We got a situation brewing in the Bitcoin mining world, and it ain’t pretty. You know how in the office, there’s always that one guy who’s raking in bonuses like it’s Christmas every quarter, while the rest of the crew busts their backs?

Yeah, well, Bitcoin miner executives are pulling a move like that, and investors? They’re not having it.

Paycheck

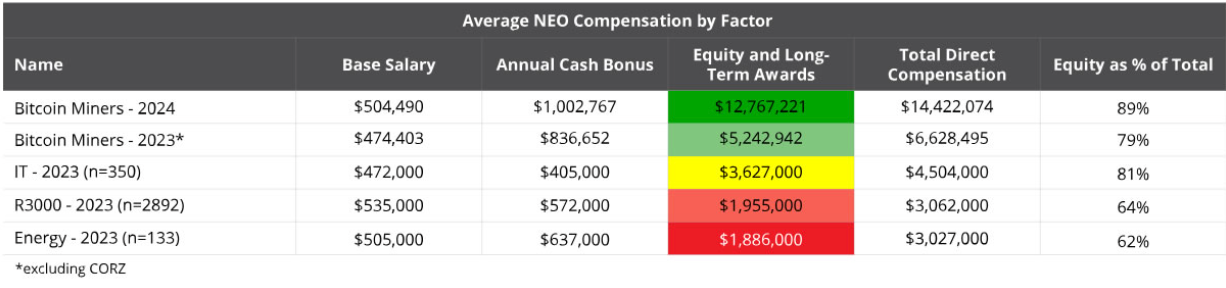

VanEck just dropped some research that’s pretty spicy, let me say that. Turns out, Bitcoin mining execs in the U.S. are earning way more than their counterparts in tech and energy sectors. How much more?

In 2023, the average was already a $6.6 million. But in 2024, it nearly doubled to $14.4 million.

That’s like going from a modest office manager’s paycheck to owning the whole damn building overnight.

Of course, most of this pay isn’t cold hard cash. Nah, it’s equity-based, stock awards making up 79% of their pay in 2023, jumping to 89% in 2024. And not just any stock awards, think mega grants that make shareholders squint.

Take Riot Platforms’ CEO Fred Thiel, who snagged a $79.3 million equity award this year.

That’s almost twice what his peers at MARA Holdings and Core Scientific got. You’d think shareholders would be throwing a party, right? Wrong.

Shareholder pushback

Shareholder approval for these fat paychecks is lagging hard. VanEck’s research shows only 64% of shareholders are giving the nod, compared to about 90% approval in the broader S&P 500 and Russell 3000 companies.

Investors are saying, hold up, this ain’t right. Why? Because these massive equity awards dilute shareholder value without a clear link to long-term gains.

It’s like giving the office janitor the CEO’s bonus and hoping for miracles.

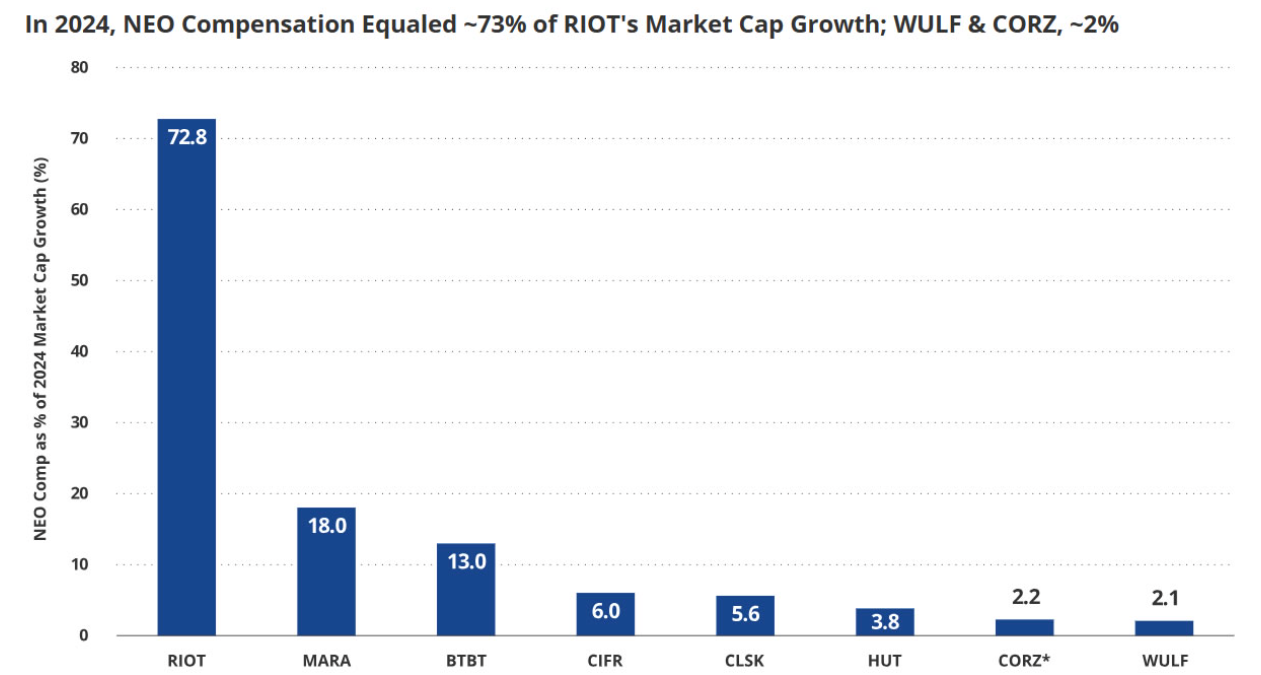

The pay-for-performance story gets even messier. Some miners, like TeraWulf and Core Scientific, tie exec pay modestly to company growth, just 2% of market cap increase.

But Riot Platforms? They handed over 73% of their market cap growth to top execs, totaling $230 million in 2024.

That’s a neon billboard flashing, too much! Investors have pushed back before, remember Riot’s shareholders rejecting the CEO’s $22 million pay package in 2022?

The story continues, with three miners facing serious shareholder pushback on pay proposals this year.

Accountability

Now, it’s not all doom and gloom. Six out of eight miners have started using performance stock units.

These are fancy equity awards that only vest if execs hit multi-year targets, like share price goals or outperforming peers. Plus, most companies now hold annual say-on-pay votes, giving shareholders a louder voice.

VanEck suggests miners should get smarter, link bonuses to how efficiently they mine Bitcoin, like cost per coin or return on invested capital. Basically, stop handing out fat checks just for showing up.

As Bitcoin mining grows into a heavyweight infrastructure business, the fat-cat paydays gotta come with accountability. Otherwise, investors will keep lighting up the boardroom with their disapproval.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.