The crypto circus is buzzing. Bitcoin, the king of cryptocurrencies, is sweating bullets as silver, that shiny old-school metal, is giving it a run for its money in 2025. Who would’ve thought?

The heavyweight champ versus the quiet glint from the jewelry aisle. And guess what? Silver’s pulling some knockout punches.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Debasement trade

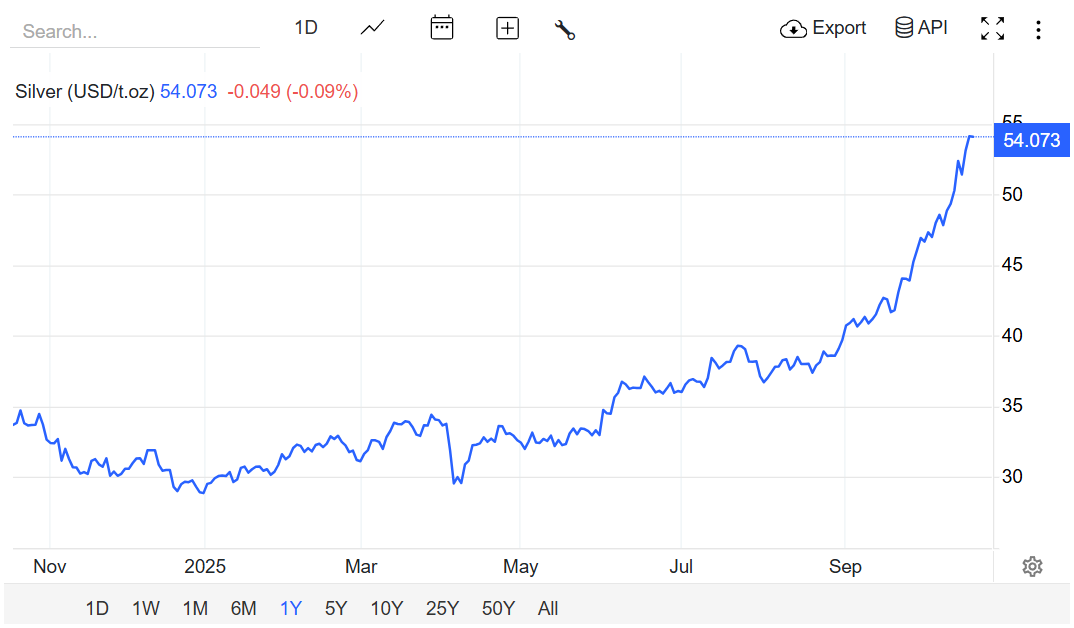

Analysts shared that this year, silver’s price has shot up by 63.9%, while Bitcoin is barely keeping pace at 64.1% gains.

But here’s the plot twist, Bitcoin’s recent stumble might just hand silver the crown for fastest-growing asset of the year. The moment Bitcoin dipped, silver’s steady climb stole the spotlight.

Back in January, 1 Bitcoin used to equal about 3,404 ounces of silver, yes, that’s a real thing to measure.

Fast-forward, and Bitcoin’s value now matches around 2,101 silver ounces. Still a giant leap when you peek back to its 2023 low of a mere 692 silver ounces during the crypto bear market apocalypse.

For the long-term believers, Bitcoin is still the trailblazer, outperforming precious metals over several years.

But silver and gold have become the darlings of the debasement trade, fancy jargon for betting against the flimsiness of the US dollar and other fiat currencies.

Boring metals?

Now, experts say there are those who scoff at the debasement hype. They see these assets as bloated bets prone to sudden drops.

Bitcoin, in particular, has a nasty habit of wiping out 10% of its value in mere hours when the mood sours, reminding everyone it’s a wild child compared to the boring metals.

Look at the last four years, and gold grabs the top prize, while Bitcoin took a two-year crash break.

Gold’s already up 58.2% this year too, creeping closer to Bitcoin’s lightning-fast ascent.

Silver as a tokenized asset? That’s still a niche gig. Tokenized silver struggles at a modest $203 million market cap.

No big-shot DeFi hookups here, so it’s a sideshow compared to the giant Real World Asset tokenization growth booming elsewhere.

Volatility

Will Bitcoin catch silver and gold? Bitcoin’s volatility is legendary and it tends to lag gold’s moves by about 60 days.

Some analysts predict that a fresh surge might be coming, pushing Bitcoin back to new highs in the next few months.

But the entire debasement narrative has a wildcard. If government debt and currencies regain their mojo, this precious metals frenzy could sputter.

Right now, spot demand for gold and silver is so hot it’s causing supply headaches.

Bitcoin, meanwhile, behaves like a volatile tech stock, not anyone’s safe haven but packing a heck of a thrill ride.

So, in the 2025 race for glory, silver’s stealing thunder with a steady climb, Bitcoin’s wild swings keep eyes glued, and gold’s patient comeback insists it’s not out of the game. But which of these treasures will shine brightest?

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 17, 2025 • 🕓 Last updated: October 17, 2025

✉️ Contact: [email protected]