Bitcoin’s price has taken a hit, dropping nearly 4% in the last 24 hours as traders cash in on profits ahead of the weekend.

This decline has sent ripples through the entire crypto market, resulting in over $250 million worth of bullish bets getting liquidated.

Bitcoin’s struggles

The price of Bitcoin fell from around $72,500 early Thursday to just above $69,000 by Friday morning, trimming down the gains it had made since Monday.

Other major cryptocurrencies followed suit, contributing to an overall market capitalization decline of 5.5%.

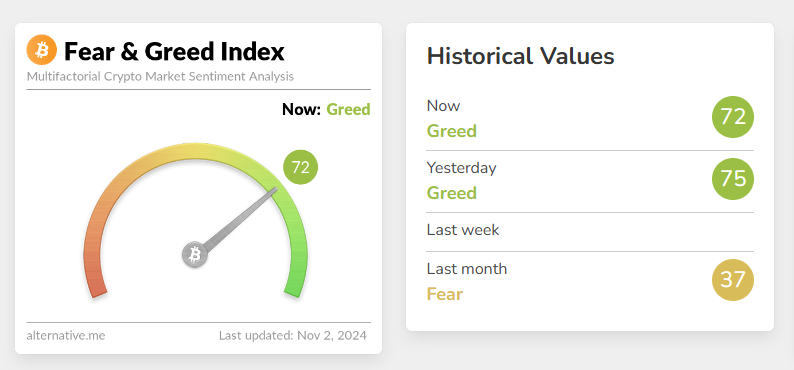

Adding to the drama, the Fear and Greed Index hit “extreme greed” levels on Thursday.

Historically, this has been a warning sign that a market correction might be on the horizon.

As of Friday afternoon in Asia, the index was still showing “greed,” suggesting that prices could drop even further.

Futures traders are happy or not?

The price drop has been particularly painful for futures traders. BTC-tracked futures saw losses totaling around $88 million, while ETH futures faced $44 million in liquidations.

SOL and DOGE futures weren’t spared either, each reached up nearly $15 million in losses.

Interestingly, almost 90% of all futures bets were bullish, meaning traders expected prices to rise ahead of the U.S. elections on November 5.

Many traders had been optimistic, maybe way too optimistic about Bitcoin reaching $80,000 in the coming weeks, driven by favorable global monetary policies and political support.

Liquidations, the bad side of the equation

So what exactly is a liquidation? It happens when an exchange forcibly closes a trader’s leveraged position because they can’t meet margin requirements.

Large-scale liquidations can signal market extremes, like panic selling or buying.

When we see a cascade of liquidations, it often means that a price reversal could be just around the corner due to an overreaction in market sentiment.

This wave of liquidations coincided with Bitcoin’s open interest hitting record levels earlier this week at over $43 billion. By early Friday, that number had dropped to just over $41 billion.