Between April 3rd and 4th, the crypto market was turned upside down. Long-dormant coins sprang to life, exchange inflows skyrocketed, and prices plummeted. What triggered this chaos?

None other than U.S. President Donald Trump’s tariff bombshell, which sent global risk assets into a tailspin.

Dip

Bitcoin’s response was swift and brutal, dropping from $88,500 to $81,000 before clawing its way back to around $83,000.

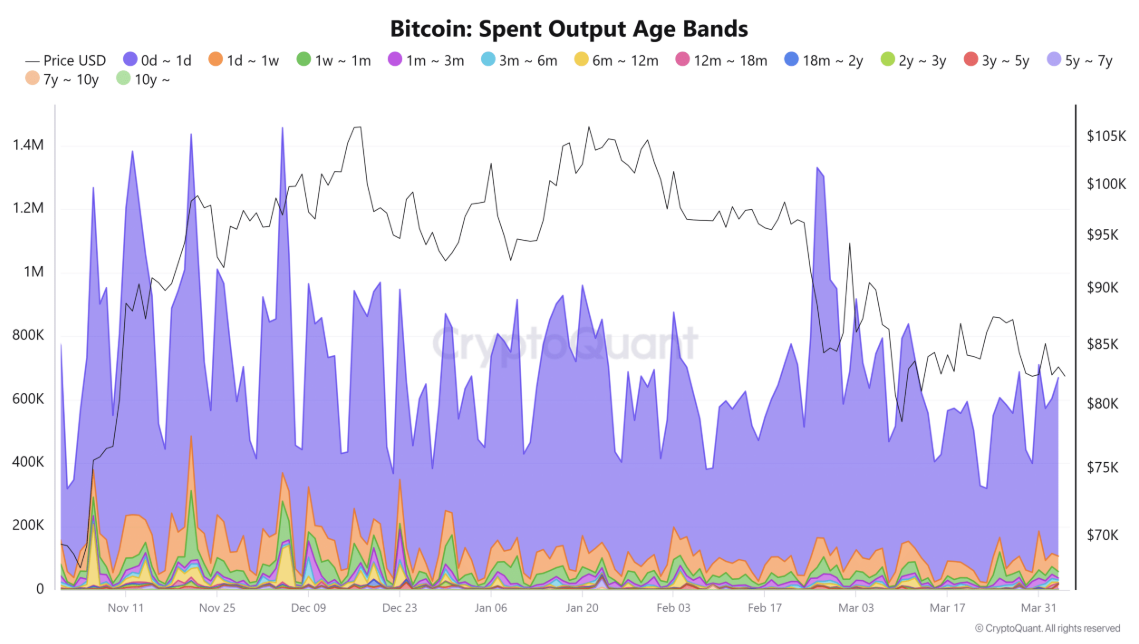

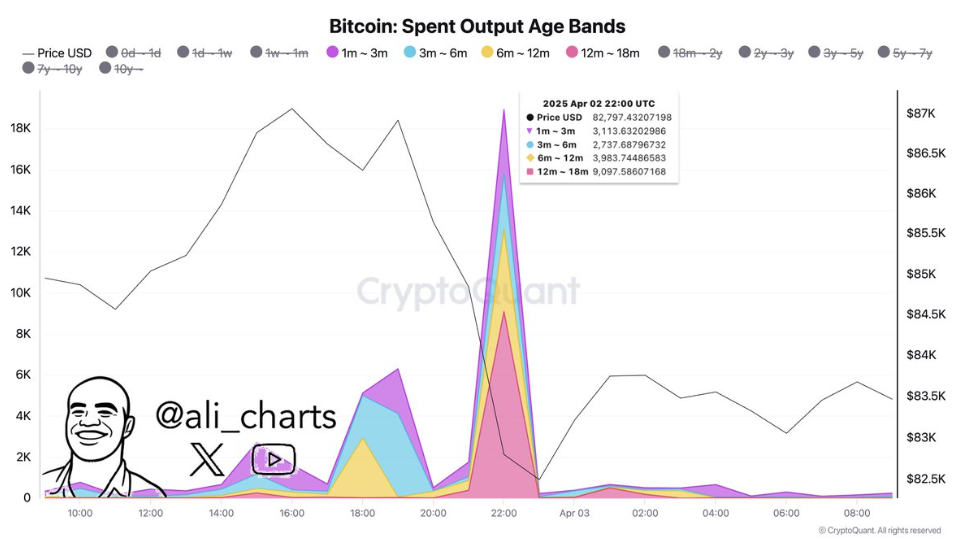

And long-term holders started moving their dormant coins, while newer players panicked and sold.

