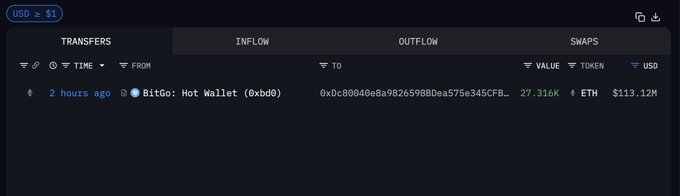

A major Ethereum transfer worth about 27,316 ETH ($113.12 million) occurred two hours ago from BitGo’s hot wallet (0xbd0) to an address identified as 0xDc08004e8a98265980bea575e345CFB…, according to on-chain data.

Blockchain analysts linked the transaction to Tom Lee’s Bitmine, suggesting it was a strategic acquisition of ETH. The move reflects growing institutional interest in Ethereum amid renewed accumulation trends across major wallets.

The transaction adds to Bitmine’s expanding crypto exposure and follows similar large-scale transfers recorded in recent weeks from custody services to private wallets.

Data platforms tracking wallet activity flagged this as one of the largest single ETH outflows from BitGo this week.

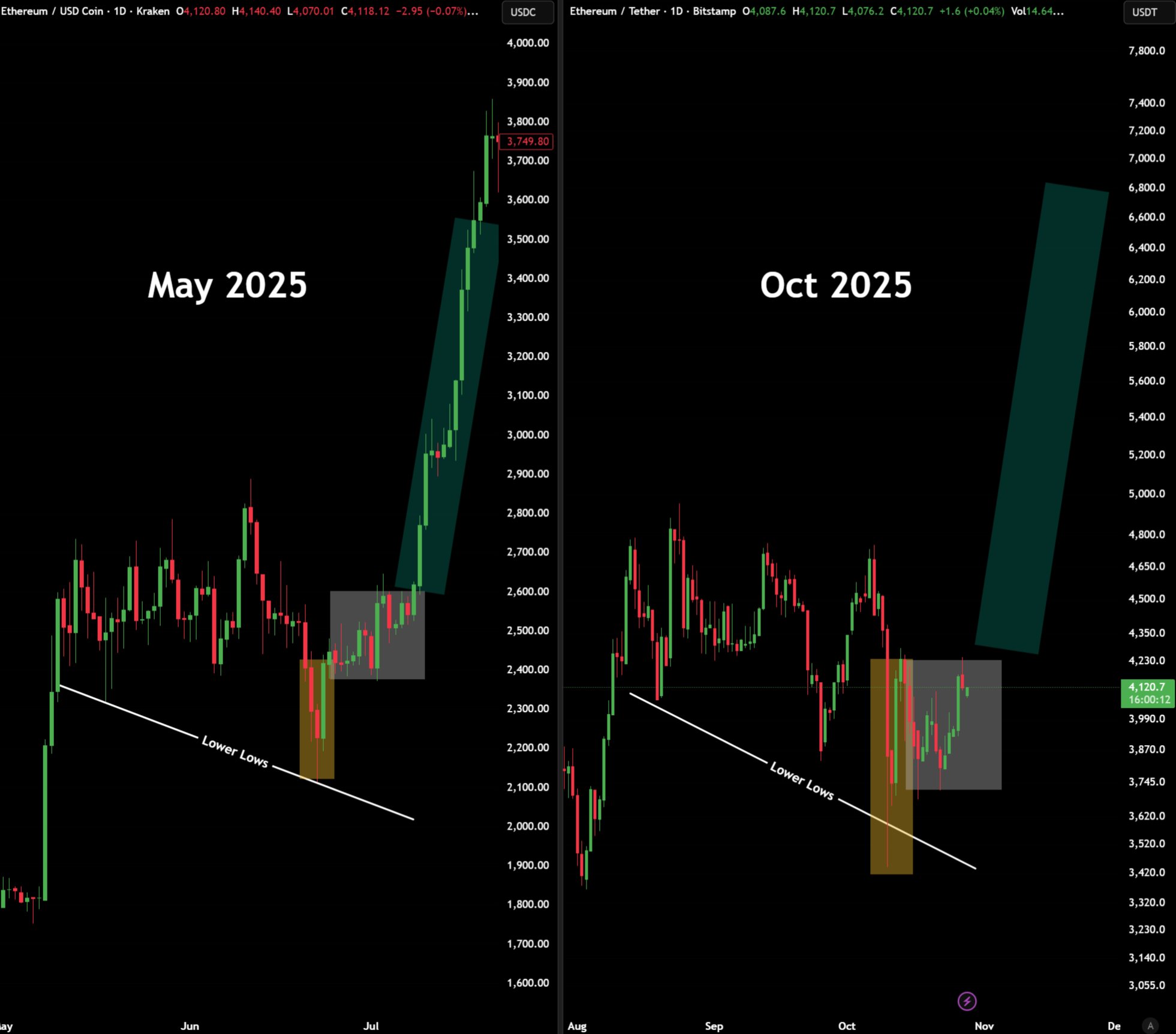

Ethereum Chart Mirrors May 2025 Setup, Targets $7,000

Ethereum’s recent price structure resembles its May 2025 setup that led to a major rally, according to new technical analysis.

The comparison highlights a near-identical pattern of lower lows followed by a recovery phase.

On the left, May’s chart shows ETH breaking a descending structure before surging from around $2,400 to $3,800 in less than two months.

The latest October 2025 chart displays the same sequence — lower lows, consolidation, and an early breakout attempt above $4,200.

Analyst Max Crypto noted that this repetition could precede another strong move. The projected path suggests Ethereum might reach around $7,000, replicating the past rally’s strength if momentum continues building.

Ethereum Prints Bullish Flag; Breakout Targets ~$6,492 (+61%)

Ethereum’s daily chart shows a clean bullish flag, a pattern where price pauses in a downward-sloping channel after a strong run and then often breaks higher to extend the move.

The flag formed from the August peak and now guides price between parallel trendlines while ETH holds near $4,032.

If buyers confirm the setup with a decisive breakout and daily close above the flag’s upper trendline (around $4,300–$4,350), the measured objective points 61% higher, taking ETH toward ~$6,492 from the current level.

The target aligns with the prior impulse’s magnitude, which the flag typically “repeats” after consolidation.

Technicals support the bullish case. Price trades close to the 50-day EMA (~$4,118.6), so a sustained reclaim and hold above it would reinforce momentum.

Meanwhile, the MACD is curling higher and the histogram has ticked green, showing improving buy pressure.

However, a failure to clear the upper rail—or a daily close below the lower trendline near $3,550–$3,600—would weaken the pattern and delay the move.

In short, ETH has built a textbook continuation structure. Break and hold above the flag, and the chart projects a rally toward $6.49K.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: October 29, 2025 • 🕓 Last updated: October 29, 2025