEC) approved Spot Ether ETFs on July 23, 2024.

These include ETFs from BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, Invesco, and two from Grayscale.

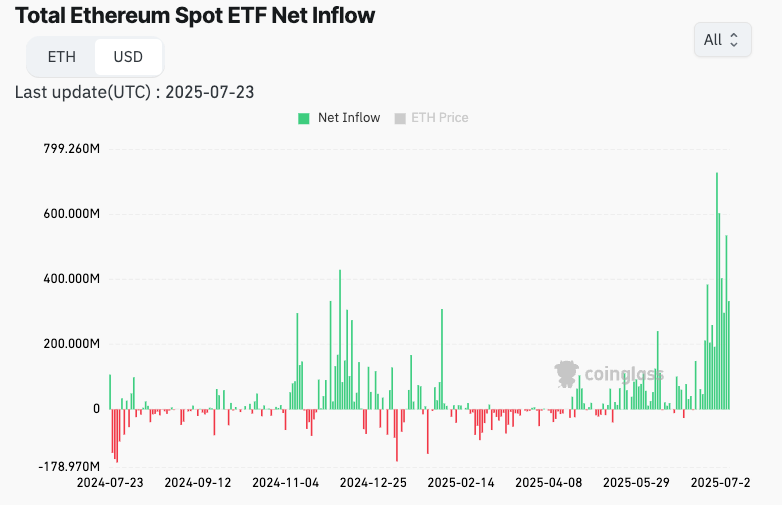

In the past 14 trading days, ETH ETF inflows reached $3.9 billion. This period accounts for nearly half of all net inflows since launch. CoinGlass data confirmed that this streak reflects one of the most active phases for Spot Ether ETFs.

ETH ETF Inflows See Strongest Daily Volumes in July

On the one-year anniversary, Ethereum ETFs recorded $332.2 million in inflows. This marked the seventh-highest daily inflow since they launched.

Nate Geraci, President of NovaDius Wealth Management, said six of the seven biggest daily inflows happened in the last two weeks.

The single highest daily inflow came on July 16, 2025. That day, the Spot Ether ETFs added $726.6 million in net flows. This activity followed a period when Ether struggled to cross the $4,000 level.

ETH has traded between $1,500 and $4,000 over the past 12 months. It reached a low in April and a local high in December. On July 24, 2025, CoinGecko reported ETH trading just above $3,600, up 8% from last year.

BlackRock Ethereum ETF Leads in Inflows, Grayscale Records Outflows

Among all Ethereum ETFs, BlackRock’s iShares Ethereum Trust ETF (ETHA) received the largest net inflows.

It brought in $8.9 billion since its launch. This made it the top-performing ETF among nearly 1,000 new funds launched since July 2024.

At the same time, the Grayscale Ethereum Trust ETF (ETHE) recorded nearly $4.3 billion in outflows. This fund first launched in 2017 as a trust and later converted to an ETF. Grayscale’s product has seen a steady exit of investors, particularly as its discount to net asset value narrowed.

Nate Geraci said on X that BlackRock’s ETH ETF leads in net inflows across all new ETF launches in the past year.

Staking Plans Under Review for Future ETH ETF Upgrades

Ethereum ETF issuers are now exploring the addition of staking to their funds. ETH staking involves locking tokens to support the Ethereum blockchain and receive rewards.

These rewards could be distributed to fund holders if approved by the SEC.

The SEC has not approved staking in Spot Ether ETFs yet. However, analysts expect a decision could come soon. If approved, issuers like BlackRock and Fidelity could adjust their ETH ETFs to include staking functionality.

Earlier in July 2025, REX Shares and Osprey Funds launched an ETF that includes staking. The product holds Solana (SOL) and passes on staking rewards to investors. SOL is currently priced at $180.21, according to market data.

The approval of staking in Ethereum ETFs could mirror this structure, allowing rewards to be paid out without changing the core ETF model.

Ethereum ETF Inflows Still Trail Behind Bitcoin Products

Despite growth, Ethereum ETFs remain far behind Spot Bitcoin ETFs in total inflows. Since early 2024, Bitcoin ETFs have taken in $54.5 billion in net inflows.

In comparison, Ethereum ETFs have recorded $8.69 billion during their first 12 months.

The ETH ETF inflow streak in July has been the longest and strongest since launch. While Bitcoin ETFs dominate in scale, the ETH fund inflows reflect sustained interest in Ethereum as a regulated asset class.

ETH ETF inflows, especially from BlackRock, have continued to rise. The data from CoinGlass shows increasing daily volume and consistent additions to AUM.

Ethereum’s price volatility did not stop this inflow trend over the past three weeks.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.