Picture an everyday Joe, armed with nothing but a smartphone and a hunch, steps into the new frontier of on-chain prediction markets.

Sberbank Enters the DeFi Dungeon: Russia’s Biggest Bank Starts Poking the Crypto Beast

In Russia’s crypto story the main character role just landed squarely on Sberbank’s very traditional, very regulated shoulders.

UK FCA Unleashes Crypto Rule Avalanche: DeFi’s Ride Gets Shackles?

The UK’s Financial Conduct Authority, the FCA straps on its regulatory armor and charges into the crypto badlands.

Cardano Bull Flag Targets $1.71 as ADA Defends Descending Channel Support

The weekly ADA USD chart shows a bullish flag pattern, which forms after a sharp upward move and pauses inside a downward sloping channel before a potential continuation higher.

U.S. Regulatory Shifts Poised to Unlock a New Era of Crypto ETP Growth

We view the recent U.S. regulatory shifts as a transformative milestone that will accelerate the mainstream adoption of digital assets by enabling a dramatic expansion of crypto exchange-traded products in 2026.

With the SEC adopting generic listing standards and in-kind creation/redemption mechanisms, exchanges can list qualifying crypto ETPs far more efficiently than under the old case-by-case approval process, shortening timelines and reducing friction for issuers and investors alike.

This new framework has already supported products like Grayscale’s multi-asset ETP and sets the stage for potentially 200 or more crypto ETPs by 2026, spanning assets well beyond Bitcoin and Ethereum.

This expansion is poised to significantly enhance market liquidity by attracting deeper capital from both retail and institutional investors.

As capital flows into these regulated vehicles, spreads are likely to tighten, and volatility may moderate, improving execution quality for major tokens like Bitcoin and Ethereum.

The shift also creates a more familiar investment landscape for institutional players, whose demand for regulated, transparent products has been a longstanding driver of broader adoption.

The addition of staking-enabled ETFs and in-kind mechanisms further aligns crypto ETPs with traditional commodity networks, making them more cost-efficient and accessible to traditional finance.

Ultimately, these developments will reshape the broader narrative for major tokens and the industry as a whole.

By embedding crypto assets into regulated investment frameworks and reducing structural barriers to entry, the market is moving toward greater maturity and global integration.

This paves the way for sustainable growth, broader participation from pension funds and asset managers, and deeper alignment between digital asset markets and traditional financial ecosystems.

Gracy Chen, CEO at Bitget

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Dogecoin Slips to $0.13 as Bearish Flag Signals Risk of Deep Drop

A TradingView daily chart for Dogecoin versus the U.S. dollar on Coinbase, created on Dec. 17, 2025, showed DOGE trading near $0.1306 after a small daily decline.

US “Tech Force” Shock: Coinbase and Robinhood Join Washington’s 1,000 Worker Push

The US Tech Force launched this week with support from private companies, including Coinbase and Robinhood, as the federal government moves to fill technology skill gaps.

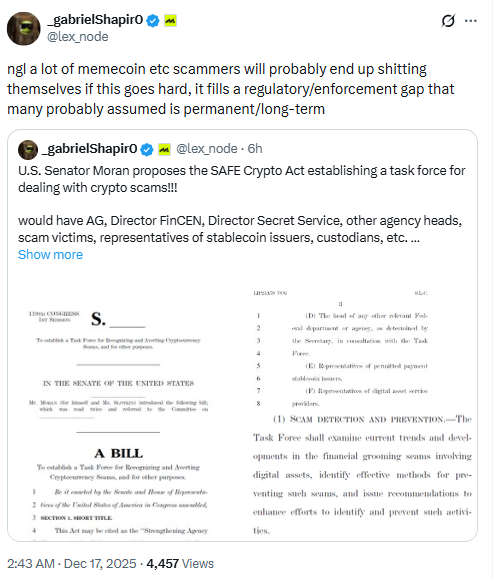

SAFE Crypto Act Targets Crypto Scams With New Federal Task Force

Two US Senators introduced the SAFE Crypto Act to tighten coordination against crypto scams and crypto fraud. The proposal would link the US Treasury, FinCEN, the US Secret Service, and other law enforcement agencies to improve how the government detects and investigates digital asset fraud.

The bill is called the Strengthening Agency Frameworks for Enforcement of Cryptocurrency (SAFE) Act. Elissa Slotkin, a Democrat, and Jerry Moran, a Republican, introduced the legislation on Monday.

Supporters said the SAFE Crypto Act focuses on enforcement coordination. It targets scams and fraud tied to cryptocurrency and other digital assets, while also involving private sector participants.

