President Donald Trump announced 100% tariff on Chinese goods. The effect?

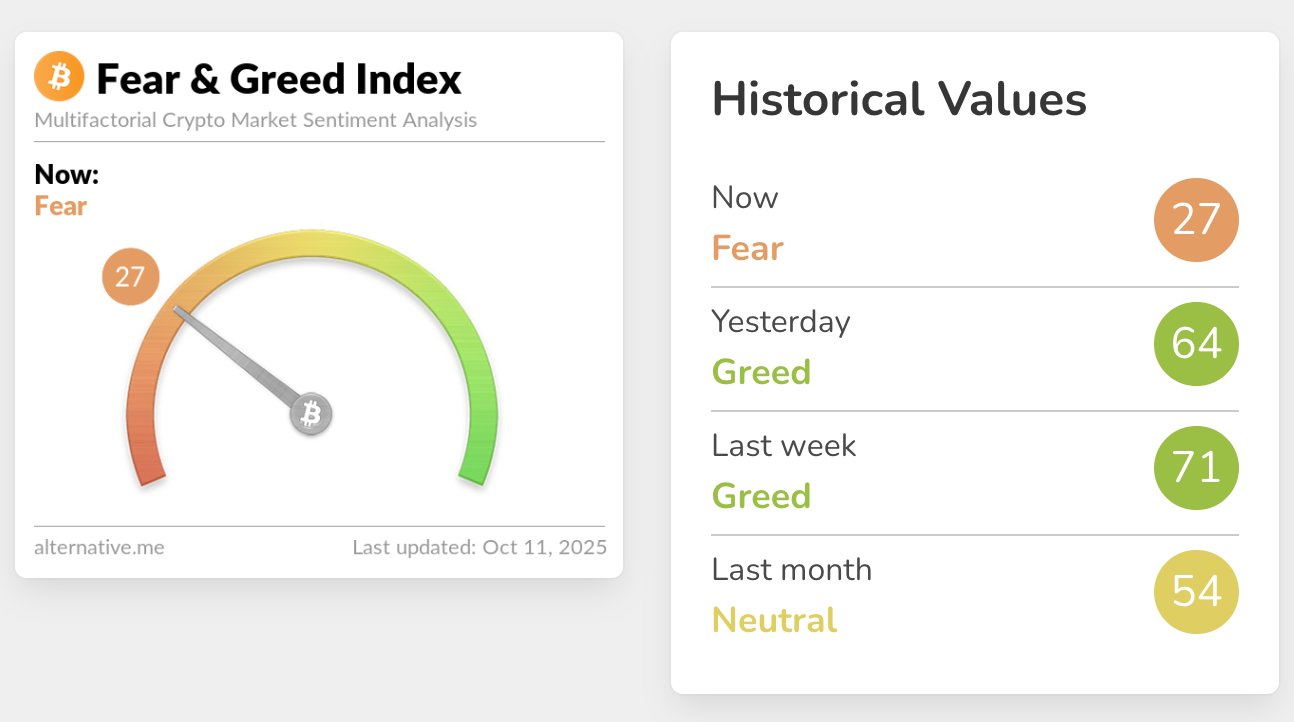

A crypto market panic so intense even the Crypto Fear & Greed Index screamed “Fear” louder than a horror flick soundtrack.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

From a cozy “Greed” score of 64 on Friday to a sharp plunge down to 27 by Saturday, the mood flipped faster than a bitcoin miner’s payout cycle.

Risky bets

Bitcoin itself wasn’t immune to the bad news. It nosedived briefly to just above $102,000 on Binance futures following the tariff shockwave, marking a sharp contrast to its local highs.

The aftermath? $19.27 billion in long and short crypto positions liquidated within 24 hours. Yep, that’s real money evaporating like morning mist as traders scrambled to dump risky bets.

Bitwise’s European research head, Andre Dragosch, made a cheeky observation on X that the market had just flashed a strong contrarian buying signal.

Dragosch thinks the crypto sentiment index hitting -2.8 standard deviations is its lowest dip since the infamous “Yen Carry Trade Unwind” story of summer last year.

💥BOOM: Our intraday Cryptoasset Sentiment Index just generated a strong contrarian buying signal!

The index reached an intraday low of -2.8 standard deviations – its lowest level since the "Yen Carry Trade Unwind" in the summer of 2024.

Stack accordingly. pic.twitter.com/7iLz4j7xWp

— André Dragosch, PhD⚡ (@Andre_Dragosch) October 11, 2025

To put it simply, the market hates what’s happening right now, and that might just mean it’s time to buy. It’s the blood-on-the-streets scenario.

Swinging

Just a few months ago, in April, the Fear & Greed Index hit similar depths when Bitcoin slipped below $80,000 amid fresh trade tensions.

That dip followed Trump’s 90-day pause on escalating tariffs, which had temporarily eased the tension cooker.

Fast forward today, and the market sentiment is swinging wildly, from Monday’s euphoric Bitcoin burst to $125,100 right back into nervous jitters.

No online excitement

Interestingly, despite these new ATHs, social media buzz was notably muted. Santiment analyst Brian Quinlivan noted that Bitcoin’s latest peaks didn’t spark the usual fireworks of excitement online.

The reaction? Modest, run-of-the-mill, as they say. Not exactly the stuff of legend, or at least not yet.

So, when political drama escalates, crypto sentiment dives, cash flows freeze up, and traders hit the panic button en masse.

Yet, history suggests that fear can be a buying opportunity if you can stomach the rollercoaster.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 13, 2025 • 🕓 Last updated: October 13, 2025

✉️ Contact: [email protected]