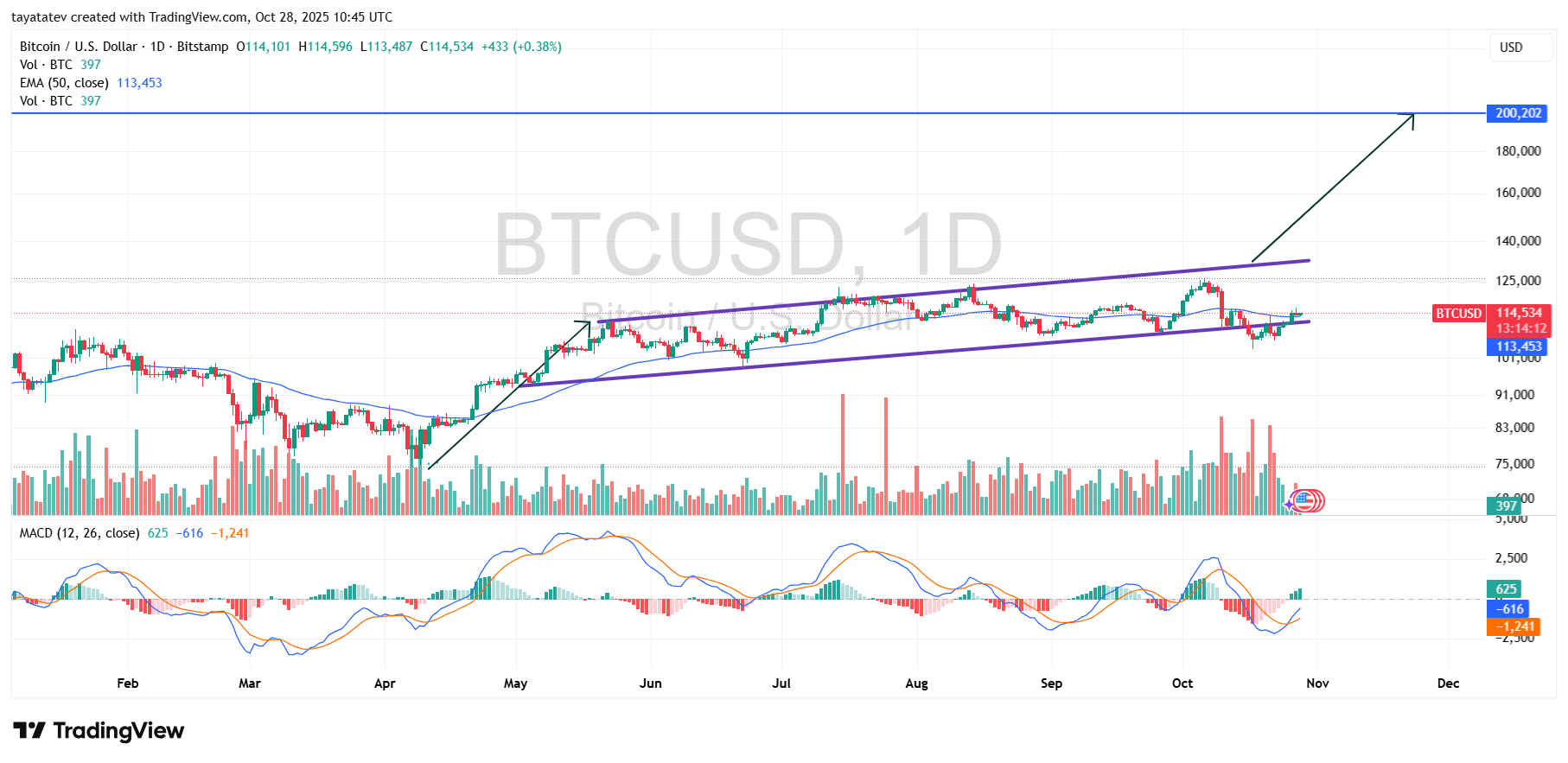

Bitcoin (BTC) traded near $114,534 on October 28, 2025, forming a clear rising channel on the daily chart.

A rising channel is a pattern where prices move between two upward-sloping parallel lines, signaling a steady uptrend within controlled volatility.

