BitMine Immersion Technologies, the biggest corporate holder of Ethereum (ETH), bought $65 million of ETH for its treasury on Thursday. It was the company’s first purchase this month.

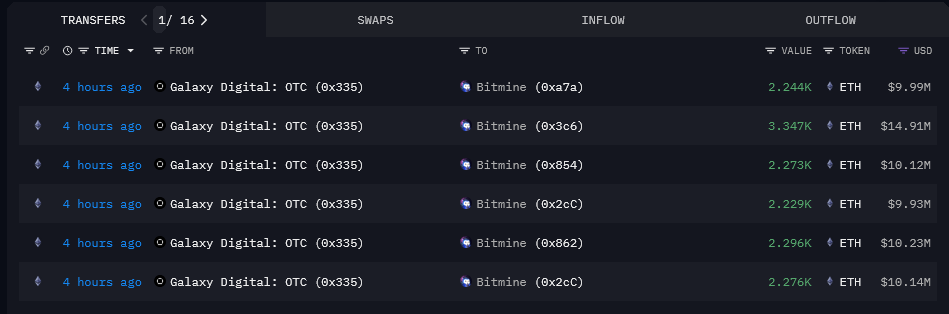

Data from Arkham Intelligence shows BitMine completed six transactions through Galaxy Digital’s over-the-counter desk to secure the acquisition.

A company representative confirmed that BitMine used cash only, with no leverage.

With this purchase, BitMine now holds more than 1.5% of Ethereum’s circulating supply.

The move comes as ETH reserves on centralized exchanges dropped to a three-year low, with supply shrinking 38% since 2022.

The decline links to corporate ETH treasuries and demand from exchange-traded funds.

BitMine Stock Moves After ETH Purchase

The stock of BitMine Immersion Technologies (BMNR) closed at $44.86 on Wednesday, up 5.58%, according to Google Finance. In after-hours trading, the stock slipped 0.54% to $44.62.

Despite a 540% rise in 2025, BMNR stock remains down nearly 67% from its July 3 high of $135.

Trading activity remains strong, with BMNR among the most traded stocks on U.S. markets. Over the last 10 days, average daily trading volume stood at 51.07 million shares, while the 30-day average volume was 54.96 million shares.

There are also unconfirmed reports that Tom Lee may appear on The Joe Rogan Experience podcast, which has more than *20 million YouTube subscribers. Such an appearance could raise visibility for both BitMine stock and Ethereum.

Tom Lee Repeats $60,000 Ethereum Price Target

Tom Lee, chairman of BitMine, repeated his Ethereum price target of $60,000 during an interview on the Medici Presents: Level Up podcast.

Lee compared Ethereum’s position in financial markets to the “1971 moment” in U.S. history. On August 17, 1971, President Richard Nixon froze wages and prices for 90 days, sparking record activity on Wall Street.

“Wall Street moving onto crypto rails, I think, is like a 1971 moment for Ethereum.

So I think it’s creating enormous opportunities to move a lot of things onto the blockchain. And Ethereum won’t be just the only winner, but it’s one of the primary winners,” Lee said.

Ethereum Staking and Corporate Treasuries

Lee also highlighted the benefits of companies holding Ethereum treasuries compared with Ethereum ETFs.

According to him, corporate holders can stake ETH and earn yield, while ETFs cannot stake their entire supply because of liquidity rules.

“ETFs, Ethereum ETFs cannot fully stake because of liquidity requirements. So they will never get the proper multiple for their staking,”

Lee noted.

Ethereum currently offers about 3% staking rewards. Lee said this could add 90% value to company treasuries, which equals a 1.9 multiplier. In comparison, BitMine’s mNav is trading at 1.13, according to Strategic ETH Reserve.

Lee stated that companies with ETH treasuries can strengthen their value through staking, while ETFs remain limited by regulation.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: September 4, 2025 • 🕓 Last updated: September 4, 2025