Bitcoin has officially crossed the $100,000 threshold, and it seems like the sky’s the limit!

Thanks to a series of positive developments this year, Standard Chartered is now predicting that Bitcoin could double in price to $200,000 by the end of 2025.

Impressive, very nice!

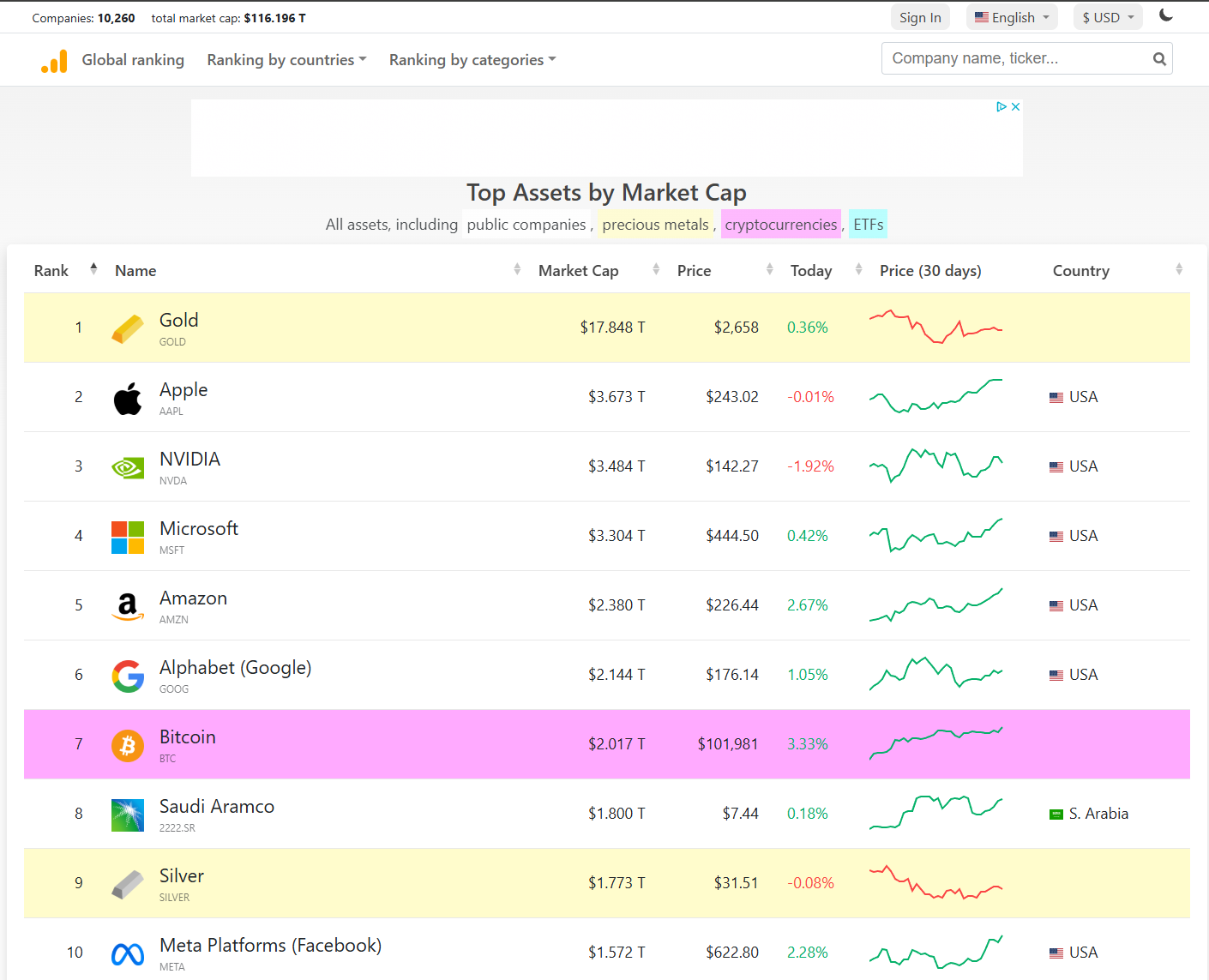

With a market cap over $2 trillion, Bitcoin is making headlines in the mainstream media too as it enters six-figure territory.

This jump in BTC’s price can be linked to Donald Trump’s win in the U.S. presidential election, which has helped propel Bitcoin up 48% since November 5.

In a note released in this week, Standard Chartered analyst Geoff Kendrick expressed optimism about Bitcoin’s future, and stated that reaching $200,000 by the end of 2025 is achievable.

Kendrick added that their bullish outlook could strengthen if more U.S. retirement funds and global sovereign wealth funds start investing in Bitcoin, so he expects institutional investments to continue at or above the pace seen in 2024.

Plus, with MicroStrategy ahead of its $42 billion three-year plan, its purchases in 2025 are likely to match or exceed those from this year.

Popular viewpoint

ARK Invest CEO Cathie Wood is on the same wavelength, and believes that even with Bitcoin hitting $100,000, we’re still just getting started.

In a post on X, she expressed excitement about the possibility of pro-crypto Paul Atkins becoming the next SEC chief.

Wood also pointed out that U.S. Federal Reserve Chairman Jerome Powell recently referred to Bitcoin as a digital version of gold.

She compared gold’s market cap, $15 trillion to Bitcoin’s current value of about $2 trillion, emphasizing that even after breaking the $100,000 barrier, Bitcoin is still in its early stages.

ARK Invest believes that Bitcoin is a much bigger idea than gold.”

To the Moon?

While this year has been quite fantastic for Bitcoin’s price action, some investors might feel they’ve missed their chance to get in on the action.

Reports indicate that retail investors haven’t fully joined this crypto bull market yet, and this rally has primarily been driven by institutional investors.

Now that Bitcoin has broken through the $100,000 mark, it finally might just spark interest among retail investors looking to buy into cryptocurrencies and further fuel this market rally.