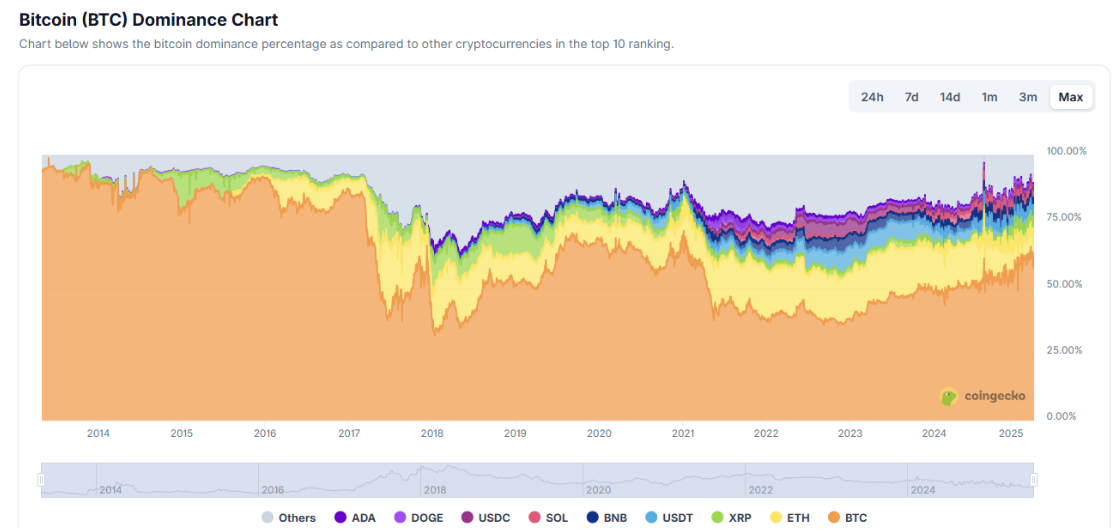

For a while, Bitcoin was the undisputed king, the Don of crypto. Everyone knew it, respected it, and its dominance felt, well, dominant.

But now? Things are shifting, and the big boss is losing some of its grip.

Bitcoin dominance, that’s the percentage of the total crypto market Bitcoin controls, just took a sharp dive. We’re talking about a drop to 59% this past week.

That’s one of the steepest declines we’ve seen all year. And we all now what that means, right?

The coin of all seasons?

So what does this mean for you, the average Joe or Jane trying to make sense of this crypto jungle?

It means that people are taking their money out of Bitcoin and spreading it around. They’re buying into alts, those other cryptocurrencies that have been waiting in the wings.

In just the last week, Bitcoin’s share of the market shrank by almost 3 percentage points, while the overall altcoin market cap surged past $1.5 trillion, hitting levels we haven’t seen since January.

For a long time, the crypto market revolved around Bitcoin. It dictated the rhythm, set the pace. But now, it’s like the other players in the orchestra are finally getting their chance to shine.

Some analysts are even saying we could see Bitcoin dominance slide down to 51% in the coming weeks.

And many believe a true altcoin season, a long-awaited period where these other coins really take off, kicks off when Bitcoin’s dominance dips below 55%.

Long term

Now, don’t get me wrong. This doesn’t mean Bitcoin is dead. It just means it’s not the only game in town anymore.

This time around, other coins like Ethereum, Solana, and even Litecoin are getting serious attention.

They’re being scooped up by big companies for their corporate treasuries, creating real demand and giving people a reason to hold onto them for the long haul.

Think of it like a new season of your favorite sports league. For years, one team dominated.

But now, other teams are building strong rosters, getting smart coaches, and they’re ready to compete. Solana, for example, has been on fire, crossing $200 again.

Even some older altcoins, the ones you might have forgotten about, are making a comeback, reinventing themselves and attracting new attention.

Surprise

The numbers are telling a clear story. The altcoin season index by Glassnode is sitting at 51 points, showing a real balance between Bitcoin and altcoin activity.

And when you look at the buy signals, alts have become way more attractive in the past months. Yes, they can be riskier, but the potential rewards are much higher.

And let’s not forget the memecoins. The riskiest of all, but these aren’t just jokes anymore. Some of them, like Pudgy Penguins, have exploded, gaining over 437% in the last 90 days. SPX6900 isn’t far behind, up 254% in the same period.

It seems like only the projects that couldn’t deliver on their promises have been left behind.

So, if you’re looking for where the action is, keep your eyes on the alts. They might just surprise you.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.