Corporate Bitcoin holdings have surpassed $100 billion, raising concerns about potential government intervention.

As of July 31, companies with Bitcoin on their balance sheets collectively own 791,662 BTC, valued at approximately $93 billion. This amount represents 3.98% of Bitcoin’s circulating supply.

The concentration of Bitcoin among corporate treasuries could become a point of control if governments decide to act.

Analysts suggest that large-scale corporate holdings may make Bitcoin more vulnerable to centralization pressures.

Crypto analyst Willy Woo compared the trend to the gold market before 1971, when the United States moved to control gold under its monetary system. Woo made the remarks at the Baltic Honeybadger 2025 conference.

Willy Woo Links Bitcoin to Gold’s 1971 Nationalization Path

Woo said that a weakening US dollar combined with competition from China could lead to a scenario where the United States targets corporate Bitcoin reserves.

“The US might do an offer to all the treasury companies and centralize where it could be then put into a digital form, not create a new gold standard,” Woo said. “You could then rug it like happened in 1971. And it’s all centralized around the digital Bitcoin. The whole history repeats again back to the beginning.”

In 1971, President Richard Nixon ended the Bretton Woods system, suspending the dollar’s convertibility into gold and removing the fixed $35-per-ounce rate.

Woo noted that while corporate Bitcoin adoption continues to grow, large institutional participation remains a key factor before Bitcoin can rival the dollar or gold.

“That’s not going to happen until you get the large gatekeepers of capital opening up to Bitcoin and pouring money in,”

he said.

Institutional Adoption and Bitcoin Whale Risks

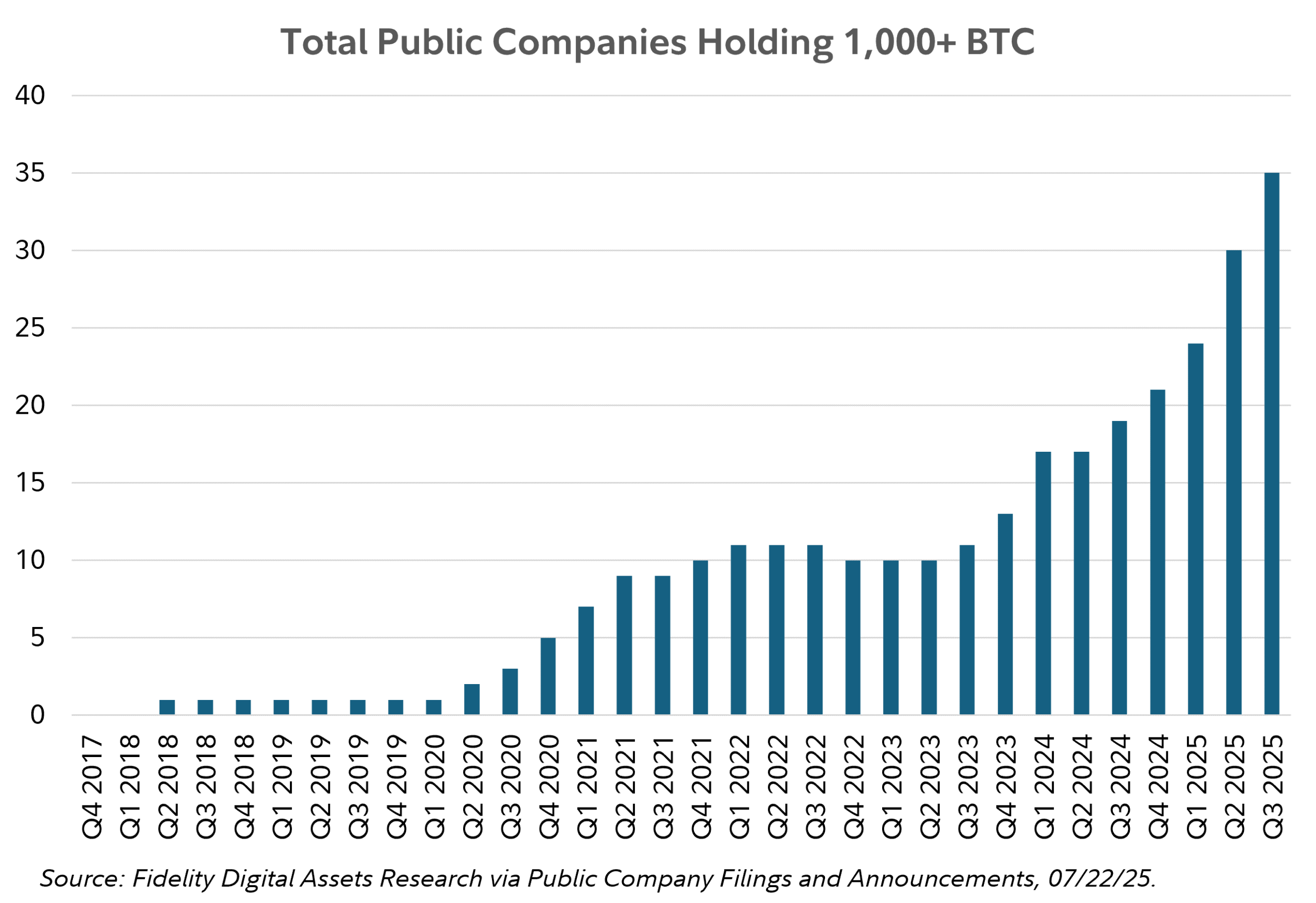

Corporate adoption is advancing quickly. As of July 25, 35 publicly traded companies each held more than 1,000 BTC.

Preston Pysh, co-founder of the Investors Podcast Network and Bitcoin venture fund Ego Death Capital, warned that nationalization measures could also target major private holders.

“They’re going to take the Bitcoin because it’s going to have an institutional custodian that does not want to go to jail,” Pysh said, adding that the first targets could be “private entities that have a lot of Bitcoin.”

These remarks highlight that Bitcoin held by institutional custodians may be more accessible to government action compared to assets stored privately.

Analysts Cite $100 Trillion Bitcoin Market Potential

Woo estimated that Bitcoin could reach a $100 trillion market size over time, despite possible nationalization risks. He pointed out that Bitcoin already holds a $2 trillion market capitalization at just 16 years old.

“We’ve got 100x to grow, and it’s probably going to take decades to get there,”

Woo said.

His projection is in line with Adam Back, co-founder and CEO of Blockstream, who described Bitcoin as a $200 trillion market opportunity in the long term.

“A sustainable and scalable $100-$200 trillion trade front-running hyperbitcoinization. Scalable enough for most big listed companies to move to BTC treasury,” Back stated on April 26 via X.

The term hyperbitcoinization refers to a scenario where Bitcoin replaces fiat currencies and becomes the main global medium of exchange.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: August 11, 2025 • 🕓 Last updated: August 11, 2025