Crypto traders and potential buyers in the EU might face restrictions in using stablecoins, as new regulations in the Euro economic area might limit the use of USDT.

Changes for Binance users

For Binance users in the European Union, USDT will be available only for selling, because the Markets in Crypto Regulation law, the infamous MiCA framework will start to take effect on June 30, impacting the whole local stablecoin market.

Binance plans to offer MiCA-compliant alternatives and regulated liquidity sources.

At present, Binance hasn’t mentioned any stablecoin other than USDT, and as of now, these new restrictions won’t affect users outside the EU.

The European Banking Authority will specify the standards for stablecoins by June 30.

The new regulations don’t specifically mention Tether’s USDT, classifying stablecoins as asset-referenced tokens, but the hard part of challenges for USDT and other assets might come from the technical requirements for cash or other reserves and their liquidity and immediate availability.

Reports about everything

Issuers of asset-referenced tokens will need to have an active office within the European Economic Area and keep regulators informed when generating new digital tokens.

Another major change is the oversight of the entire crypto sector, as EU authorities and banking regulators will create an annual report on the number of issuers of tokens, e-money, or any asset-referenced tokens, stablecoins.

They want also monitor EU-based users who own crypto assets issued by entities outside the EU, make the surveillance of the citizens more distopian-like.

The new rulers

EU regulations have mostly supported crypto trading rather than banning it.

The new regulations’ alleged goal to give legitimacy to crypto assets, especially stablecoins, for our safety.

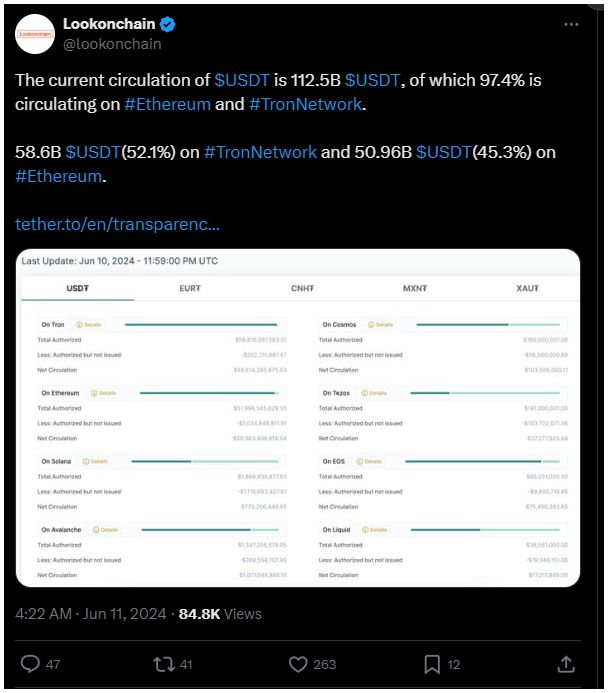

If Tether’s reserve balance doesn’t comply with new EU regulations, USDT might be delisted, and trading pairs could be removed.

Based on surveys’ data, around 31 million people in the EU hold cryptocurrency, with ownership and usage levels much lower compared to Asia or America.

Coinbase is leading in trading USDT on US-based exchanges, and Kraken, a key EU-based market, handles 116 million in USDT trades and is a major broker for converting to fiat currencies.

A freeze on USDT would undoubtedly disrupt this option for European traders.