BitMEX founder Arthur Hayes drops a bombshell, Fed money-printing to save the yen might send Bitcoin price skyrocketing.

Dollar liquidity floods in, BTC blasts off. Markets buzz with yen drama fueling the fire.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Yen Chaos Pushes Fed Toward Dollar Flood

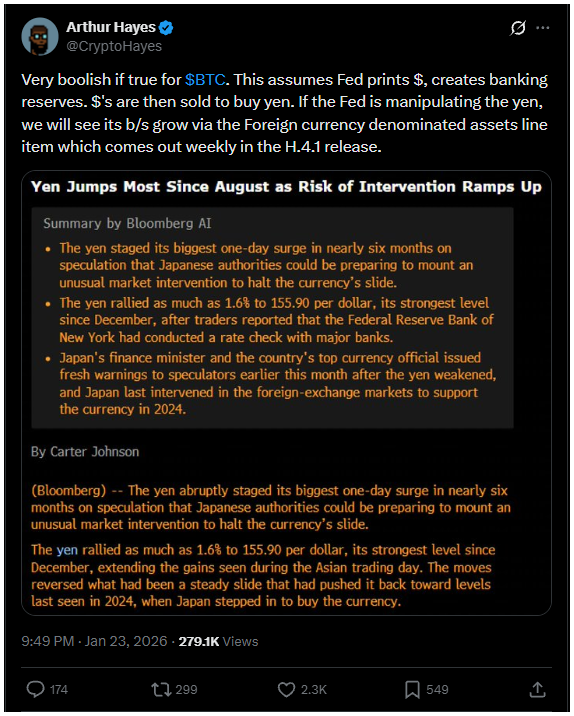

Japanese yen just notched its fattest one-day pop against the dollar since August.

US and Japan bigwigs hint at intervention to halt the slide. Traders smell action after sharp dollar-yen swings.

New York Fed’s poking big banks on yen market vibes, per reports from January 23. That’s Treasury’s playbook, rate checks scream “we’re sweating stability.”

Dollar tanked 1.7% that day, weakening versus Taiwanese dollar and South Korean won too. Volatile week leaves policy holes gaping across the Pacific.

Hayes lays it out on X, Fed cooks up bank reserves, call it printing dollars, brrr, swaps ’em for yen.

Liquidity gushes worldwide, landing as foreign assets on Fed’s balance sheet, so global cash party likely ensues.

Bitcoin Treasuries Echo Past Liquidity Lunacy

This smells like 2020’s COVID cash blitz, when Fed balance sheets ballooned $3 trillion in months, catapulting Bitcoin from $10k to $69k peaks.

Hayes now sees the same script, yen prop-up via dollar dumps mirrors QE madness that juiced risk assets.

Strategy rode that wave to billions, BTC treasuries thrived on loose money. Yen meddling could replay it, pumping Bitcoin price as fiat floods flee to crypto safety.

Why care? These interventions stick around, bloating balance sheets and begging for inflation hedges like BTC.

Dollar Wobbles Amid Bond Mayhem and Politics

Treasury yields spiked on US bond selloffs, and traders blamed Trump Greenland talk at first. Nah, says Treasury Secretary Scott Bessent, blame Japan’s bond rout.

Long-term JGBs plunged as borrowing fears mount before a snap February 8 election. New PM Sanae Takaichi, in office since October, called it to cement her coalition.

She’s pitching a two-year grocery sales tax freeze to win votes, so it’s a big suprise that investors panic over debt piles?

Bitcoin price watches close, and Hayes bets Fed’s yen stunt juices liquidity, sidelining dollar woes. Sass the suits all you want, but when printers whir, BTC grins.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: January 26, 2026 • 🕓 Last updated: January 26, 2026

✉️ Contact: [email protected]