ARK Invest, Cathie Wood’s brainchild, one of the sharpest investors in the game, has been sitting on the sidelines for months when it comes to Jack Dorsey’s Block.

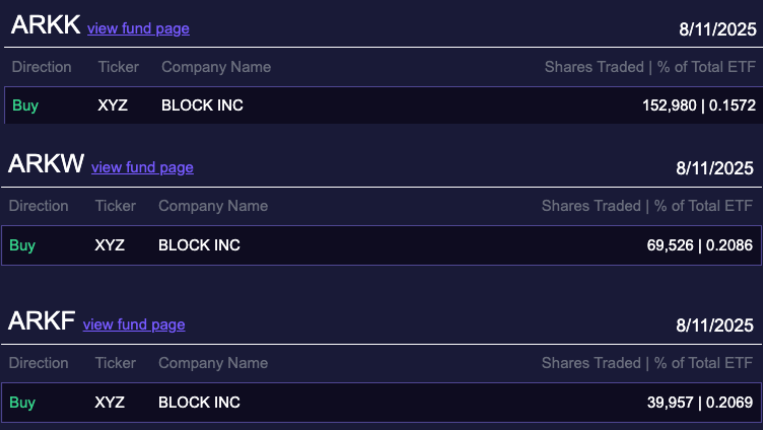

No moves, just watching the drama. But now? Boom. They snap up 262,463 shares of Block, worth $19.2 million.

The tide is turning for Block?

Now, the thing is that this buy breaks a dry spell. ARK had been unloading Block shares like hot potatoes just last month, dumping over half a million shares worth $40 million. The selloffs were big, the mood cautious.

No Block buys in all of 2024 or earlier this year. The last known buying spree? Way back in 2023. So this sudden purchase?

It’s like a sign, a glimmer in the murky market fog that maybe, just maybe, the tide’s turning for Block.

Block’s been grinding, mind you. Last quarter, they hauled in a $2.5 billion profit, up 14% from the year before.

Their Cash App raked in $1.5 billion itself, while Bitcoin accounts on the app hit 8 million. Big numbers, big trust. But despite these wins, the stock dipped nearly 7% after the earnings report dropped.

Stocks, man, they’re like a rollercoaster, sometimes climbing, sometimes dropping you hard. Since May though, Block’s bounced back, even if it’s still way off the January highs.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Expanding operations

And guess what? Word on the street is Block’s cooking up a fresh batch of Bitcoin banking tools aimed squarely at small and medium businesses.

Meaning? More ways to handle crypto, easier and smarter. The first of these banking goodies should drop late in this year.

It’s like the family expanding operations with a new racket, big potential, and all eyes watching.

Dominate crypto payments

For the everyday investor, stuck at the water cooler or grinding through spreadsheets, this might look like numbers on a screen.

But let me tell you, this move by ARK Invest? It’s a big vote of confidence in fintech’s future, and in Jack Dorsey’s play to dominate digital payments and crypto.

When the big players start buying back in, experts say we better pay attention. Because in this game, the comeback is often sweeter than the initial blow.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 14, 2025 • 🕓 Last updated: August 14, 2025

✉️ Contact: [email protected]