Imagine waking up one morning to find your Bitcoin stash has skyrocketed overnight. Sounds like a dream, right?

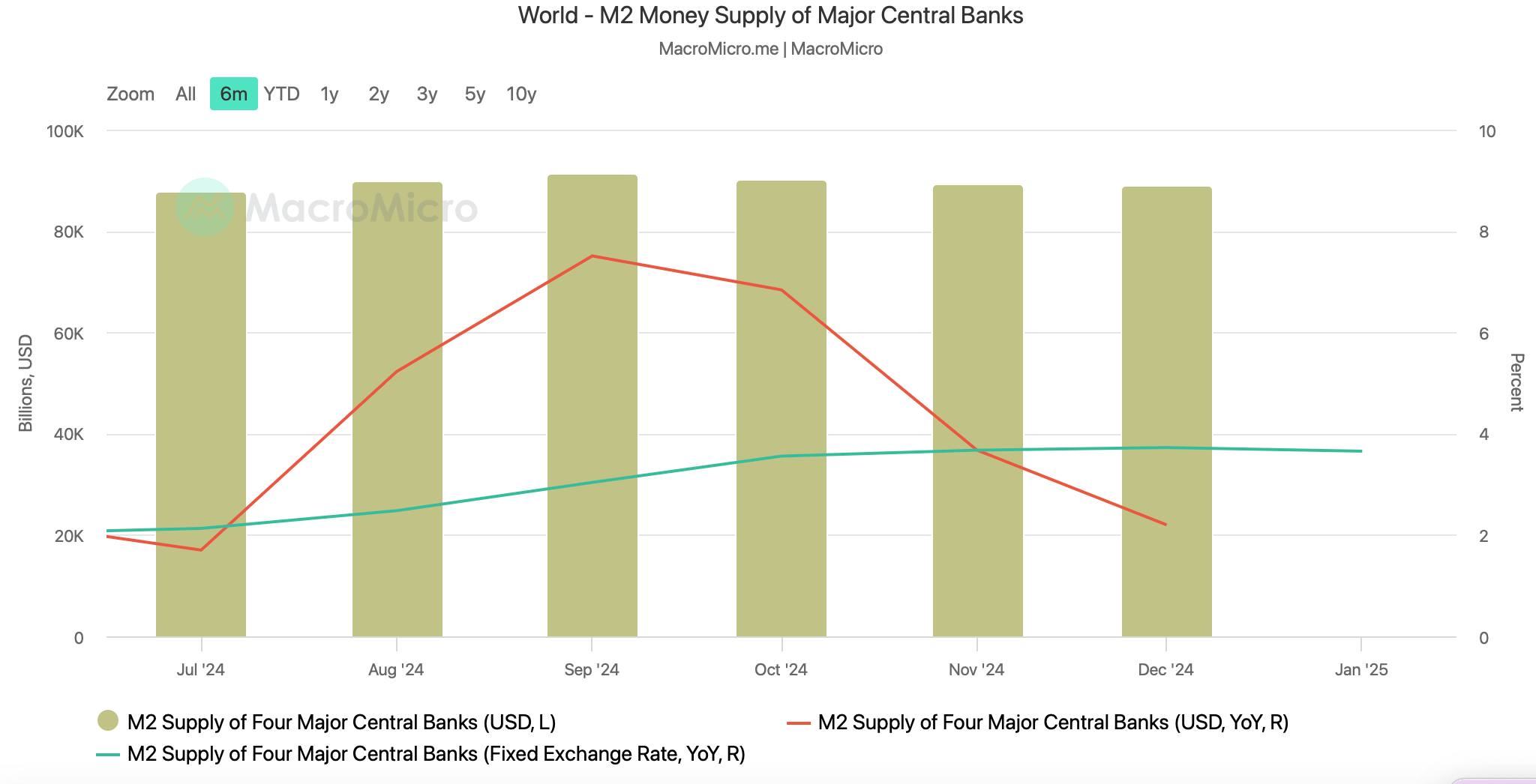

Well, some analysts think it could become a reality if the global M2 money supply continues to grow.

This isn’t just about wishful thinking, because there’s some solid history backing it up.

The M2 connection is strong

The M2 money supply is like the economy’s lifeblood, as it includes everything from cash to savings accounts.

Historically, when M2 increases, global liquidity rise as well, and Bitcoin tends to follow suit.

Economist Lyn Alden found that Bitcoin moves in sync with global M2 about 83% of the time.

It’s all about liquidity and interest rates, more money flowing around means more people are likely to invest in riskier assets like Bitcoin.

The perfect storm for Bitcoin?

Right now, the M2 money supply is on the rise globally, with only a few exceptions.

Pav Hundal from Swyftx notes that while it’s not the best time to bet the farm on a quick correction, things are looking up for March and beyond.

The U.S. has just raised its debt ceiling by $4 trillion, which could keep the money flowing.

Crypto analysts like Bitcoindata21 and Colin Talks Crypto are buzzing in the social media about a potential big move for Bitcoin.

They think the weakening dollar could boost the global M2, which in turn could send Bitcoin to the moon.

Bravo Research points out that the U.S. money supply has doubled in just a decade, setting the stage for a parabolic run-up in Bitcoin.

Hold on

But let’s not get too carried away, especially after Bitcoin just dipped below $90,000 after some economic uncertainty, so it’s not all smooth sailing, as they say.

Still, with the M2 money supply growing and analysts predicting a strong future, it’s definitely an exciting time for crypto users and investors.

Have you read it yet? SEC drops OpenSea investigation

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.