Recent market data suggests a significant shift in Bitcoin futures trading.

Alex Adler Jr, an on-chain and macro research analyst, highlighted that the average funding rate across three major exchanges—Binance, Bybit, and OKX—has dropped to zero.

Historically, similar occurrences in the current market cycle have often been followed by bullish movements. This raises the question: is Bitcoin on the verge of another price surge?

Bitcoin Futures Funding Rate Reaches Neutral Territory

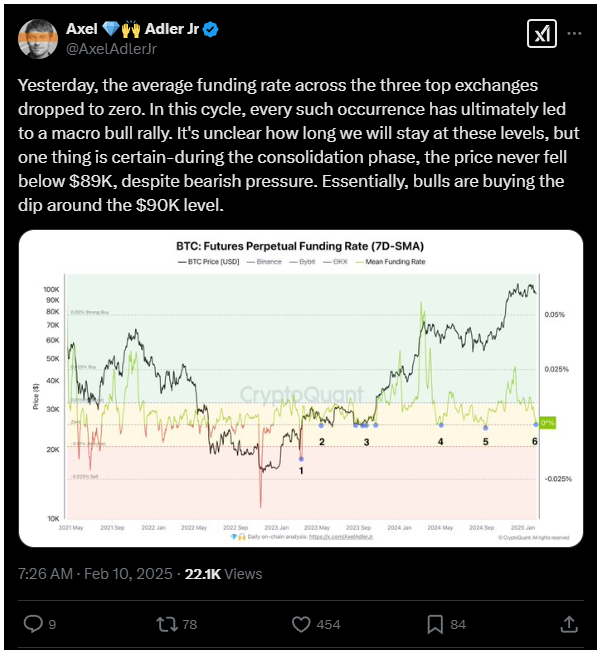

A recent chart shared by Adler, titled BTC: Futures Perpetual Funding Rate (7D-SMA), illustrates how the funding rate for Bitcoin futures contracts has evolved over time, using a seven-day simple moving average.

The funding rate plays a crucial role in determining market sentiment:

- A positive funding rate indicates that long positions dominate, meaning traders expect Bitcoin’s price to rise.

- A negative funding rate suggests that short positions dominate, indicating a bearish outlook.

- A zero funding rate reflects a balance between long and short positions, signaling market uncertainty.

Currently, the funding rate has dropped to zero, indicating that neither bullish nor bearish sentiment holds a clear advantage.

Historical Patterns: A Bullish Signal?

According to Adler, previous instances in this cycle where the funding rate touched neutral territory were followed by bullish momentum. If this pattern holds, Bitcoin could be on the verge of an upward move in the near future.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Bitcoin’s Current Market Performance

At the beginning of this month, Bitcoin’s price stood at $102,417.80. However, between February 1 and February 5, the market experienced a sharp decline of approximately 5.67%.

Between February 6 and February 9, Bitcoin remained within a narrow range of $96,615 to $96,440 before breaking out with bullish momentum on February 10.

In the past 24 hours, Bitcoin has risen by about 0.9%, yet it has not fully recovered from the early February correction. Over the last 14 days, the cryptocurrency has declined by 4.3%.

What’s Next for Bitcoin?

The recent drop in Bitcoin’s funding rate to zero indicates a period of market indecision. However, if past trends repeat, this could be a precursor to a significant upward move.

Traders and investors will be closely monitoring the market to see whether history aligns with current conditions, potentially setting the stage for the next Bitcoin rally.