Bitcoin is at a turning point after experiencing a painful 15% drop from its recent highs. Traders and analysts now are speculating about the exact reasons behind the decline, but many agree that demand for Bitcoin is weakening.

Market is drying up, Bitcoin buyers are gone

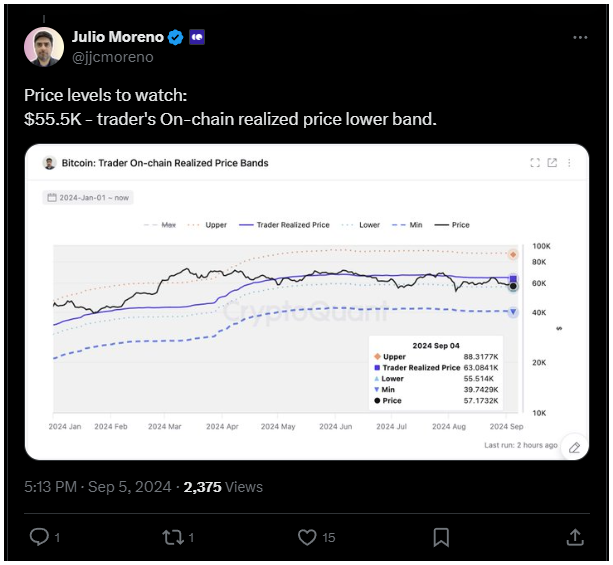

The head of research at CryptoQuant, Julio Moreno provided a pretty detailed analysis of the current situation, and shared that he believes that the drop in market demand is a key factor affecting Bitcoin’s recent price movements.

As the crypto market faces this hard time, uncertainty is also increasing among the traders, making it tough to predict the next major move.

And this is increase the uncertainty again. Finding the future trend in the coming days could be important for Bitcoin’s price direction as buyers and sellers compete at important levels.

And we simply can’t know now if Bitcoin will bounce back, and we will get more decline.

Bitcoin selling pressure is strong

Bitcoin is under strong selling pressure, mainly due to a drop in demand growth. Moreno points out that this decline is evident across various valuation metrics, which have remained in bearish territory.

One important indicator is the 30-day sum of BTC demand, which just turned negative, showing weak buying interest.

Moreno shared his findings on X, telling that the strongest warning signs have been present since July when Bitcoin’s demand began to fall in a visible way.

Moreno also told that $55,500 is an important psychological level to watch, as it represents the lower realized price for many traders.

The market may struggle to attract new buyers if this level isn’t reclaimed soon. If the price can’t going back above this level, it likely will decreasing more.

Bitcoin price movement is in jeopardy, bulls or bears will win?

At the time fo writing Bitcoin is trading at $54,500, slightly below the important $55,000 mark after several days of slow decline and poor price action.

For Bitcoin to maintain its position above $55,000, buyers will need to reclaim the 4-hour 200 moving average, which is currently at $59,373, and push the price above the key psychological level of $60,000.

Without this, it will be hard, or even impossible to start a new bullish trend and gaining momentum.

On the other hand, if Bitcoin fails to hold the $54,500 support, a much bigger drop could come, pushing the price down to $49,000 or even lower.

It would be a clear bearish shift, challenging the current market sentiment and testing the strength of Bitcoin’s gains. We will see in the next few days!