While the market was caught up arguing about a massive Bitcoin dump this week, a quieter but potentially far more telling story happened on the institutional side.

Cathie Wood’s ARK Invest has now purchased shares in the crypto exchange Bullish for ten consecutive trading days.

Stay ahead in the crypto world – follow us on X for the latest updates, insights, and trends!🚀

On the most recent day alone, the firm scooped up millions of dollars worth through its ETFs. This is a deliberate, sustained pattern.

Bullish, the Peter Thiel-backed platform that went public relatively recently, has been the consistent target.

ARK added to its position via multiple ETFs, with the latest filings confirming buys every single trading day over the past ten sessions.

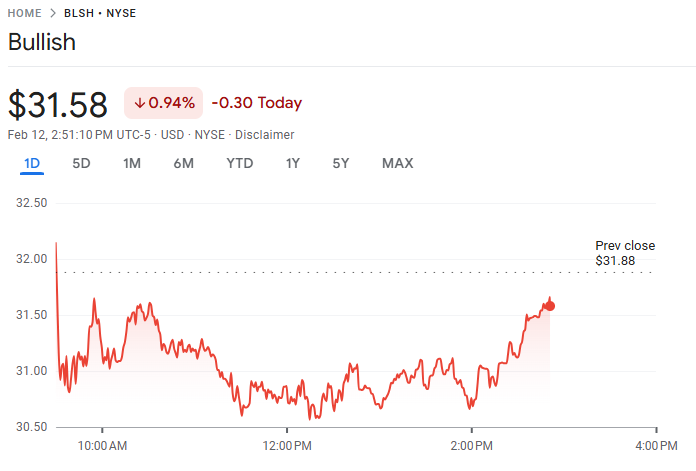

Source: google finance

If you follow crypto investing even casually, you know Cathie Wood. She’s one of the few names that actually register with everyday investors.

When her team keeps loading up on the same stock day after day, right through noisy volatility, it carries real weight.

ARK is bullish

This move isn’t about jumping on a short-term hype wave. Firms like ARK don’t repeat buys like this without serious homework.

They’re betting on where the entire sector is headed over years, not reacting to the latest hourly candle.

Meanwhile the timeline stays flooded with heated takes on who dumped what and whether manipulation is at play.

Those discussions are emotional and loud. But they frequently overlook the patient, structural shifts that end up defining the space.

What ARK is showing here is textbook institutional behavior. They filter out the daily drama and zero in on the fundamentals: wider adoption, stronger infrastructure, and companies genuinely building sustainable crypto businesses.

Accumulating

For anyone watching from the sidelines, maybe thinking about dipping a toe into crypto, this kind of action serves as a quiet but powerful signal.

Price swings and online arguments come and go. Serious capital, though, tends to follow longer horizons and genuine belief rather than headline noise.

So while much of the market spent the week panicking or finger-pointing, Cathie Wood’s team simply kept accumulating.

That single fact reveals quite a bit about where some of the sharpest institutional minds see genuine upside.

Crypto market researcher and external contributor at Kriptoworld

Wheel. Steam engine. Bitcoin.

📅 Published: February 13, 2026 • 🕓 Last updated: February 13, 2026

✉️ Contact: [email protected]

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.