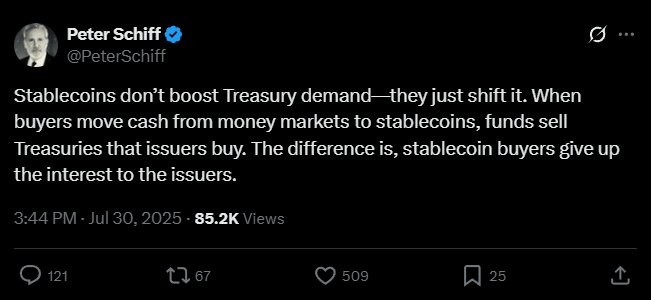

Peter Schiff, our favorite crypto-sceptic just dropped a bomb on stablecoins. The man’s saying these slick digital dollars aren’t the financial superheroes they’re cracked up to be.

Nope, instead, they might be stirring a mess in the U.S. Treasury markets and making borrowing cost headaches worse.

Treasury markets in trouble?

You got stablecoins, those nifty little beasts in crypto land that promise to keep their value pegged to good old fiat cash.

Fast, transparent, and flashy, right? Well, Schiff thinks these stablecoins don’t actually add fresh money to Treasury markets. Instead, they’re swooping in, snatching cash from traditional money markets.

So, where does that leave the big money, the long-term government bonds, the stuff that pretty much sets mortgage rates? In trouble.

And don’t forget, Schiff may wrong about Bitcoin, but otherwise he’s a quite sharp guy, so when he says there’s a trouble brewing here, he’s probably right.

See, when investors stash cash in stablecoins, those coin issuers turn around and buy short-term Treasury bills to back them up. But Schiff says the interest paid on those Treasuries?

It stays with the issuers. Not passed down to investors like traditional money market funds do.

That means less dough flowing into private lending. What happens next? Long-term yields creep up. Borrowing gets pricier.

Tighten the flow of capital

And it doesn’t stop there. Schiff points out these stablecoins simply can’t handle long-term Treasuries.

It’s like trying to fit a square peg in a round hole. This mismatch creates ripple effects, a credit market imbalance that could tighten the flow of capital to businesses and borrowers.

In plain talk, money parked in stablecoins might be sitting pretty but it’s not helping the businesses that need loans to grow.

Double-edged sword

Big financial players like BlackRock are throwing their weight behind stablecoins, touting them as so-called game-changers for the market.

But Schiff’s waving red flags, worried the rapid growth of these assets might be nudging us toward financial instability.

The moral of this story? Stablecoins, slick, fast, tempting, could be the double-edged swords of the financial industry.

They’re indeed changing the game, alright, but not without ruffling some feathers in the Treasury markets and beyond. It’s worth it?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.