BlackRock just dropped a nice $80.6 million on Ethereum, and this ain’t some casual move. It’s like the big boss walking into the room and saying, I believe in this. Ethereum’s price?

Sitting around $2,750 in the time of writing, but the market’s buzzing like a busy office on deadline day.

Everyone’s whispering about a breakout, maybe $4,000, maybe even $10,000 if the stars align.

The new favorite

Now, BlackRock isn’t playing small here. On June 5, they scooped up $34.7 million worth of ETH in a single day.

Then, like a guy who can’t get enough, they came back for another $73.21 million.

That brings their total stash to 1.49 million ETH, valued at nearly $4 billion. That’s putting serious muscle behind Ethereum’s future.

Staking is tempting

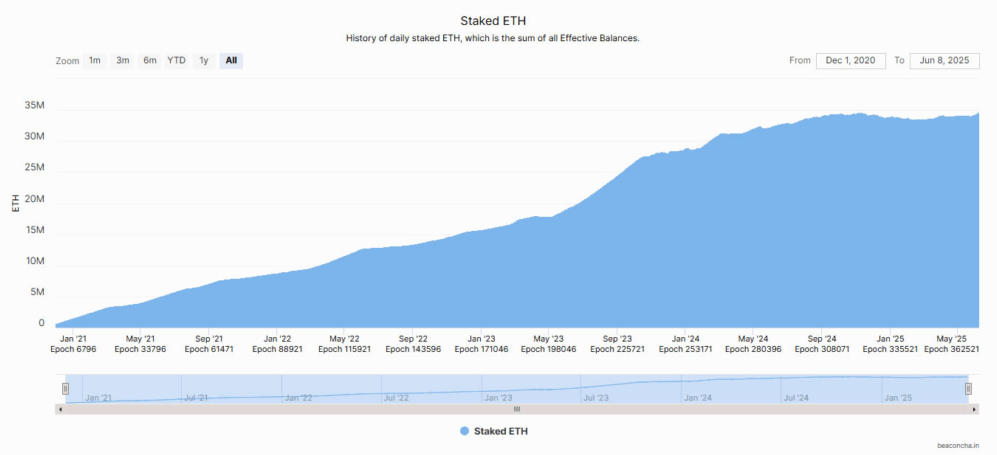

And it looks like it’s not just BlackRock getting cozy with ETH, because Ethereum’s staking scene is booming.

Over 34 million ETH is locked up for staking. Almost 28% of the circulating supply.

Think of it like your coworkers hoarding the good coffee in the break room, staking means they’re holding tight, confident this ride’s going long.

Plus, the SEC might soon approve staking for spot Ethereum ETFs, which could open the floodgates for even more institutional cash.

Big things ahead

Veteran trader Peter Brandt is watching closely, and says a breakout above $3,000 could be just around the corner.

The charts are looking bullish, with solid support at $2,200 and resistance at $4,000. Break through that $4,000 ceiling with some pretty serious volume, and we might just see Ethereum blasting off toward $10,000.

Ethereum is back in beast mode.$ETH smashed through $1.5K and $2.2K like paper.

Now it’s staring down $4K.Next stop? Price discovery.

$10K isn’t a dream it’s a setup. pic.twitter.com/ldU1wLFeVx

— Merlijn The Trader (@MerlijnTrader) June 10, 2025

That’s like your underdog team suddenly making it to the finals, unexpected, thrilling, and everyone’s talking about it.

So BlackRock’s big buy, the staking milestones, and the growing institutional appetite all point to one thing, Ethereum’s likely gearing up for a major move. You love to see it!

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.