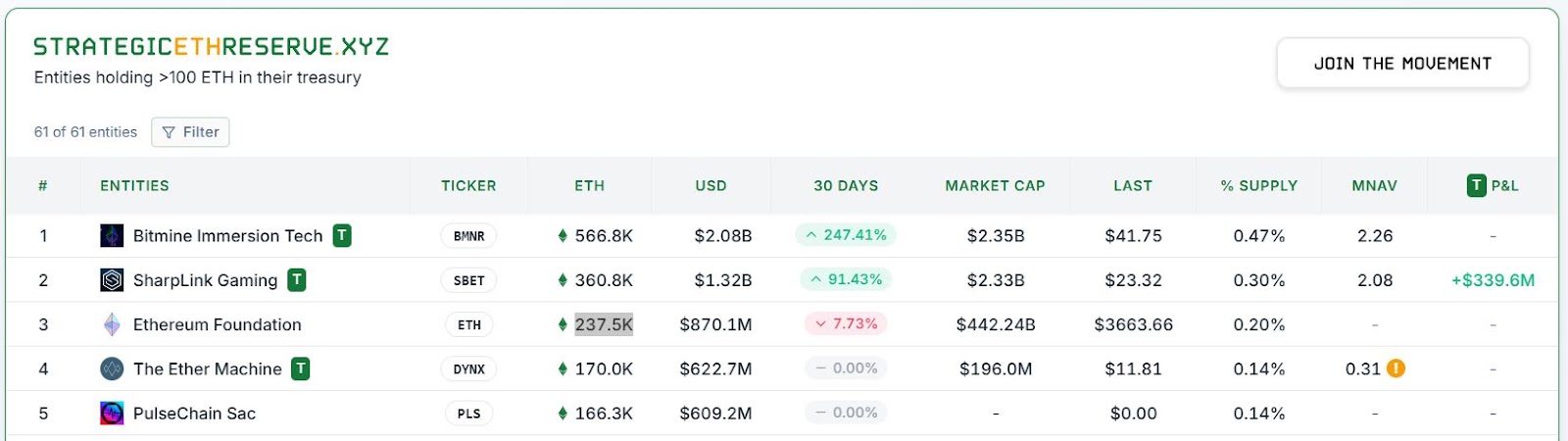

BitMine acquired 566,776 ETH in the past 16 days, worth over $2.03 billion based on current ETH price. This made BitMine the largest ETH treasury holder, according to data from Strategic Ether Reserves.

The company disclosed the acquisition in a statement released on July 24. BitMine ETH holdings now exceed those of SharpLink Gaming and the Ethereum Foundation.

SharpLink holds 360,807 ETH, while the Ethereum Foundation holds 237,500 ETH.

Tom Lee, chairman of BitMine and managing partner at FundStrat, said,

“We are well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply.”

BitMine aims to accumulate 6 million ETH.

BitMine used proceeds from its $250 million private placement on July 8 to fund these purchases. On July 17, the firm held 300,657 ETH.

Three days later, it added 137,515 ETH for $476 million. Another 163,142 ETH followed, pushing its total to 566,776 ETH.

BitMine Targets 5% of Ethereum Supply Amid Institutional Race

At the current ETH price of $3,632, 5% of the total Ethereum supply equals approximately $22 billion. BitMine’s goal is to acquire and stake that amount.

Ethereum does not have a fixed supply. Its total supply changes depending on token burns and issuance.

If BitMine reaches its 5% target, its ETH treasury will surpass Michael Saylor’s Bitcoin holdings.

Saylor’s company holds 607,770 BTC, representing 2.9% of Bitcoin’s fixed 21 million supply. In contrast, BitMine wants 5% of a floating Ethereum supply.

BitMine regained the top ETH treasury spot after flipping SharpLink Gaming. SharpLink bought 79,949 ETH on July 22, increasing its total holdings to 360,807 ETH.

This purchase brought its ETH treasury value to about $1.3 billion.

Strategic Ether Reserves confirmed BitMine’s new lead after the purchase. The company continues to expand its ETH accumulation faster than any other corporate holder.

ETH Treasury Moves Affect BitMine and SharpLink Stock Prices

BitMine’s stock (BMNR) surged after its ETH treasury announcement. The stock climbed over 3,000% and hit an all-time high of $135 on July 3.

The stock increase followed BitMine’s public disclosure of its Ethereum buying strategy.

SharpLink Gaming (SBET) also saw gains. Its share price jumped 171% after it announced its Ethereum strategy on May 27. The stock reached $79.21 shortly after the announcement.

Market response followed both companies’ ETH treasury activity. BitMine’s continuous ETH accumulation appeared alongside a rapid stock increase. SharpLink’s stock showed a similar trend after its 79,949 ETH purchase.

Strategic Ether Reserves recorded these treasury moves in their July update. Both firms remain at the top of the ETH treasury rankings.

Strategic Ether Reserves Hold Over $8B in ETH

Strategic Ether Reserves data shows 61 entities hold a combined 2.31 million ETH. This equals 1.91% of the current Ethereum supply and is valued at $8.46 billion. The data reflects institutional interest in Ethereum treasuries.

In comparison, Bitbo reports that 206 companies hold more than 3.4 million BTC. These firms collectively own 16.5% of Bitcoin’s total supply, worth over $408 billion.

Ethereum’s corporate reserves remain smaller by percentage. However, BitMine ETH holdings now represent a large part of the growing ETH treasury trend.

The data confirms an active push among firms to secure Ethereum as a strategic reserve.

Tom Lee’s public statement aligns with this approach. BitMine plans to use staking and long-term holding to build its ETH position.

Its accumulation of over $2 billion worth of Ethereum in two weeks places it at the center of institutional ETH strategies.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.