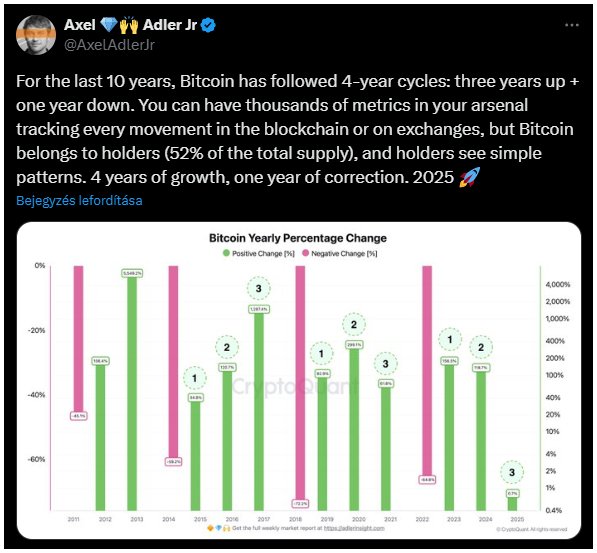

Bitcoin moves like clockwork, three years, boom, boom, boom, up and to the right. Then, just when everyone’s buying yachts and talking like geniuses, wham! One year, it all goes sideways.

Down, even. Like the universe reminding you, stay safe. And on paper, 2025 is an up year.

Halving? Global liquidity?

Now, here’s the thing. Axel Adler Jr., sharp guy, knows his charts, he’s out there saying 2025 could be another one of those breakout years.

You look at the numbers, it’s hard not to get a little excited. In 2013, Bitcoin went up 5,642%. In 2017? 1,287%.

And 2020, a cool 299%. But then, like a bad hangover, you get 2014, 2018, 2022, down 58%, 72%, 64%. Every time, it’s three years of fireworks, one year of rain.

The first rule of Bitcoin is you never sell Bitcoin

Fast-forward to now. After that ugly correction in 2022, Bitcoin’s been on a tear, up 156.9% in 2023, 153.7% in 2024.

If the pattern holds, 2025’s lining up to be the third act in this bull run. You seeing the picture? It’s like déjà vu, but with more zeroes on your portfolio.

But here’s where it gets interesting, because over half of all Bitcoin is locked up by long-term holders. These aren’t your cousin Vinny, flipping coins for a quick buck.

These are the guys who buy like a psychopath, stash it away, hodl, and forget about it until the grandkids ask what a blockchain is.

The never selling guys. The stay humble, stack sats guys. That kind of conviction? It’s what keeps the ship steady when the seas get rough.

Fireworks

Now, don’t get me wrong. There’s always a wildcard. Adler’s got three scenarios for 2025, we could see an explosion, a slow grind sideways, or if things get ugly, a correction back down to $70,000.

But with so many coins in strong hands, and the cycle history looking like a mobster’s ledger, predictable, reliable, maybe a little too neat, smart money’s betting on another run before the music stops.

So, you zoom out, you watch the cycle, and you remember, this market doesn’t care about your feelings. It’s got its own rhythm.

And if you’re in for the ride, keep your eyes open, 2025 might just be the year you tell your friends, “I told you so.”

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.