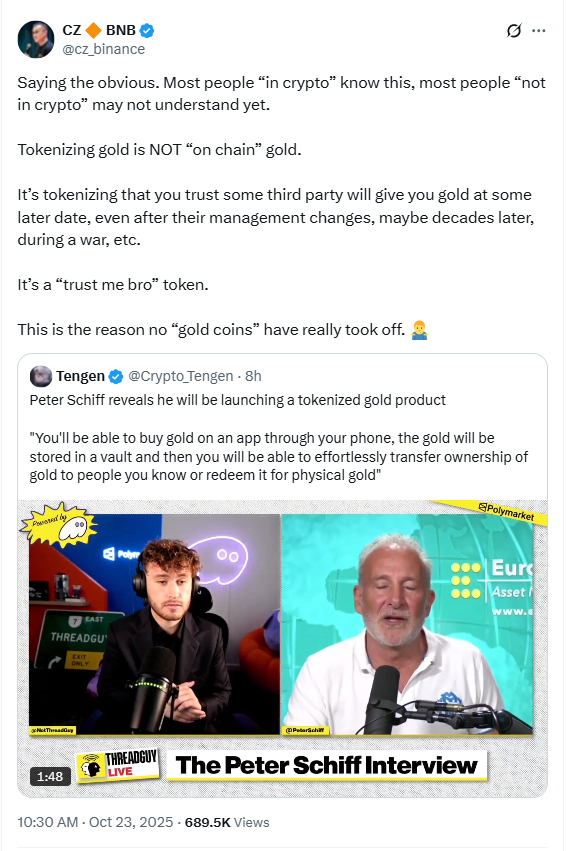

Changpeng “CZ” Zhao dismissed Peter Schiff’s tokenized gold plan on X. He called it a “trust me bro” asset dependent on third-party custody. He said tokenized gold is not on-chain gold.

He wrote that users must trust a custodian to deliver later. He noted risks from management changes or conflicts. He framed the core issue as redemption and custody.

Schiff outlined the plan on the ThreadGuy podcast. Users would buy and store physical gold in a vault via an app. They could transfer ownership on a blockchain or redeem bars.

Schiff also described payments tools. A debit card would link to gold holdings. People could spend against balances without touching the vault.

CZ contrasted tokenization with native crypto assets. He highlighted custody, audits, and delivery timing. He focused on how promises differ from final settlement.

“Bitcoin will go to zero”: Schiff repeats long-held view on Bitcoin

Schiff kept his stance on Bitcoin. He said it has no intrinsic value and will “go to zero.” He called it a “gigantic pump-and-dump.”

“I still think it’s going to zero,” he said. “What I underestimated was the gullibility of the public and the marketing savvy of those promoting it.” He spoke while Bitcoin traded near $109,642 in recent snapshots.

He argued that early adopters benefit most. He said later buyers face losses as momentum fades. He described flows as driven by belief, not claims on assets.

His comments targeted value anchors and settlement rights. He linked those to custody and redemption. He kept focus on mechanics rather than trading calls.

Reserve currency debate: US dollar, gold, and a sovereign debt crisis

Schiff warned about a coming sovereign debt crisis larger than 2008. He predicted hyperinflation and stress in US Treasurys. He said foreign central banks are shifting reserves to physical gold.

He argued the US dollar is losing global reserve status. He compared the moment to the post-Nixon 1970s reset. He said the system could “inevitably return to gold.”

He cited official sector buying trends. He said Treasurys are being reduced. He added that vault accumulation signals a quiet monetary shift.

He also referenced a possible gold price level above $4,000 per ounce. He tied that to ongoing reserve changes. He kept emphasis on custody and redemption terms.

Gold price whipsaw: $2.5 trillion erased, 8% two-day drop since 2013 worst

Earlier this week, gold saw a sharp reversal. It lost about $2.5 trillion in market value within 24 hours, per The Kobeissi Letter. The metal fell 8% over two days, its worst slide since 2013.

The drop followed a strong 2025 rally. Gold had risen about 60% this year amid inflation and geopolitical stress. The surge pushed market value higher before the sudden swing.

Commentary compared the wipe-out with crypto metrics. The value erased exceeded the entire Bitcoin supply at that snapshot. The move sharpened discussion about safe-haven roles.

The episode returned focus to vault custody and audits. Tokenized products still rely on redemption speed and delivery rules. CZ highlighted that split between tokens and metal.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 23, 2025 • 🕓 Last updated: October 23, 2025