Alright, experts say the world’s crypto game isn’t about to be won on Wall Street, no sir.

The real action, the pulse, that’s shifting to Asia. And it’s a quite big deal, fueled by Beijing’s stimulus plans, South Korea’s ETF ambitions, and Japan’s yen-backed stablecoin.

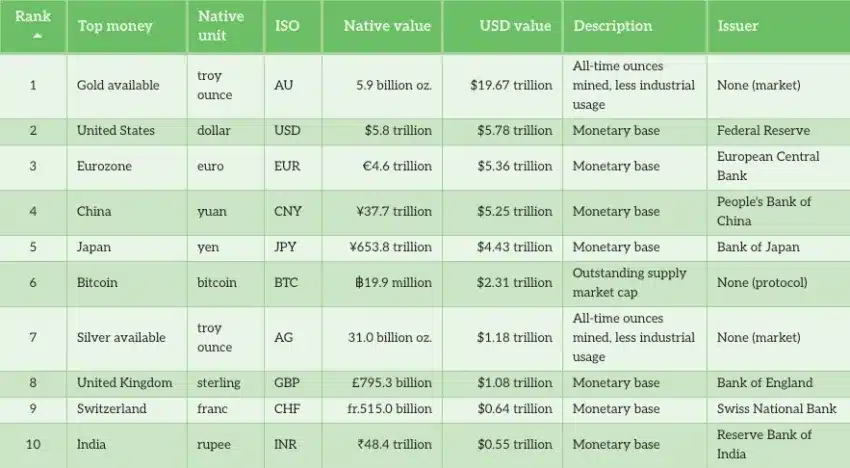

Global liquidity

China’s economy? Well, it’s not exactly sprinting right now. Things look a bit foggy.

But the People’s Bank of China, that’s the central bank with some serious muscle, is ready to pour liquidity into the system, analysts think maybe as soon as September.

History tells us that when China opens the money tap, risk assets go nuts. Bitcoin’s price dances more closely with global liquidity flows than even the S&P 500 or gold.

So yeah, when Beijing sneezes, altcoins catch a cold, or better yet, catch a rally.

Don’t get it twisted. China still keeps crypto trading tightly under wraps at home.

But its economic weight makes the country a big baller that can shake markets worldwide. Almost 20% of global GDP rolls through its system.

Corporate crypto ban

Shift your gaze southwards, to South Korea. These guys aren’t just sitting around waiting.

The new buzz is about that they’ve got a four-step plan. Spot Bitcoin ETFs, KRW-pegged stablecoins, and a roadmap to undo the corporate crypto trading ban from 2017.

Already, nonprofits and public institutions have gotten the green light to offload holdings, while listed companies are gearing up to trade on a trial.

No joke, the Korean won is the second-most traded fiat in crypto, with roughly 30% of global fiat-for-crypto trades this year.

Almost one in three Koreans own crypto. Imagine that, your crypto anon internet friend, who never stops yammering about the next big thing? Probably a crypto holder in Korea.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Rising sun, shady jungle

Japan is doing its own crypto dance, launching its first yen-backed stablecoin called JPYC.

JPYCはCircle、アステリア、電算システム、パーソル、アイフルその他の上場企業から直接またはCVC経由で出資頂いています。

尚、非公表でご出資頂いている上場企業もあります。また、シンプレクスさんに取引システムの開発をお願いしています。

— 岡部典孝 JPYC代表取締役 (@noritaka_okabe) August 18, 2025

Backed by bank deposits and government bonds, this coin promises a tight 1:1 peg to the yen.

And guess what? Circle, the company behind USDC, chipped in on the funding. So Japan’s stablecoin scene likely isn’t staying local for long.

Thailand’s throwing crypto into the mix to lure tourists back. Their new sandbox, TouristDigiPay, lets visitors swap crypto into Thai baht and pay around town through licensed e-money providers.

So, Asia is orchestrating the next global wave. Beijing’s prepping its stimulus, Seoul’s opening institutions to accepting crypto, Tokyo’s launching fiat-backed tokens, and Bangkok’s inviting your vacation wallet to join the party. Wall Street, you better watch your back.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Cryptocurrency and Web3 expert, founder of Kriptoworld

LinkedIn | X (Twitter) | More articles

With years of experience covering the blockchain space, András delivers insightful reporting on DeFi, tokenization, altcoins, and crypto regulations shaping the digital economy.

📅 Published: August 20, 2025 • 🕓 Last updated: August 20, 2025

✉️ Contact: [email protected]