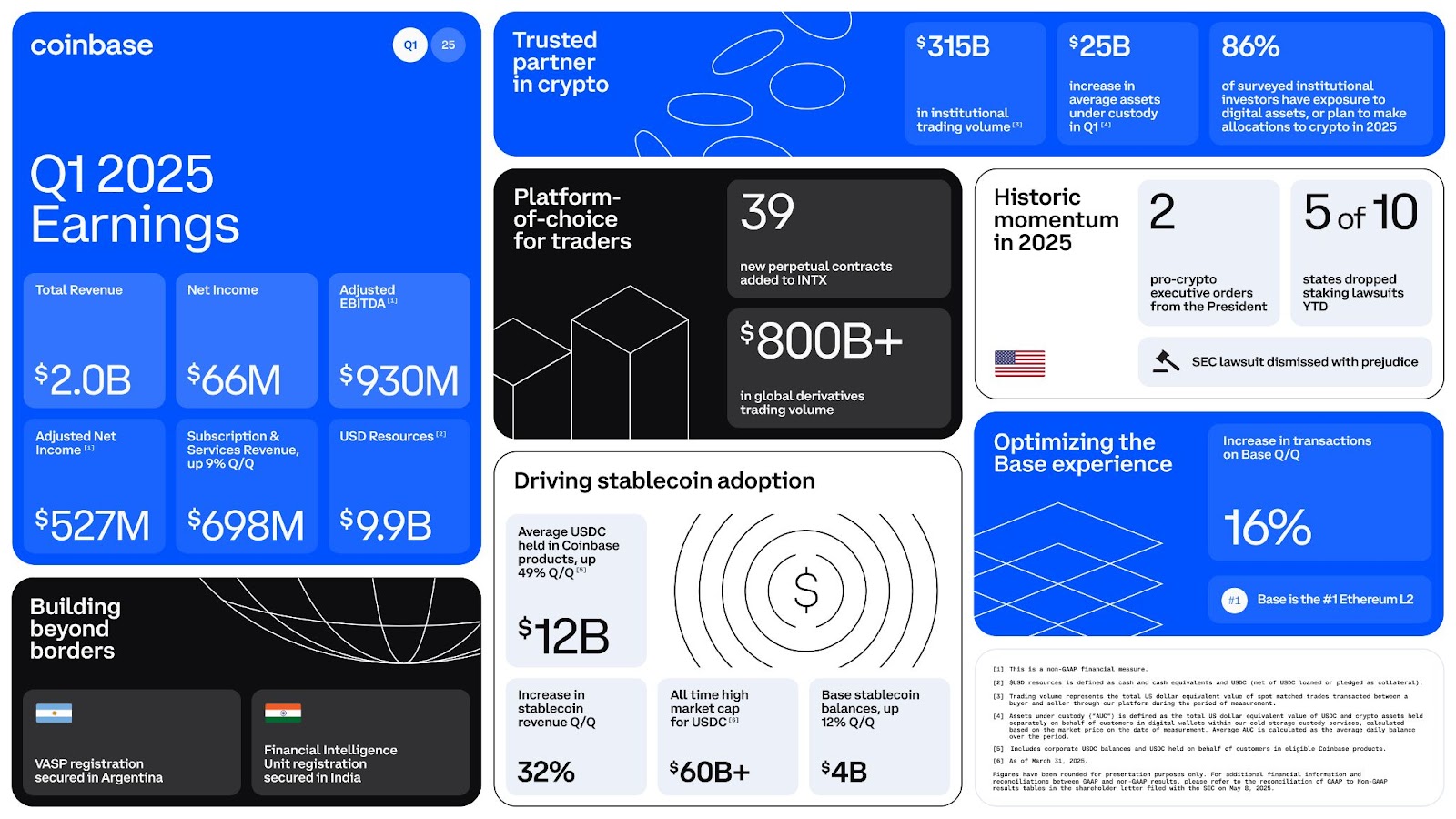

Coinbase revenue dropped 10% in Q1 2025 to $2 billion, according to the company’s May 8 earnings report.

The figure came in 4.1% below industry expectations. The drop followed a slowdown in crypto trading activity during the first quarter of the year.

The Coinbase earnings report showed a sharp decline in net income, which fell 95% from $1.29 billion in Q4 2024 to $66 million in Q1 2025.

This reduction included a $596 million paper loss on its cryptocurrency holdings. Coinbase stated that weaker market conditions drove both income and revenue down.

Despite the drop in revenue, the company posted earnings per share of $1.94. That result exceeded the Zacks Consensus Estimate of $1.85 for the quarter.

Coinbase Trading Volume and Transaction Revenue Decline

Coinbase trading volume dropped 10.5% quarter-over-quarter to $393 billion. At the same time, transaction revenue declined 18.9% to $1.26 billion.

The company linked these declines to lower overall crypto market capitalization and reduced investor activity.

According to Coinbase, trading activity slowed as crypto prices dropped during the quarter. The Coinbase earnings report cited the Trump administration’s tariffs as one of the contributing factors to the market pullback.

In contrast, Q4 2024 had seen higher engagement, partly driven by the results of the U.S. presidential election. That quarter produced a near-record profit for the company.

Coinbase Subscription Revenue Sees Modest Growth

While transaction revenue dropped, Coinbase subscription revenue increased 8.9% quarter-on-quarter, reaching $698.1 million.

Stablecoin revenue contributed the most to this growth. The company did not specify which stablecoins delivered the highest revenue.

The Coinbase Q1 2025 report noted that its subscription and services business continued to expand. Coinbase claimed it had gained market share globally in both spot and derivatives markets.

Coinbase also highlighted its expansion into Argentina and India, where it obtained new registrations to operate under local rules.

These steps were part of the company’s push to grow in emerging markets.

Coinbase SEC Lawsuit Dismissal Cited as Legal Milestone

In its regulatory update, Coinbase referenced the recent dismissal of its lawsuit with the U.S. Securities and Exchange Commission (SEC). The company described the outcome as a “major judicial win” for crypto regulation.

Coinbase did not provide further legal detail in the Q1 2025 earnings release. However, the company said the case dismissal supported efforts to create rules that encourage crypto adoption.

The lawsuit had centered around how digital assets are classified and whether Coinbase had violated securities laws. The case dismissal followed months of legal proceedings and public debate.

Coinbase Deribit Acquisition Marks $2.9 Billion Expansion

Coinbase completed a $2.9 billion acquisition of crypto derivatives platform Deribit on May 8. This is now the largest corporate acquisition in the crypto industry to date.

The Coinbase Deribit acquisition aims to strengthen the company’s role in the crypto derivatives market.

Deribit processed more than $1 trillion in trading volume during 2024. The platform currently holds $30 billion in open interest.

Coinbase said the acquisition significantly expands its access to the global derivatives sector.

Before the deal, Coinbase had limited exposure to derivatives, operating only through its Bermuda-based platform. The Coinbase Deribit acquisition changes that positioning.

Coinbase stated the deal makes it the “global leader” in the crypto derivatives market.

Competitor Kraken had previously announced its own move into the sector, acquiring NinjaTrader for $1.5 billion in March.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.