The lower boundary around $101,000 has repeatedly acted as strong support, while the upper trendline near $125,000 marks resistance.

The price currently hovers just above the 50-day exponential moving average (EMA) at $113,453, confirming renewed bullish momentum after testing the lower channel support.

Volume data also reflects steady participation, while the MACD indicator shows a bullish crossover — a signal that buying momentum is strengthening as the histogram turns positive.

Technical Indicators Support Bullish Outlook

Bitcoin’s price has respected the rising channel since early 2025. Every pullback to the lower band has resulted in rebounds toward the upper trendline. This consistency shows traders’ confidence in the ongoing structure.

If Bitcoin maintains its position above the 50-day EMA, the next test would likely be the upper boundary near $125,000.

A decisive breakout above this resistance could confirm the next leg higher. Based on measured moves, the potential upside equals the height of the channel projected from the breakout point.

That projection suggests a possible 74% rise from the current price, targeting around $200,000.

The pattern’s measured target aligns with long-term resistance near that psychological level, often cited as a next major milestone by market analysts.

Momentum Aligns with Year-End Rally Potential

MACD momentum supports this bullish continuation. The blue signal line crossing above the orange line marks renewed upward strength.

Positive divergence from the histogram confirms that bullish energy is returning after weeks of consolidation.

If this pattern continues, Bitcoin could break above its rising channel by late November or early December.

A confirmed breakout would validate the 74% measured move, pushing BTC toward $200,000 before the year ends.

Technical confirmation requires sustained closes above $125,000 and rising volume.

For now, Bitcoin’s structure, moving averages, and momentum indicators all point to an intact uptrend that could extend into record territory.

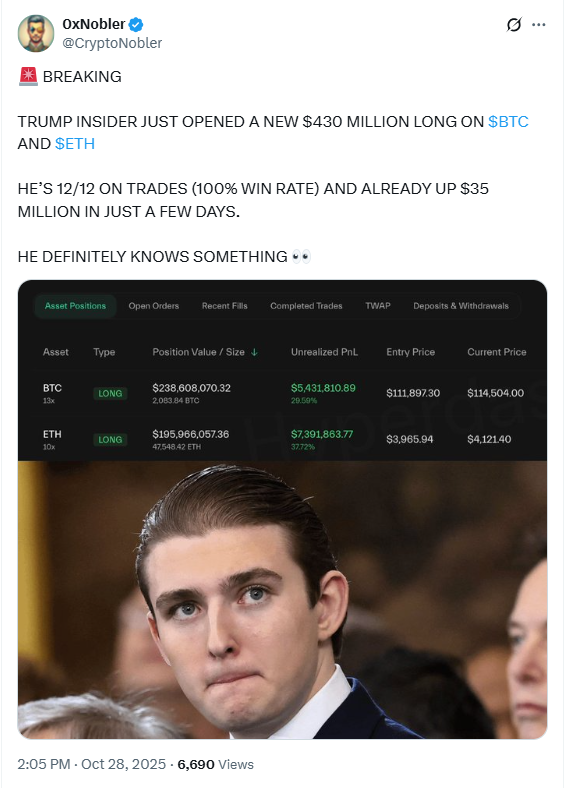

Trump Insider Opens $430 Million Long on Bitcoin and Ethereum

A trader described as a Trump insider reportedly opened a $430 million long position split between Bitcoin (BTC) and Ethereum (ETH), according to a post by analyst 0xNobler on October 28, 2025.

The screenshot shared in the post shows $238.6 million in BTC and $195.9 million in ETH long positions.

Unrealized profits already exceed $35 million, with BTC up $5.4 million and ETH up $7.3 million, marking a combined 100% win rate on 12 trades.

The BTC entry price appears near $111,897, and ETH near $3,965, both now trading higher at around $114,500 and $4,121, respectively.

The 13x leverage on BTC suggests strong conviction and confidence in continued price appreciation.

While the trader’s identity remains undisclosed, the scale and early profit have fueled speculation about insider sentiment toward upcoming U.S. policy or market moves.

The post’s timing also coincides with growing anticipation for crypto-related regulatory decisions and election-linked volatility.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 28, 2025 • 🕓 Last updated: October 28, 2025