Let’s start with the numbers! Last year, TON blockchain came bursting into the crypto industry like a whirlwind.

The main engine was the gaming, a bunch of viral tap-to-earn games on Telegram, yes, those addictively simple games like Hamster Kombat and Notcoin that sucked in millions.

By September, daily active wallets hit almost 2 million.

Gaming hype

The CEO of STON.fi, Slavik Baranov just shared an opinion piece, published by the Cryptoslate, and let me tell you, there are some pretty interesting thoughts that makes you think.

Firts, the big hype usually comes from the DeFi sector, but as Baranov mentioned, not this time.

The magic of TON, the hype was a flashy firework show, not the slow burn that builds empires.

Of course, most gamers logged off when the freebies ran out, no surprise. Speculative money? Just as quick to bounce.

After the game lights dimmed, things settled. The daily active wallets shrank but held steady around 100,000 to 200,000, way beyond the 26,000-before-hype days. That’s like a team regrouping after a loss and coming back stronger.

And the DeFi world on TON got serious, protocols jumped from 35 to 67, nearly doubling the ecosystem’s muscle. It signaled a shift towards real, lasting financial tools.

One billion users

TON’s DeFi now boasts token swaps, staking, and lending protocols worthy of respect. Early star?

EVAA kicked off lending in early 2024. Not far behind, the AMM protocol STON.fi amassed close to $400 million in liquidity.

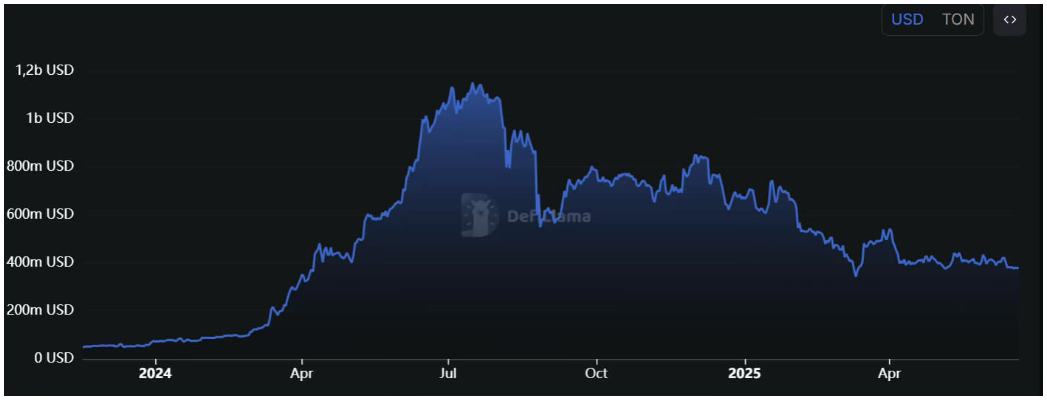

By summer’s peak, TVL hit $1.1 billion! Now? It hangs around $400 million, reflecting a natural ebb as those tempting incentives faded.

TON’s architecture is no lightweight. Designed for scale, but its complex, low-level setup. Developers have to build many things from scratch, slowing early growth but promising sturdier, slicker services down the line.

Plus, being tied to Telegram, one billion users strong, is both a golden ticket and a tightrope walk. Any Telegram hiccup sends ripples through TON’s waters.

Institutional interest

The bright side? Baranov highlighted that institutional heavyweights are throwing their chips in.

Big time. Sequoia, Draper, and others invested in Toncoin, and Standard Chartered’s Zodia Custody backs Ton’s assets for big players.

Just last July, The Open Platform raised a juicy $28.5 million with a $1 billion valuation. They’re a nod that TON’s more than a passing fad.

So, the goal is clear, turn Telegram from gaming hotspot to financial powerhouse by making crypto payments feel as easy as sending a text.

Imagine paying your café tab or borrowing microloans without leaving the chat window. It could be the future.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: September 2, 2025 • 🕓 Last updated: September 2, 2025

✉️ Contact: [email protected]