Over 1,057 BTC, some of which had been sleeping for seven to ten years, suddenly woke up and hit the market.

From the short term holders, over 18,930 BTC with coins aged between one month and eighteen months joined the exodus.

Selling pressure is coming?

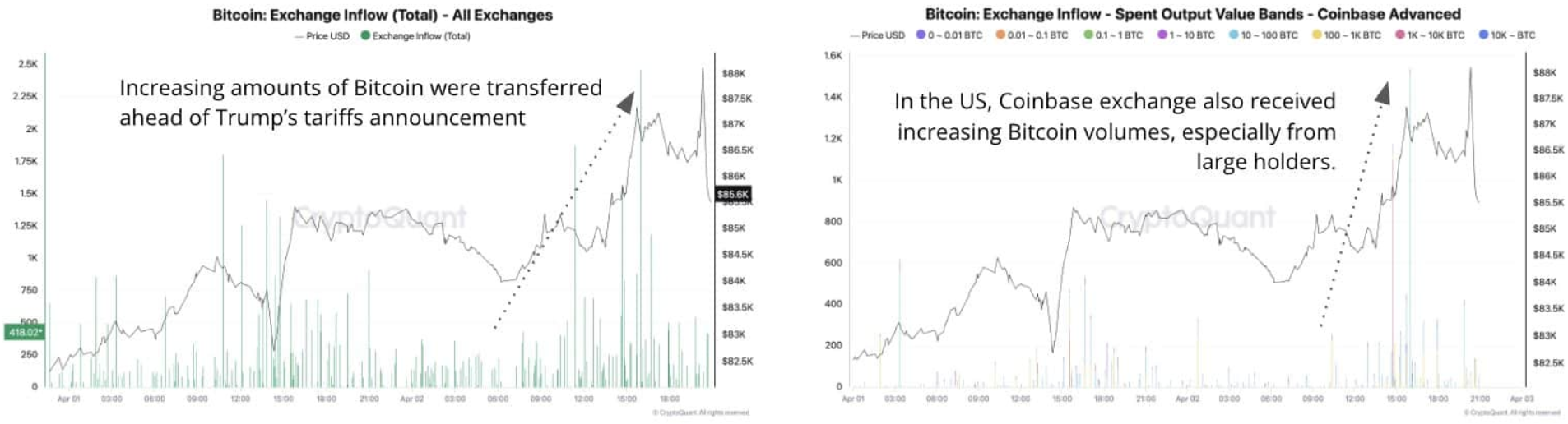

Now, you might wonder if the big players are preparing to bail. Because it looks like they are.

A single block saw a huge 2,500 BTC flow into Coinbase, a clear sign that whales are gearing up to sell.

These inflows coincided with Bitcoin’s sharp drop, confirming that capital was flooding into exchanges rather than cold storage, a pretty bearish sign if there ever was one.

Market

But on the other hand, something unexpected happened on derivatives exchange Bybit.

The Taker Buy/Sell Ratio surged to 5.3, indicating a frenzy of aggressive buyers outpacing sellers. It’s like the whole market was moving in sync, reacting to Trump’s tariffs.

Zooming out, this drama shows just how sensitive Bitcoin and crypto traders are to macroeconomic stress. Yet, there’s a silver lining.

Analysts suggest that geopolitical instability could weaken the dollar, potentially boosting demand for Bitcoin as a safe haven.

For now, though, it’s all about short-term fear and positioning.

Have you read it yet? PayPal announced that Solana and Chainlink join the party

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.