Grayscale is preparing to launch the first spot Chainlink ETF in the United States through a Chainlink trust conversion.

The Grayscale Chainlink ETF is expected to start trading this week as a LINK ETF that tracks the spot price of LINK and also includes Chainlink staking rewards.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

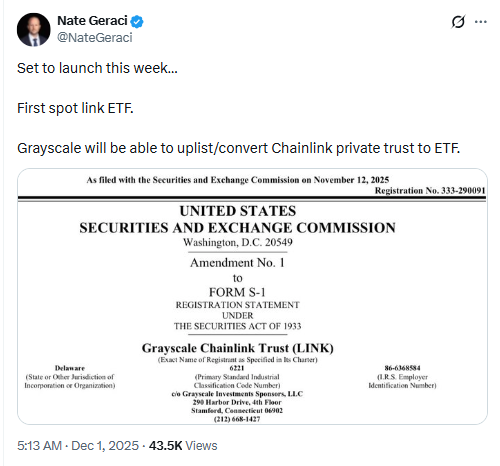

ETF Institute co-founder Nate Geraci said on X that the spot Chainlink ETF is “set to launch this week” and that Grayscale will “uplist/convert Chainlink private trust to ETF.”

His comment confirms that the Chainlink trust conversion will move the existing private product into a listed fund.

At the same time, another LINK ETF from Bitwise remains in the pipeline. That filing means Grayscale may be first to market with a spot Chainlink ETF, but it will not be the only LINK ETF in the US crypto ETFs universe for long if other products clear SEC crypto ETF approvals.

Spot Chainlink ETF Converts Existing Grayscale Chainlink Trust

The Grayscale Chainlink ETF will come from the conversion of the Grayscale Chainlink Trust, which launched in late 2020.

The trust gave investors exposure to LINK through a private structure instead of direct token ownership. Trading in that format focused on accredited and qualified investors.

With the Chainlink trust conversion, Grayscale plans to move those trust shares into a spot Chainlink ETF that trades on a national exchange.

In the ETF format, the fund will hold LINK directly and track the spot price of the token. This structure places the Grayscale Chainlink ETF alongside other US crypto ETFs that rely on spot holdings rather than futures.

The LINK ETF will keep the core idea of the original trust, which is exposure to LINK without investors managing wallets or on-chain transfers themselves.

However, the shift into an ETF wrapper brings intraday trading, clearer pricing on an exchange, and a structure that fits better into traditional brokerage accounts under the current US crypto ETFs market.

Grayscale Chainlink ETF Adds Staking Rewards On Top of Spot LINK

Grayscale has also designed the Grayscale Chainlink ETF to capture Chainlink staking rewards. Under the plan, the fund can stake part of its LINK holdings through approved infrastructure and then receive on-chain rewards.

After fees and operating costs, those Chainlink staking rewards will flow back into the fund for the benefit of shareholders.

This setup means the spot Chainlink ETF will not only mirror the spot price of LINK. It will also reflect the extra return that comes from Chainlink staking rewards, subject to the staking share and costs.

The LINK ETF structure keeps those mechanics inside the fund, so investors see the result through the ETF’s net asset value and distributions instead of running staking directly.

In its own research, Grayscale has described the Chainlink ecosystem as “critical connective tissue” between crypto and traditional finance.

The firm highlighted Chainlink’s role in price oracles and cross-chain messaging, which it sees as a bridge for tokenized assets and legacy systems.

That view supports the decision to launch a dedicated Grayscale Chainlink ETF rather than treating LINK only as a small part of broader US crypto ETFs.

Launch Timeline Backed by Nate Geraci and Eric Balchunas

Nate Geraci’s post about the spot Chainlink ETF aligns with estimates from Bloomberg Intelligence.

Senior ETF analyst Eric Balchunas has pointed to Dec. 2 as the expected launch date for the Grayscale Chainlink ETF, based on internal calendars tracking US crypto ETFs.

That date would place the product in the first batch of non-Bitcoin and non-Ethereum spot crypto funds with staking features.

On Nov. 24, Eric Balchunas also wrote on X that “there are 5 spot crypto ETFs launching over next 6 days.”

He added that Bloomberg Intelligence expects a “steady supply” of US crypto ETFs, possibly “over 100 in next six months.”

His comments frame the Grayscale Chainlink ETF as part of a larger wave of US crypto ETFs moving through the SEC crypto ETF approvals process across several assets.

Within that group, Grayscale’s spot Chainlink ETF stands out because it combines spot LINK exposure, a Chainlink trust conversion, and Chainlink staking rewards in a single listed product.

While the Bitwise LINK ETF and other filings wait for decisions, Geraci and Balchunas both place the Grayscale launch on the near-term calendar.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 1, 2025 • 🕓 Last updated: December 1, 2025