Bitcoin was supposed to be the rebel with a cause, the great equalizer in finance, the digital Robin Hood shaking up the old money game.

But as BTC inches closer to its all-time highs, the numbers are telling a story that’s a little less revolution and a lot more same old, same old.

The big fish in the Bitcoin pond

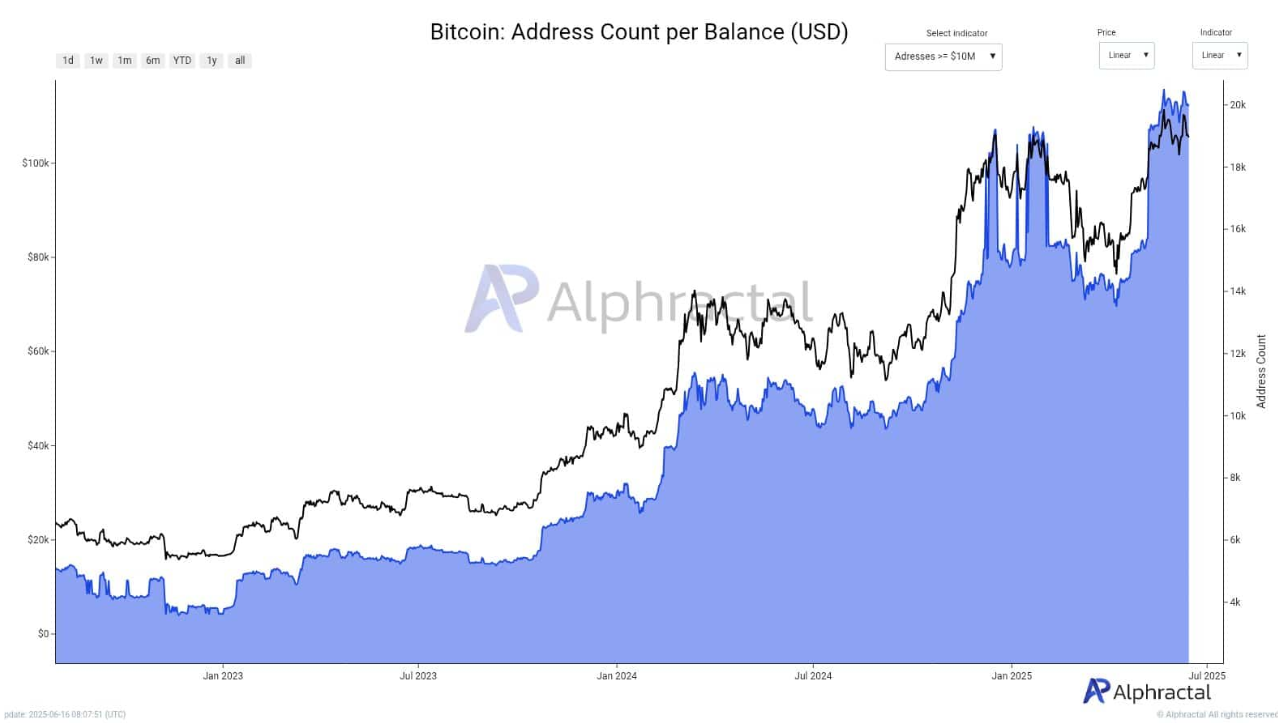

Get this, over 20,000 Bitcoin wallets now each hold more than $10 million worth of BTC. That’s nearly 10% of all Bitcoin out there, roughly $200 billion in value.

Imagine that for a second. A relatively tiny club, sitting on almost one-tenth of the entire supply. It’s like the office water cooler gossip turning into a boardroom power grab.

Look, we don’t want to FUD you. 20,000 wallets are a lot. For comparison, 10% of the total supply is in 4-6 wallets in Ethereum, 1-3 wallets both in Binance Coin and XRP, and 5-10 wallets in USDT.

If we count the $10 million, as baseline, then tens of thousands wallets hold USDT, several thousands hold ETH, and only a few thousands hold XRP or Binance Coin.

But the $10 million Bitcoin club? It’s growing fast, like that one guy in the office who suddenly starts showing up with a fancy new car and nobody knows where the money’s coming from.

Wealth concentration is the new normal?

Since 2018, these mega-wallets have been multiplying alongside Bitcoin’s price jumps. But 2025? The pace is downright dizzying.

Unlike past bull runs where retail investors were buzzing, this time it’s the whales calling the shots while everyday traders stay on the sidelines, nursing their coffee and watching the show.

Bitcoin’s design is all about decentralization, but the wealth distribution looks a little sus.

The top 20,000 wallets control 1.87 million BTC, creating a hierarchy that feels more Wall Street than blockchain. But it’s way more decentralized than the other top5 crypto.

🐳 Bitcoin has surged as high as $108,947 with traders continuing to await another challenge of last month's $112,000 all-time high. Interestingly, after 3 months straight of declining whale & shark numbers, the $BTC network has 622 more 10+ $BTC wallets in just under 4 weeks. pic.twitter.com/NpKkC5zsj9

— Santiment (@santimentfeed) June 16, 2025

What does this mean for the little guys?

If you’re a retail investor, you might be wondering, should I be worried? Well, it depends on how you see Bitcoin’s role.

On one hand, this concentration chips away at the dream of an inclusive, decentralized currency, or the naysayers and critics saying that.

On the other, it could mean institutions have faith in Bitcoin’s staying power, bringing more liquidity and stability.

But honestly, when a handful of whales hold so much sway, price moves can get manipulated, and the market’s fair game vibe starts to fade.

It’s like playing poker with a stacked deck, fun for the big players, frustrating for the rest.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.