SAFE Crypto Act Links FinCEN, US Treasury, and US Secret Service

The SAFE Crypto Act would set up a law enforcement task force focused on crypto scams and crypto fraud. The framework would coordinate action between the US Treasury, FinCEN, law enforcement, regulators, and private sector players.

Slotkin described the task force as a way to combine resources across agencies. “This task force, established by the SAFE Cryptocurrency Act, will allow us to draw upon every resource we have to combat fraud in digital assets,” Slotkin said.

Moran tied the bill to wider crypto use and public protection. “As cryptocurrency becomes more widely used, this legislation would help counter threats and make certain all Americans are better protected from crypto scams,” Moran said.

FBI Reports $9.3 Billion in Crypto Investment Scam Losses in 2024

The FBI reported Americans lost $9.3 billion to crypto related investment scams in 2024. The figure marked a 66% increase from 2023, according to the report cited in the coverage.

The FBI data showed older victims faced the biggest losses. Individuals over 60 accounted for $2.84 billion in losses tied to FBI crypto investment scams.

The reporting also noted how the FBI count works. The figure can include any investment scam that mentions crypto as part of the pitch, even when it does not use blockchain transactions.

Delphi Labs and TRM Labs Point to Enforcement Structure and Industry Support

Gabriel Shapiro, general counsel at Delphi Labs, said enforcement coordination could pressure scammers. In a Tuesday post on X, he wrote: “Scammers will probably end up shitting themselves if this goes hard.”

Shapiro also pointed to senior officials who could take part under the SAFE Crypto Act structure. He referenced the attorney general, the director of FinCEN, and the director of the United States Secret Service as key leaders in pursuing crypto criminals.

Blockchain forensic firm TRM Labs also signaled interest in supporting the effort. Ari Redbord, TRM Labs vice president and global head of policy, said collaboration can help track and disrupt illicit networks faster.

“By bringing industry and law enforcement together, we can meaningfully reduce criminals’ ability to exploit transformative technologies for harm,”

Redbord said.

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.

Tatevik Avetisyan is an editor at Kriptoworld who covers emerging crypto trends, blockchain innovation, and altcoin developments. She is passionate about breaking down complex stories for a global audience and making digital finance more accessible.

📅 Published: December 17, 2025 • 🕓 Last updated: December 17, 2025

Visa’s Stablecoin Sidekick: Calling All Banks to the Crypto Party!

Imagine that you’re a wide-eyed banker in the ordinary world of fiat drudgery, shuffling paper checks like some forgotten relic from the ’80s.

U.S. Banks Embracing an On-Chain Future Signals a Structural Shift in Finance

We fully endorse Bank of America’s view on the multi-year “on-chain future” for U.S. banks, where accelerating stablecoin regulations and blockchain integrations are paving the way for a seamless convergence between traditional finance and digital assets.

According to BofA’s latest research, rapid progress in regulatory frameworks for stablecoins and tokenized deposits is a key catalyst driving this shift, positioning American banks to migrate core financial activities onto blockchain rails over the coming years.

This evolution is not about fleeting hype but reflects real institutional demand for safer, efficient and programmable liquidity.

As regulatory clarity solidifies, particularly through laws like the GENIUS Act that establish federal stablecoin oversight, banks are increasingly exploring on-chain tooling that could transform payments, settlements and liquidity provisioning.

Should major U.S. banks begin issuing compliant stablecoins or tokenized deposits, we could see significant expansion of global liquidity, faster transaction settlement times, and richer DeFi composability built on regulated infrastructure.

Beyond stablecoin issuance, the outlook for tokenized real-world assets is becoming clearer, with analysts forecasting that bonds, equities, cash-like instruments and cross-border payment systems could progressively migrate on-chain.

This integration enhances institutional participation by addressing longstanding operational frictions in legacy systems, reducing costs and enabling 24/7 settlement capabilities.

Of course, key risks persist. Regulatory harmonization across jurisdictions and operational resilience for banks issuing or interacting with on-chain assets remain priority areas for policymakers and financial institutions alike.

However, these barriers are steadily declining as frameworks mature and pilot implementations show practical viability.

Indicators worth watching include stablecoin settlement volumes, growth in tokenized real-world asset market caps, and liquidity flows into bank-backed tokenized products, all of which will illuminate the pace at which traditional finance embraces the blockchain era.

In sum, Bank of America’s on-chain thesis captures a foundational structural shift: regulated financial institutions are increasingly viewing blockchain not as an experimental appendage but as a core infrastructure layer for the future of payments and asset management.

This is a powerful endorsement of digital assets’ role in bridging traditional markets and the decentralized economy.

Gracy Chen, CEO at Bitget

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.