Something surprising is stirring in the crypto market. A fresh wave of stability disguised as a $6 billion growth in stablecoins.

The total crypto market cap just bounced up roughly $150 billion in a 72-hour sprint, making everyone ask, is this the market’s rocky bottom or just another tease?

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Smart money was just waiting for the right moment

Market analysts say normally, when money flows into stablecoins instead of vanishing, it’s a bullish whisper.

It means capital isn’t fleeing the ship, just shifting decks for a better vantage. Right now, we’re seeing exactly that old-school “risk-off to risk-on” magic.

Ten days ago, the crypto world got slapped hard by a flash crash, slashing liquidity left and right.

But the post-crash tale suggests smart money was just waiting for the right moment to jump back in.

And the moment has arrived. With that context, stablecoins skyrocketed to a record $318 billion in market cap. The rest of the market, the risky, not-so-stable stuff, shrunk by $630 billion at that low point.

FOMO is coming?

Now, experts highlighted that Tether’s USDT and Circle’s USDC minted a combined $6 billion since the crash.

This aggressive coin printing screams strategy, a well-timed move to mop up liquidity and stay ready for action.

Glassnode’s data telling the same, fleshes out the story, nearly $3 billion in USDT drifted out of exchanges while $2 billion flowed in.

That’s classic rotation, not an exit ramp. Investors ran to stablecoins as the market flipped into risk-off mode, now cautiously easing back. Could this mean FOMO is stirring in those crypto veins again? Maybe.

Renewed confidence

Zooming into the network jungle, Ethereum leads the comeback trail.

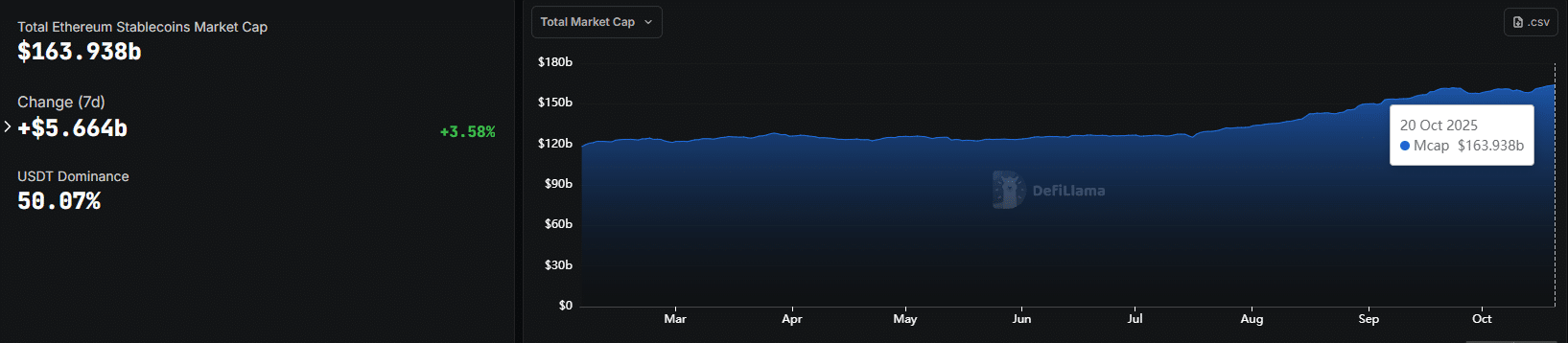

Over seven days, stablecoin supply on ETH jumped $5.6 billion to a record $164 billion, boosting the network’s TVL by 2.73%, adding about $4 billion in fresh capital.

This on-chain revival signals renewed confidence and frisky investor appetite.

All these moves, minting frenzy, rising market caps, and swelling blockchain activity, paint a picture of careful repositioning, not panic.

The crash likely flushed out the weak hands, leaving a leaner, stronger crew ready to ride the next wave.

So, no, stablecoins aren’t just safe harbors, they’re now also launching pads. If this market is staging a comeback, those $6 billion minted might just be the opening act for crypto’s next bullish chapter.

💬 Editor’s Take:

There’s something fascinating about this phase — the market looks quiet on the surface, but underneath, money’s clearly on the move.

You don’t see $6 billion worth of new stablecoins minted for no reason. That’s capital getting ready, not running scared.

It feels like the calm before a bigger shift — the moment when the pros quietly reload while retail is still licking its wounds. Maybe the comeback already started, just without fireworks.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: October 22, 2025 • 🕓 Last updated: October 22, 2025

✉️ Contact: [email protected]