Bunq Crypto launched on April 29, allowing users of the neobank to access over 300 cryptocurrencies including Bitcoin (BTC), Ether (ETH), and Solana (SOL).

The service is now available in six countries: the Netherlands, France, Spain, Ireland, Italy, and Belgium.

The neobank partnered with Kraken, the 14th-largest centralized crypto exchange, to power its trading operations. Users can now manage both traditional finance and crypto investment from one app.

Bunq CEO Ali Niknam said the decision came after a clear rise in demand for digital assets.

“We believe that now many, many people, the large majority, are interested in crypto,”

Niknam stated. He added that users prefer to access crypto investment through platforms they already use and trust.

Regulatory Clarity Enabled Bunq Crypto Launch

According to Niknam, a more defined regulatory landscape made it easier for the neobank to offer crypto investment products. He said recent months have shown major regulatory progress across Europe.

“We have seen a lot of that change over the course of the past couple of months,”

he noted.

Niknam confirmed that Bunq felt “sufficiently assured as a regulated entity” to launch Bunq Crypto under existing compliance standards.

The move brings crypto investment into a regulated environment within the European Economic Area.

Bunq’s announcement came months after Revolut expanded its own crypto services to 30 countries in the region in November 2024.

Bunq Survey Finds 65% Want Crypto in One App

Internal research by Bunq showed that 65% of Europeans want one platform to manage banking, savings, and crypto investment. That demand helped shape the release of Bunq Crypto.

In the same study, over 50% of investors said they want to invest in crypto but find current tools too complex or not secure enough.

Bunq’s update offers access to Bitcoin and hundreds of other tokens from a single application.

Niknam said,

“Our users across the world have long waited for a simple, safe and straightforward way to invest in digital assets.”

Bunq Crypto Expansion Targets U.S. and U.K. Next

Bunq reported 12.5 million users in June 2024, rising from 9 million the year before. The Bunq Crypto feature is the first step in a global rollout.

After starting in six countries, the neobank plans to offer crypto investment across the entire European Economic Area, then expand to the United Kingdom and United States.

The company’s strategy mirrors a larger shift in digital finance. As demand grows for integrated platforms, banks and fintechs are merging services like crypto investment, savings, and payments into single interfaces.

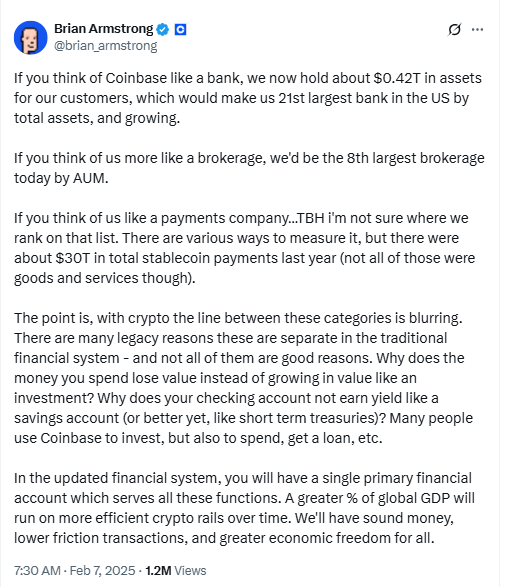

In February, Coinbase CEO Brian Armstrong noted that future financial systems would revolve around a primary financial account that includes crypto, banking, and more.

Bunq Crypto reflects this shift by placing Bitcoin and other assets inside a full-service neobank application.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.